Both broadcast radio and digital audio, when broken out individually, deliver significantly higher profit return on investment (ROI) than the all-media average across short-term and full-term campaigns.

This is the highlight from the High Gain Audio research, revealed by Radiocentre at its annual Tuning In conference on Tuesday.

Commercial audio audiences have been expanding. Rajar’s recent report showed that commercial audio now reaches over three-quarters of UK adults each week. And with commercial audiences having grown by 23% in the last five years, the latest study aims to boost industry confidence in audio’s impact.

The analysis was developed along with WPP Media using data from Thinkbox’s Profit Ability 2 research, covering 141 brands (with 84 having allocated budget to audio) and £1.8bn in media spend during 2021-2023.

Advertising generates profit, but not all media channels are equal

‘Profitable headroom’

According to the research, digital audio delivers a full-term (two years) profit ROI of £5.20 for every £1 spent, while broadcast radio delivers a £5 return.

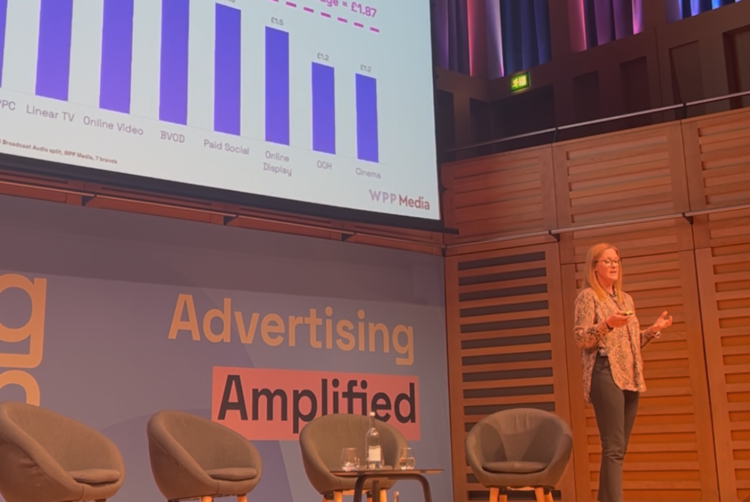

This compares with an all-media average of £4.11.

Notably, the picture is similar for short-term (three months) profit ROI: digital audio returns £2.70 and broadcast radio £2.30 — both exceeding the all-media average of £1.87.

The results did not change whether campaigns were focused on demand generation or demand conversion.

According to Radiocentre, the findings reinforce digital audio’s price premium relative to broadcast radio, given its higher ROI.

Moreover, the findings showed brands that allocated 15% of their total media spend to audio saw a 5% increase in overall short-term total campaign ROI, compared with campaigns that exclude audio.

As Jane Christian, managing director, analytics and insights, at EssenceMediaCom, said on stage at Tuning In: “There is profitable headroom for both forms of audio.”

This is further reflected in results where brands maximised audio spend to 24%. This amplified total campaign short-term ROI by 8% compared with campaigns that exclude audio.

Mark Barber, planning director at Radiocentre, said: “High Gain Audio‘s key takeaway is clear: multiplatform audio advertising is underinvested, with both broadcast radio and digital audio individually exceeding the all-media profit ROI average.

“That’s why, based on the outputs from this analysis, and acknowledging that each individual media campaign will have its unique set of dynamics to accommodate, we’re advocating that, to benefit more fully from its amplification effect on overall campaign ROI, advertisers consider setting a new horizon where 20% of total media spend is allocated to audio.”

Suggesting how reallocating budget from pure-play channels could open up extra investment for audio, Barber stressed the importance of using both digital audio and broadcast radio as they play a “complementary” role.

Finally, he called on advertisers to evolve their marketing mix models (MMMs) to better understand broadcast radio and digital audio effects through utilising campaign audience reports.

WPP Media also conducted additional analysis using a multiplatform audio dataset of WPP campaigns, focusing on brands where the effects of digital audio and broadcast radio could be separated within MMMs.

Adwanted UK are the audio experts at the centre of audio trading, distribution, and analytics. We operate J‑ET - the UK’s trading and accountability system for both linear and digital radio. We also created Audiotrack, the country’s premier commercial audio distribution platform, and AudioLab, the single-point, multi‑platform digital audio reporting solution delivering real‑time insight.

To scale up your audio strategy,

contact us today.