Netflix CEO: ‘Work still ahead of us’ to improve ad offering

Netflix’s ad tier membership grew 35% quarter on quarter, the streaming giant announced as part of its Q3 earnings report.

In the 12 countries where the ad plan is available, it accounted for more than half of new sign-ups.

Total revenue grew 15% year on year to $9.8bn. Netflix is forecasting 14.7% year on year growth in Q4 to $10.1bn.

While Netflix did not release specific figures for the total number of ad tier subscribers, it noted that 5.1 million total net streaming subscibrers were added in the third quarter.

That amounts to a significant deceleration; for comparison, in Q3 2023, Netflix gained 8.8 million subscribers.

Notably, the streaming giant’s new in-house ad tech platform is “on track” to launch in Canada beginning in Q4 this year, before releasing more broadly in 2025. Netflix had previously expanded its programmatic buying partners beyond Microsoft to include The Trade Desk and Google DV 360.

‘We’ve got a road map’

On Netflix’s earnings call, co-CEO Greg Peters said the streaming giant is “carrying two top-level priorities” for its ads business: growing ad tier membership to achieve “sufficient scale to be relevant in each market for advertisers” and improving its “capabilities and attractiveness to advertisers”.

Peters said Netflix expects to be at “critical scale” for its ad partners in each of the 12 markets its ad tier is available in by next year. He added that engagement with the ad tier “remains healthy” given that ad plan subscribers have a similar amount of viewing hours to ad-free members.

Given the “significant progress” on growing ad tier subscriptions, Peters explained that Netflix can thus “turn more attention” to “effectively monetising all that growing inventory”.

“I think it’s worth noting we’ve got a lot of work still ahead of us to achieve that goal, to make our offering better for advertisers. It’s going to be a priority for us for several years coming, but we’re moving,” he said. “We’ve got a road map for more formats, for more features, for more measurement. That’s all coming.”

In August, Netflix closed its upfront advertising deal-making period at a “150%-plus increase” compared to the year prior, which suggested increased advertiser interest. Netflix has leaned into selling not just ad slots, but also brand sponsorships.

Netflix and the upfront story: A new character that leaves the audience wanting more

However, its ad revenue growth still remains opaque given Netflix has not released specific numbers regarding how many ad tier users exist in different regions, nor how much revenue advertising is driving.

Peters added that Netflix’s goal over the next decade is to “combine the best of digital advertising”, including through targeting, personalisation and relevance “with the best of TV advertising”.

“We’ve got healthy CPMs at the high end of that premium CTV ad market,” he said. “That’s where we want to be positioned.”

Still, Peters warned that ads will not be a “primary driver” of the company’s revenue in 2025 as the streamer continues to scale its ad tier audience and inventory “faster than our ability to monetise it”.

Still, Netflix expects ad revenues to double year on year in 2025, albeit off a small base.

Analysis: Advertising a ‘don’t look here’ tactic

Mike Proulx, VP research director at research and consulting company Forrester, commented that “on the surface, Netflix is trending in all the right directions”.

“Financially, revenue and operating margins continue to increase and expenses are down. Viewer engagement is also notably up,” he said. “However, a steep decline in net new subscribers is what’s concerning. While there’s room for net subscriber growth internationally, in the US things are getting tapped out.”

From that perspective, Proulx noted that accelerating revenue growth through advertising will become “paramount” to Netflix’s strategy. It is also likely why the company has warned it will stop reporting on subscriber numbers beginning in Q1 2025.

“In a way it’s a ‘don’t look here’ tactic to draw attention away from a material deceleration in new subscribers and, instead, draw focus to overall revenue which gives a fuller picture of the company’s financial health,” said Proulx.

User retention a competitive advantage

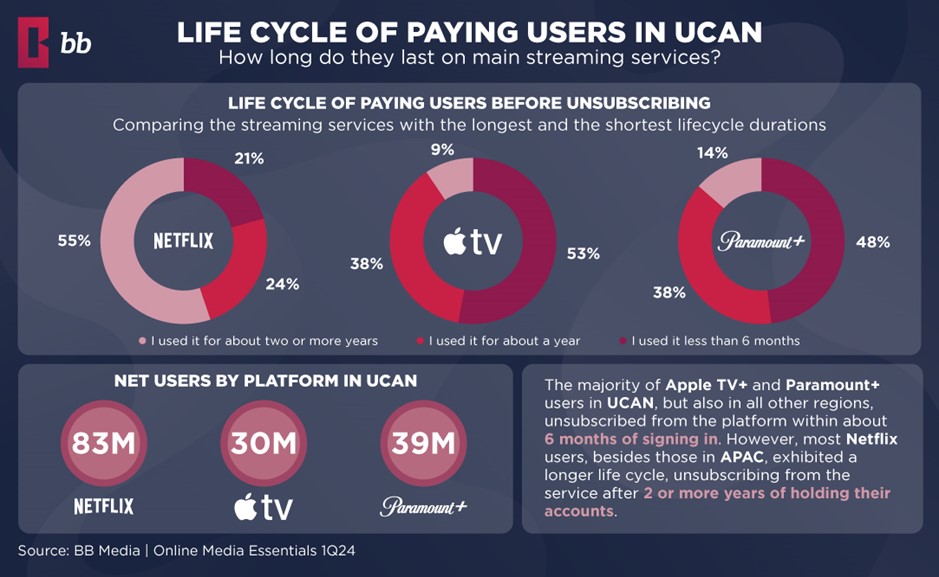

Despite decelerating subscriber growth figures, Netflix has retained a clear competitive advantage over other streaming services by better retaining its subscribers despite broad concerns around churn in the subscription video-on-demand (SVOD) market.

According to a report this week by media and entertainment data science company BB Media, Netflix “consistently excels” at retaining users longer than competitors like Apple TV+ and Paramount+.

BB Media found that a majority of Netflix’s users (55%) in the US and Canada have remained a subscriber for at least two years, whereas a majority (53%) of Apple TV+ subscribers and a plurality (48%) of Paramount+ subscribers in the same region have used those streaming services for less than six months.

BB Media’s analysis suggested Netflix’s first-mover advantage, significantly larger content library when compared to its peers, and diverse regional offerings have insulated it from churn.

Apart from investments in major cultural touchstones like Squid Game (the second series of which launches in December), Netflix has also expanded its footprint in live sports, such as by streaming two NFL games on Christmas Day as well as next month’s Jake Paul-Mike Tyson boxing match.

Netflix co-CEO Ted Sarandos expressed excitement about the streamer’s forthcoming content slate, noting that new seasons of some of its biggest shows — namely Wednesday and Stranger Things — are scheduled for release in 2025.

In addition, films like Guillermo del Toro’s Frankenstein, a new Knives Out sequel from Rian Johnson, and the launch of a One Hundred Years of Solitude series look to provide broad consumer appeal and growth especially in the Latin American region next year.