Lantern: Why it’s an exceptional development

Opinion

Lantern is exactly the kind of innovation broadcasters need to protect and grow their businesses and get back into the room with advertisers.

Lantern is, simply put, an outcomes-based measurement solution created by three of the UK’s major commercial TV companies: Sky, ITV and Channel 4.

In a short space of time, the broadcasters have collaborated to build, test and launch a beta version. This is exactly the kind of innovation broadcasters need to protect and grow their businesses and get back into the room with clients.

What impresses most isn’t just that Lantern tackles outcomes, but the speed of its launch, the fact that broadcasters didn’t let politics derail it and the sheer level of granularity in the data, feedback loops and outcomes it can now deliver to advertisers.

Lantern will serve as measurement solution for Universal Ads in UK

Key benefits

For me, there are three key benefits.

Performance spend and SMEs: As TV rightly pursues performance budgets and small and medium-sized enterprise (SME) advertisers, it needs to offer data and insights on par with, or better than, the platforms.

Client access: Broadcasters have long struggled to secure meetings with clients because they lacked the high-level insights that platforms provide. Lantern provides exactly the sort of data that media managers and marketing teams can’t ignore.

Incremental sales: It’s the big one. We’ve been stuck in an era of targeting likely buyers and claiming attribution when they would buy anyway. Proving advertising leads to incremental sales is the next big thing. Lantern does that — and more.

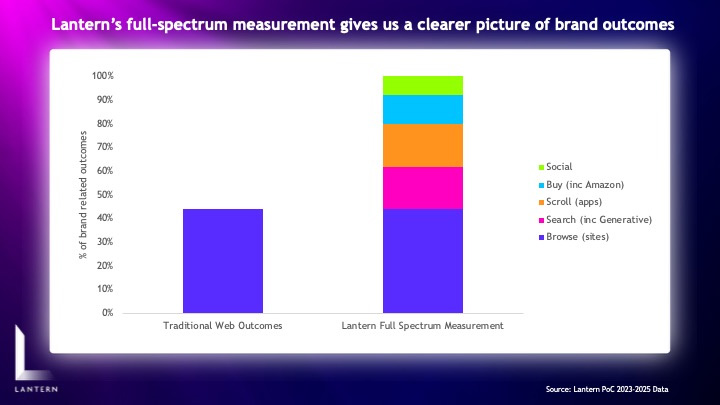

Lantern employs the use of a panel to access these insights. Ads rarely act in isolation; exposure may lead consumers to search, check social media, use generative AI, visit a website etc. Lantern tracks these behaviours and what particularly impressed me was the breadth of impacts that is trackable.

To give an idea of the level of insights, here’s the full spectrum (as they call it) of brand outcomes they are able to share with clients (taken from Thinkbox’s event on 23 September).

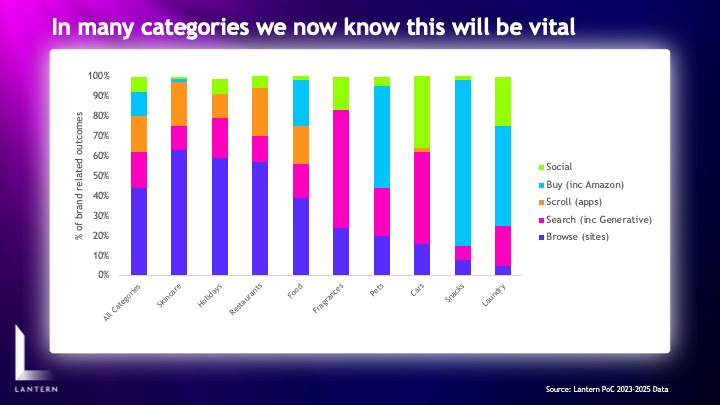

Since proof of concept, Lantern has been able to capture category behaviour, which will be invaluable for brands. Imagine being able to walk into a client meeting and show them whether they’re over- or under-performing in their category, then advise on the tactics to improve outcomes.

Lantern can also be used to report against performance KPIs, which is essential. Not all brands or agencies will buy that way; audiences and GRPs remain fundamental. But the reality is that many brand and media managers are incentivised on KPIs such as footfall, sales, website traffic, pricing power, repeat purchase, loyalty and so on.

This is one of the main reasons platforms are so successful. The TV industry may not like these KPIs — they’re often short-term — but that doesn’t matter to the buyer.

Buyers are rewarded on these measures and TV can now promise to deliver and measure against them. That’s huge in rebalancing spend. (I say “rebalance” because clients are over-indexing in digital/platform spend precisely for this reason. I have data to support this; I don’t make things up!)

How Lantern will bring outcome measurement to TV — with Sameer Modha and Matt Hill

Outcomes and insights

At the moment, the three broadcasters are funding Lantern together and aren’t charging clients for insights. This is something the industry must provide. Platforms already do; if broadcasters want to win spend back, they don’t really have a choice.

If clients can see TV’s impact on the same factors digital claims credit for, Lantern could play a vital role in protecting existing budgets, attracting new money and bringing spend back.

Since 2015, UK viewership is roughly flat once you combine broadcasters and streamers. Demographics aren’t that different either. Some groups are down, but not by much. And yet advertiser spend on TV is flat or down.

Why? Measurement.

Advertisers want instant outcomes and insights for quarterly business reviews. They need to justify where to put money in the next two or three months. Lantern helps meet that need.

In my discussion with Sameer Modha and Henry Vernon, it was fascinating to hear how Lantern was built.

To tackle legal challenges and move to the next stage of development, broadcasters have agreed to pool inventory so that impression data is held centrally. Again, it’s one of the main benefits of such a tight collaboration, as I’m sure this move will improve flexibility to do other things in the future.

Lantern also ties in with Universal Ads (launched by Freewheel with all commercial broadcasters) to target SMEs. This market accounts for around 80% of Meta’s revenue and depends on data to justify spend. SMEs are less sophisticated advertisers, so they’ll lean heavily on this kind of measurement.

TV cannot grow by squeezing more from the same top advertisers. Those budgets will shift around, but won’t return to the levels they once were. Growth has to come from new sources.

The SME market is desperate for alternatives to platforms. Brands that rely on performance data for spend are enormous — Sky put the addressable “performance spend” market for TV at £1.5bn in the UK. Mid-sized FELT brands that have maxed out on digital and want to grow are another huge opportunity.

Lantern gives TV a real shot at winning — or at least attacking them all.

Justin Lebbon is a consultant and co-founder of Adwanted Events

Justin Lebbon is a consultant and co-founder of Adwanted Events