WARC has downgraded its growth expectations for the global ad market for this year and 2023 as Apple’s decision to block ad-tracking by default on iPhones appears to have negatively impacted social media spend.

The Ad Spend Outlook 2022/2023: Impacts of The Economic Slowdown forecast global advertising investment to rise by 8.3% this year to $880.9bn, partly driven by positive results from advertising holding companies in the first half of the year, and an expected boost from the US midterm elections and the men’s FIFA World Cup in Qatar in the second half.

However, the report predicts this growth will slow to 2.6% in 2023 as investment is “inhibited” by economic conditions, as well as a reduction in third-party cookies used for marketing purposes.

This marks a downgrade of 4.3 percentage points to the 2022 growth forecast, and 5.7 percentage points to 2023’s forecast compared to previous global forecast in December 2021. This marks a reduction of nearly $90bn growth potential over the next two years.

Social media companies’ $40bn shortfall

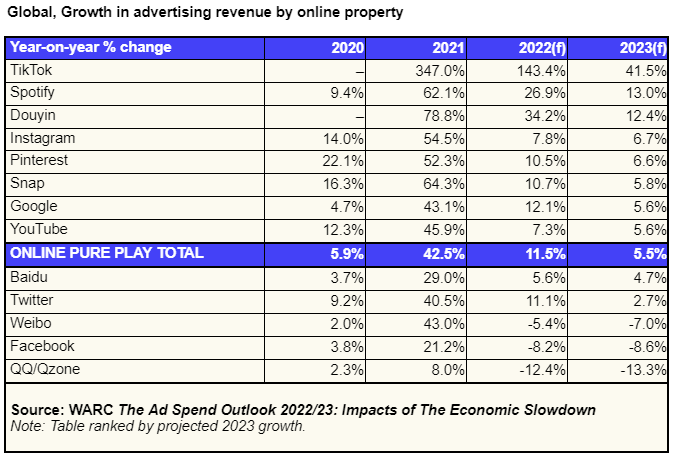

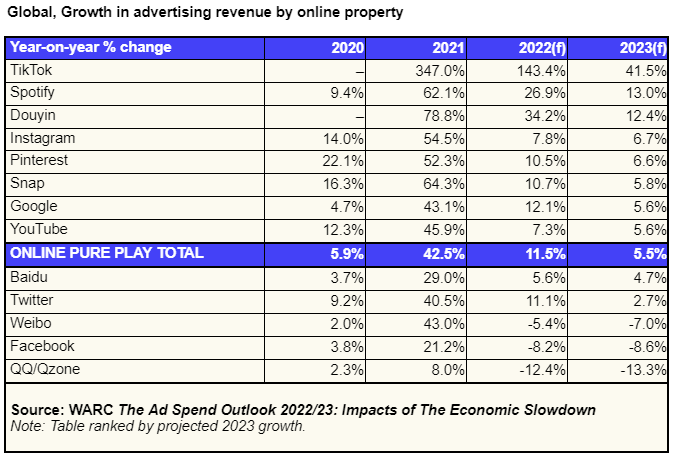

WARC predicts social media adspend will grow by 11.5% in 2022, compared to 47.1% in 2021. In 2023 this is expected to dip to 5.2% growth, which is the slowest rate for the sector.

This is partly from the impact of small and medium-sized businesses “bearing the brunt of worsening economic conditions” leading them to reduce advertising activity, hitting social media companies hardest.

Additionally, Apple’s blocking of third party cookies across two billion devices, used by 12% of the global population, has already had “an adverse impact” on social media companies relying on this data.

WARC believes this along with Google’s delayed move to deprecate cookies from its Chrome browser will remove $40bn from social media companies’ bottom line in 2022 and 2023.

It predicted Meta’s full year growth will be flat over 2022 and 2023, while TikTok, Snap and Twitter are all expected to register growth next year, albeit at a slower rate than previously.

AVOD and BVOD set for spend growth

Spend in the video streaming sector is expected to grow faster than the total ad market with 8.4% and 7.0% growth forecast for 2022 and 2023.

Investment in advertising-funded video-on-demand (AVOD) services including Hulu, Amazon Prime Video and YouTube is expected to rise to 8.0% this year, and 7.6% next year to reach a value of almost $65bn.

YouTube in particular is set to “ease off” growth from 45.9% in 2021, to a forecasted 7.3% in 2022 and 5.6% in 2023 as it has proven “vulnerable” to privacy changes on Apple devices. This could result in a 39.4% share of the global AVOD market but would represent a declining share of 0.9% compared to 2021.

However, there is already “evidence of saturation” amongst audiences in the streaming market meaning short and medium-term growth could be hindered as new entrants compete with established players for existing and incremental adspend.

WARC also predicted broadcaster video-on-demand (BVOD) to increase its advertising income by 9.7% this year, and 5.2% next year, but from a lower base so it would reach a projected value of $18.5bn in 2023.

(Click on the table to enlarge in a new tab)

WARC’s forecast is based on data from 100 markets.

Adwanted UK are the audio experts at the centre of audio trading, distribution, and analytics. We operate J‑ET - the UK’s trading and accountability system for both linear and digital radio. We also created Audiotrack, the country’s premier commercial audio distribution platform, and AudioLab, the single-point, multi‑platform digital audio reporting solution delivering real‑time insight.

To scale up your audio strategy,

contact us today.