IPA Bellwether: Highest marketing budget growth since 2014

Total marketing budgets in Q4 2023 have seen “strongest upward revisions” since 2014, according to the IPA’s latest Bellwether Report.

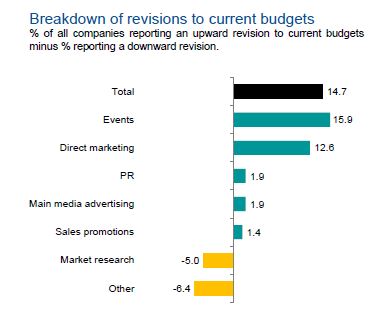

The quarterly study, which surveys marketers’ confidence and media spend decisions, revealed that Q4 had a net balance of 14.7% of marketers reporting an increase in their total marketing budgets — the highest level since Q2 2014 and more than double the figure from the previous quarter’s 5.3%.

This is the 11th consecutive quarter of a net increase in total marketing budgets — the longest uninterrupted period since 2018, despite a persistent “intensely challenging backdrop for UK businesses” with high borrowing costs, inflationary pressures and a forecast recession.

By channel, five sectors recorded positive net balances: events (15.9%), direct marketing (12.6%), PR (1.9%), main media advertising (1.9%) and sales promotions (1.4%).

Main media advertising includes video (TV, cinema and online), audio (radio and other audio), published brands (print or online), OOH and other online advertising. Video and other online advertising were the only sub-categories to record a positive net balance at 6.6% and 13.2% respectively.

The biggest change was in direct marketing, which reported a net increase of 4.3% in the previous quarter. Events and direct marketing were “the principal drivers” of total marketing budget growth at the end of last year, the IPA noted.

Looking further ahead to 2024 and 2025, the outlook for total marketing budgets was “remarkably strong”, with a net balance of 29.4% of companies planning to expand budgets, while “optimistic preliminary budget setting” was seen in five of the seven Bellwether categories.

Events, direct marketing and main media in particular registered net balances of 17.8%, 16.8% and 14.2% of respondents intending to increase budgets in 2024 and 2025.

Analysis: Marketing is vanguard of economic cycle

Another finding was “a widening” divergence between the perception of individual company and industry-wide financial prospects. A net balance of -12.7% of participants were confident about their industry’s financial outlook, compared with 32.4% who were optimistic about their own businesses.

Joe Hayes, principal economist at S&P Global Market Intelligence, said: “The resilience of UK marketing continues to be at odds with the worsening economic climate businesses are facing. Instead, companies are demonstrating the foresight to maintain a long-term view towards their brands, maintaining a healthy level of investment in the tools to stave off competition, retain clients and win new business.

“The UK economy is expected to endure a shallow recession, which will end in the first half of 2024, and our data clearly shows more companies are prepared to ride out the bumps to put themselves in a strong position when the recovery phase kicks in than those that aren’t.”

Tim Heden, managing director at Electric Glue, told The Media Leader: “Media tends to sit at the vanguard of the economic cycle — whilst it would be churlish for the industry to be suggesting higher client budgets whilst they are struggling to keep the lights on, the phrase ‘never waste a good recession’ springs to mind.”

He pointed to studies from Kellogg’s in the 1930s (which advertised through the Great Depression and came out as the number one cereal produced in the US) as well as more recent market studies that showed the benefit of “keeping a foot on the gas pedal through choppy waters”, as the potential loss of front-of-mind awareness often outweighs the investment cost of media.

True value of marketing

Adam Morton, chief product officer at UM London, suggested that the latest Bellwether report could show that the true value of marketing is being understood.

He told The Media Leader: “It’s good to see the positivity, as that’s helping protect budgets generally. It might be a case of brands and businesses have got better measurement in place so they can understand the true value of marketing. I’ve often said that the weight of evidence has been there for quite some time.

“Looking at the work done by the IPA and all the things everyone’s aware about that the brands that invest in difficult economic times are stronger at the end and able to maintain and protect price — it’s not like that evidence is new, but it seems like that advice is now being heeded.”

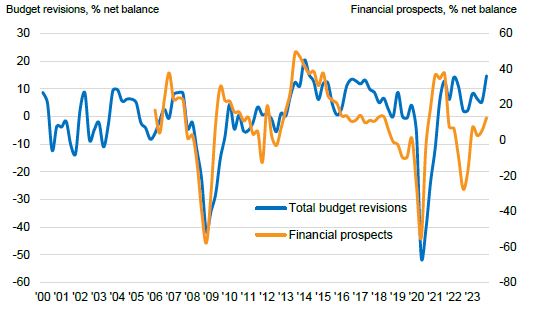

However, Morton saw the “overriding theme” of recent Bellwether reports as “volatility”.

He explained: “Thinking about Bellwether reports over the last 12 months or so, they’re in line with what we’re seeing versus the overarching economy in that they’re quite volatile. It’s sometimes difficult to pick trends out because what you see one month or one quarter can change.”

In particular, Morton highlighted last quarter’s total marketing budget growth slowdown compared with this quarter’s near 10-year high, alongside channel investment “flying up and down” quarter by quarter.

Another example of volatility was UK inflation unexpectedly going up by 10 basis points in December when it was expected to decline.

Gone are the days when budgets are set at the beginning of the year and adhered to, Morton added, with many now assessing budgets on a quarterly or sometimes monthly basis, depending on the category.

Scratch the surface

Jackie Lyons, head of planning at Havas Media Network UK, told The Media Leader the report painted “a positive picture” for total communications spend, but it raised questions around brand and performance investment in media channels.

She continued: “Advertising investment is looking buoyant. And who doesn’t like to see marketing spend increasing? But when you scratch the surface, and appreciating this data is surface level, it may not be brand spend that sees the lion’s share of investment.

“Video is up 6.6%, which is definitely promising, but as with all Bellwether reports, I would be keen to learn more about the huge growth in online of 13.2%. Is this all in brand-building digital or perhaps increases in short-term performance?”

Lyons said she would “be keeping an eye” on declines in high-reach channels like publishing, audio and OOH as it might suggest an increase in performance over brand spend.

“If that’s so, we need to make a stronger case for brand-building media in the media mix,” she concluded.

Worst is behind

Heden added that the latest report showed “cautious optimism”, especially after “a decade’s worth of shocks” in three years, including the Covid-19 pandemic, two wars, an energy crisis, inflation, high cost of living and Trussonomics. These did not have a positive impact on consumer confidence or media investment growth.

He added: “However, signals are there that the worst of these storms are behind us, and with inflation coming under control and likely reduced interest rates, the broader economic outlook is not as bad as forecast last year.

“As ever, there are channel stories within and clients are chasing value and effectiveness more than ever. Media owners and agencies have had to adapt to a more short-term client outlook — this is likely here to stay.”