Digital publisher confidence falls despite revenue increases

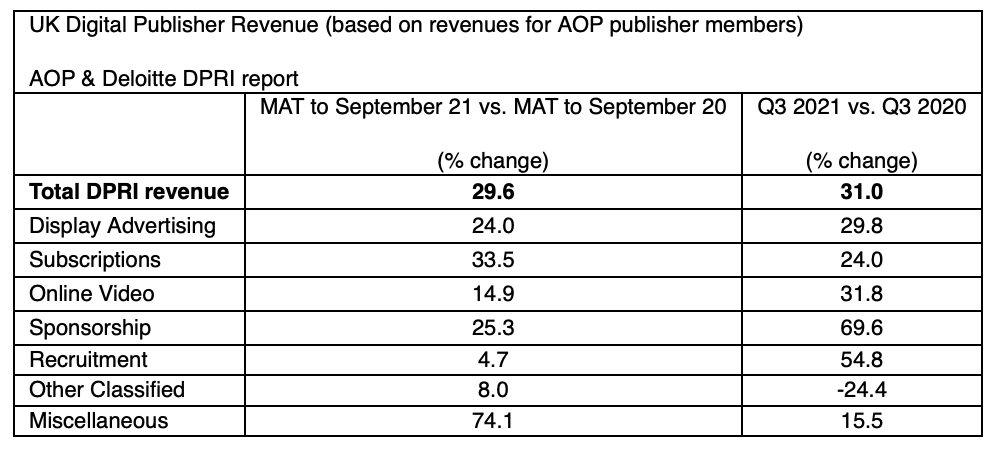

Confidence about the publishing industry has fallen despite 31% year-on-year growth in total digital publishing revenue, the AOP’s latest quarterly survey has found.

The latest Digital Publishers’ Revenue Index for Q3 2021 from the Association of Online Publishers and Deloitte has found that total digital publishing revenue rose to £149.4m.

However, the majority of AOP board members had lower confidence about the publishing industry and their companies’ future “financial prospects”.

More than eight in 10 (84%) of AOP board members reported positive revenue growth and all respondents said they were considering new products “to be a priority” in the next year, up from 55% in Q3 2020.

This is compared to a third of publishers who said cost reduction targets were a priority, down from 55% at the same time last year.

There was “sustained” revenue growth across the board with digital advertising keeping its top revenue spot for publishers achieving 29.8% year-on-year growth to £59.8m, while sponsorship and subscription revenues grew by 69.9% and 24% respectively from the same period last year.

Online video saw “substantial growth” for digital publishers with smartphone revenue increasing 86.6% and tablets 304.2% compared to Q3 2020.

Digital audio growth, comprising internet radio and podcasts, experienced the biggest growth with “a surge” of 520.6%, increasing from £0.6m revenue in September 2020 to £3.4m in September 2021.

Richard Reeves, managing director at AOP, said: “As we close the chapter on 2021, the challenges for the year ahead remain undetermined, so, as an industry, we must continue to remain resilient and collaborate to tackle any imbalance and inefficiencies we could be faced with.”

“A major factor in this will be diversification in revenue strategies, which has already been a major focus for this year, supported by the exponential growth in online video and digital audio this quarter,” he added.

The report is based on a survey of 15 UK digital publishers, including 11 consumer and four business-to-business publishers.