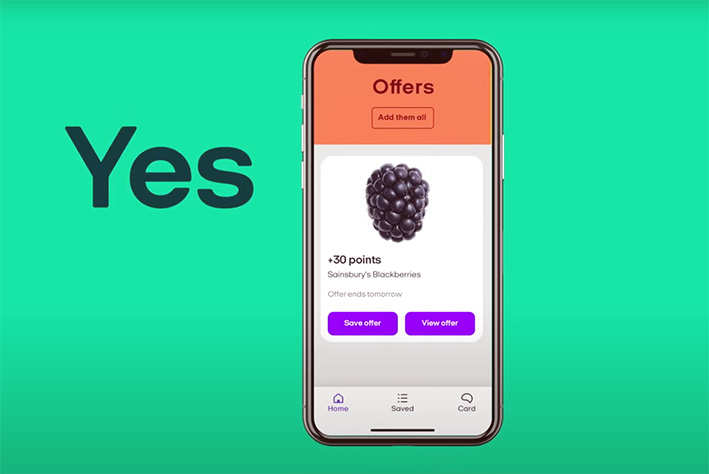

Digital retail media was another strong growth performer in 2024, according to IAB UK’s latest Digital Adspend Study.

For brands, the combination of retail media and streaming allows them to move across the funnel to reach consumers earlier.

Amazon’s head of video sales specialists discussed new ad formats and a “supercharged” partnership offering, and argued that Prime Video is driving hard-to-reach audiences that can be targeted across the purchase journey.

IAB UK’s James Chandler joins host Jack Benjamin to explain why he believes we’re entering a “funnel-less future” as the consumer journey gets truncated by shoppable advertising in AV formats.

Many brands still see retail media primarily as a performance channel focused on driving conversions. But it can help advertisers drive incremental reach and increase brand equity.

In a rapidly growing segment, media owners need to form key alliances, retailers should act like media owners and advertisers require strong governance.

In 2025, how can retail media do an even better job convincing brands — and the world — that it is worth the investment and will transform marketing for the better?

A new sustainability pillar has also been added to the framework.

The Henley Centre’s influential Media Futures 1999 analysed how the internet would impact businesses and consumers. Its authors look at how it helps us go about looking at the future of AI now.

Brands must reach consumers with their products and services at every possible stage of the buying process, driven by stronger collaboration, an increasing focus on first-party data and evolving regulations.

CEO Andy Jassy believes there will be continued growth its ads business, which, like AWS, drove double-digit growth in Q3.