YouTube on TV screens: what Barb has learned from 18 months of data

Opinion

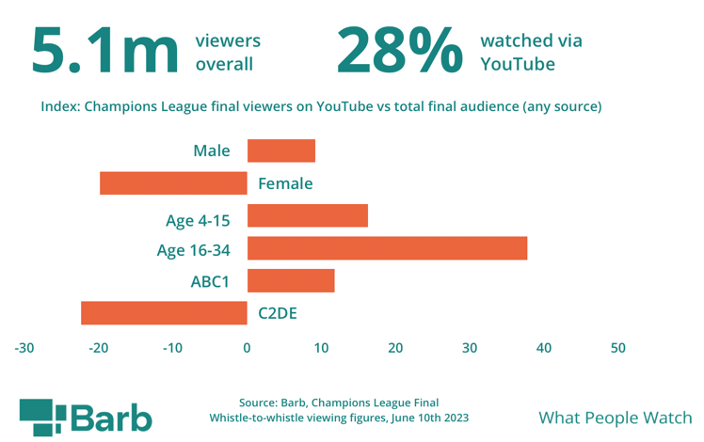

This year’s Champions League Final was again broadcast freely on YouTube. Total viewing was down, but what we’re learning through innovation is expanding all the time.

Like many football matches, the Uefa Champions League Final provokes partisan feelings. It can even create unusual alliances on the principle that my enemy’s enemy is my friend.

Personally speaking, last year’s final was disappointing as Liverpool lost out on the chance of winning a seventh title. This year Manchester City gave its fans something to cheer about with its first.

The success of English teams in reaching the final in recent years throws a spotlight on BT Sport’s practice of bringing its coverage of the final out from from behind a paywall. Like last year, people could watch the final live through the BT Sport channel on YouTube. And again, like last year, people responded positively.

Last year’s final between Liverpool and Real Madrid was watched by 6.2 million people, 26% of who watched through YouTube. The decline in the total number of viewers compared to last year is perhaps indicative of a long-standing truth; the biggest TV audiences are for matches involving Liverpool or Manchester United.

As well as tapping in to the healthy appetite of the media industry when it comes to football and audience figures, these numbers show Barb’s continuous innovation.

As the industry’s standard measurement of what people watch, we’ve pursued an audience-centric measurement strategy for many years. In recent years new metering technology has allowed us to report reach and time-spent viewing for streaming services. And, by extending our use of audio-matching techniques, we now report on the popularity of shows on the likes of Netflix and Disney+, both of whom have signed up to Barb.

These same audio-matching techniques enable us to report when people watch broadcaster content on a TV set through YouTube.

And it’s not just events like BT Sport’s coverage of the Champions League Final. Channel 4 has posted over 1,000 hours of archive content on the leading video-sharing platform — we know when people watch any of these shows on a TV set in the same way we know when audiences are viewing one of 15 broadcast channels that live stream through YouTube.

How many people are really watching YouTube on a TV set?

Returning to the evidence of how people watched this year’s Champions League Final on a TV set, a slightly larger proportion of the overall audience watched through YouTube. It would be wrong to take this as evidence of a longer-term trend that people are increasingly watching the video-sharing service on a TV set. Yet Barb now has 18 months’ worth of independently-collected data which starts to shine a light on this question.

First, a couple of words on method. We report the amount of time people spend watching YouTube and other streaming services thanks to a Kantar meter attached to WiFi routers across the entirety of our representative panel of UK homes. Being representative means some homes don’t have one of these meters as they don’t have broadband — yes, 6% of homes still don’t have WiFi through either fixed or mobile broadband.

The good news about our technology is we know how each person on our panel streams pure-play video-on-demand (VOD) and video-sharing services to their TV sets, smartphones, tablets and PCs. We’re currently capturing viewing through WiFi networks only, but could go further and report viewing through mobile networks with the participation of the streamers. That said, we don’t expect many people are streaming YouTube to a TV set through a mobile network.

Having got the science bit out of the way, our data show the monthly reach of YouTube on a TV set is 18.8 million. For clarity, this is the number of adult viewers aged 16+ — it’s an average across 16 months from December 2021 until March 2023. We’ve used Barb’s standard definition of reach, which is at least three minutes’ consecutive viewing.

This monthly reach figure increases to 24.5 million if we include children aged between four and 15, who are most likely to watch the video-sharing platform through the biggest screen. Perhaps children are more likely to watch on a TV set as it gives parents a greater chance to monitor viewing choices. It will also be a function of smartphone ownership being more limited among the younger part of the four- to 15-year-old age group.

Given this, it’s not surprising the proportion of children watching YouTube on a TV set each month has indexed, on average, 148 against all aged four and above from December 2021 until March 2023. In other numbers, this means nearly 60% of all aged four to 15 have been watching YouTube on a TV set on a monthly basis.

So yes, our data show the TV set is being widely used to watch YouTube.

Where measurement goes next

We also see the largest screen accounts for just about a third of the YouTube viewing we capture through the WiFi network. This has grown since Barb started reporting YouTube viewing — it’s up from 28% in Q1 2022 to 33% in Q1 2023. Yet to confidently translate this into a narrative that the TV set is increasingly the go-to device for watching YouTube, we would need to know how viewing on mobile networks has changed over the same period.

The numbers I’ve drawn on for this analysis are the tip of an iceberg. When we launched our viewing data for the likes of Netflix, Disney+, YouTube and TikTok in November 2021, we boldly claimed it was a once-in-a-generation upgrade for the industry’s standard measurement of what people watch. Subsequent feedback from across the industry supports this description.

But we’re not standing still. Earlier this year, Barb made a commitment to go even further in how we deliver the industry’s standard measurement of what people watch.

Having asked the industry how we prioritise the measurement of content on YouTube and other video-sharing platforms, we now aim to report content that adheres to industry-agreed standards of brand safety, such as the WFA’s GARM.

We also plan to report fit-for-TV content which encompasses channels and videos that are not only brand safe, but also produced to demonstrable editorial standards and with an eye to aligning with prevailing regulation. This is an important development as it will allow buyers to compare content produced to comparable standards across linear channels, pure-play VOD streamers and video-sharing platforms.

As a joint-industry currency, Barb’s development is guided by the active participation of all sides of our industry. And while consensus may not always deliver the quickest solution, we have demonstrated consistently over the years that consensus does deliver genuine innovation — accountably, objectively and transparently.

Justin Sampson is CEO of Barb Audiences

Justin Sampson is CEO of Barb Audiences