US video streaming market growth stalls

The US streaming market’s growth has stalled, according to Kantar’s latest Entertainment on Demand data.

The proportion of US households who have video streaming services grew just 0.4% quarter-on-quarter, stalling at 86% of households following substantial growth increases during 2021, when individuals and families were locked down during the Covid pandemic.

The latest first-quarter data revealed that there are differences in growth between streaming tiers, however. While subscription video on demand (SVOD) penetration decreased 0.2% to 81.4% of households, advertiser-supported VOD (AVOD) grew 2.2% to 20.2% and free ad-supported streaming TV (FAST) grew 0.9% to 25.3% household penetration.

Though AVOD and FAST streaming continued to grow, it did so at a slower rate compared to previous quarters.

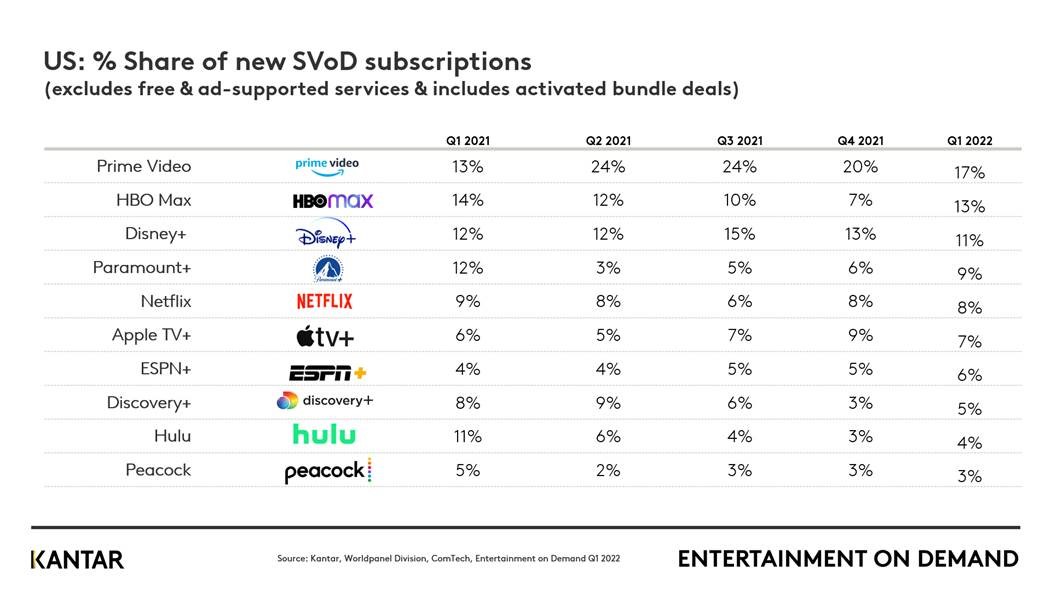

Amazon Prime Video is still the top destination for SVOD subscribers for the fourth straight quarter, but it lost 3% market share during Q1 as HBO Max and Paramount+ grew their subscribers to 13% and 9%, respectively.

Meanwhile, Netflix’s subscribers shrunk for the fifth consecutive quarter, declining 0.2% in household penetration quarter-on-quarter, putting it down 4% year-over-year.

The lack of growth is in part produced by a stalling of households “stacking”, or subscribing to multiple services – the average US household currently subscribes to 4.7 streaming services, which is unchanged from last quarter.

Kantar says the US may have reached peak stacking, and expects to see greater churn rates and switching between subscription services as consumers are more selective about what they watch.

However, despite inflation increases tightening budgets, streaming demand appears to be relatively inelastic. Though saving money is still the largest driving factor of cancellation in the US, the plateauing of stacking, rather than a reduction, shows that US households are not cutting back on their streaming services as much as in other countries like the UK.

Kantar suggests instead that content saturation may be main driver of stalled growth, with streamers finding it increasingly difficult to find content they want to watch, often signing up then cancelling services after viewing a specific piece of content.

The data analytics company also noted that it will likely be more challenging for new entrants to the streaming market to justify their value, offering CNN+ as a case study for how difficult it is to launch a new, niche service.

More value-driven price points are likely to be needed to prevent cancellations. Netflix signaled it will open up an ads tier at a lowered cost following its disappointing Q1 earnings.