Like and subscribe: YouTube’s reach can no longer be ignored

Opinion

YouTube’s growth isn’t driving the imminent demise of other platforms and channels. But TV advertisers should consider how it fits into media plans for the year ahead.

‘Tipping point for television as YouTube overtakes BBC’ was a headline in The Times recently. The article claimed it’s a ‘tragedy’ for fans sitting around the set.

It’s a misleading interpretation of BARB’s audience data; YouTube’s overall audience reach is only larger than the BBC’s for multi-device use (referred to as 4 Screen Viewing), but still smaller for TV viewing.

Daily minutes viewed on YouTube in December on 4 Screens was 41 mins, compared to 21 mins on TV solus (which makes sense). It reflects how consumers are behaving, especially when viewing on mobile devices.

However, it needs to be put into context.

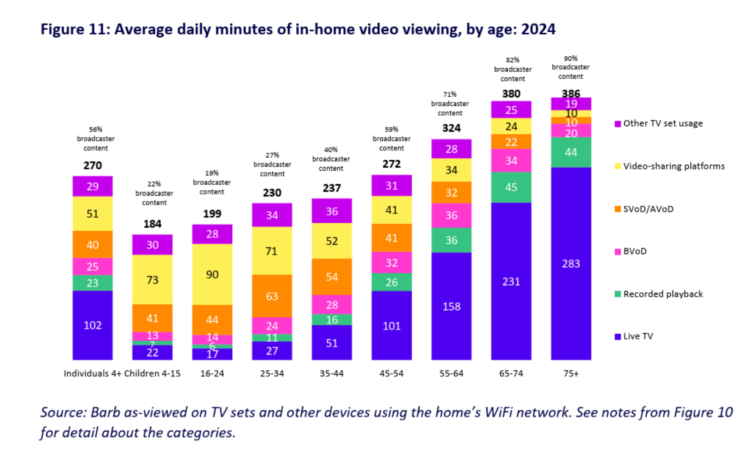

* AV viewing is incredibly popular and will probably grow. The population spends about four-and-a-half hours a day viewing at home.

* About 19% of viewing is to user-generated content sites (and it hasn’t materially changed year on year).

Analysis of the latest BARB data shows that YouTube’s growth isn’t driving the imminent demise of other platforms and channels; people are spending more time watching video-sharing sites alongside other platforms. Increasingly, audiences are fragmented across many channels and platforms.

| Total viewing 4 Screens

DAILY MINUTES VIEWED |

DEC 2025 | DEC 2023 | +/- (MINS) |

| BROADCASTER | 144.12 | 165.54 | -21 |

| SVOD/AVOD | 47.06 | 45.12 | +2 |

| VIDEO SHARING | 52.15 | N/A | N/A |

There is debate about whether YouTube is TV.

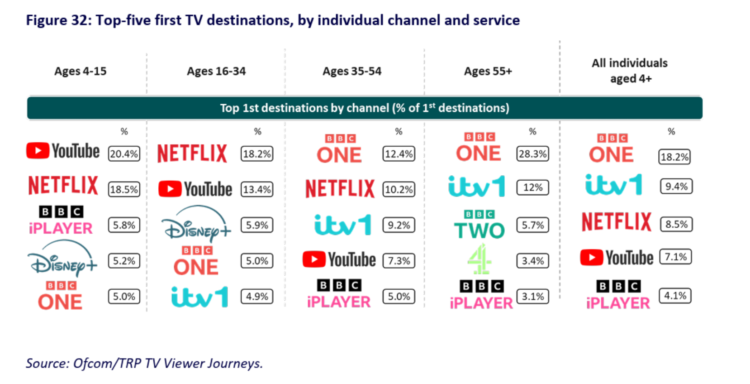

It’s redundant; to some audiences, YouTube is their initial viewing destination, and they access broadcast-quality content on their TV sets. To younger audiences, it is a vital part of their viewing experience.

However, YouTube isn’t a channel; it’s a content distribution platform driven by an algorithm.

There are over five billion videos on the site, some broadcast quality, much user-generated dross.

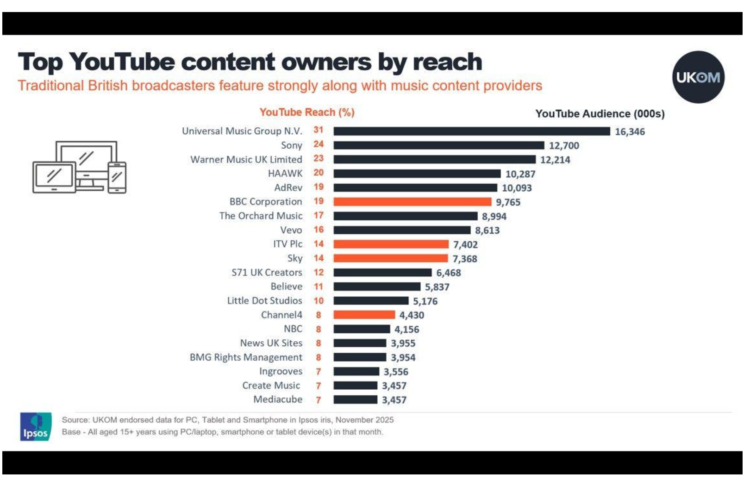

However, every established broadcaster has a YouTube channel, the BBC, ITV, Channel 4 and Sky, demonstrating that some YouTube content is TV. These are used by broadcasters to deliver high-quality content that delivers advertising revenue. Channel 4 sells its own advertising inventory.

The key issue for future TV advertisers will be around audience access, finding and communicating with the most valuable consumers, and mass reach will be an absolute premium.

TV advertising used to be a simple model where most people viewed a limited range of free-to-air channels, and brands could quickly build mass reach and attention. Some audiences now avoid almost all linear TV and are heavy YouTube users.

According to the OFCOM Media Nations report for 2025, 16-24-year-olds spend 90 minutes a day watching videos on platforms at home, accounting for 45% of their viewing.

Only 19% of their viewing is broadcaster (generated) content, 9% to Live TV. The leading platforms for all audiences under 35 years old are video-sharing platforms; it has to be a core part of the channel mix for advertisers to reach these audiences.

Planning effective AV campaigns in the future will require access to complex combinations of platforms. We’re used to having a simple, universally accessible channel infrastructure where a single standard piece of content could be transmitted and a robust, common data source could be deduplicated and measured for audience delivery.

In a multiplatform world, this doesn’t exist; there is little point in debating its pros and cons. The agency’s role is to reach specific audiences where they are viewing.

The definition of what counts as a viewer and what constitutes an impression varies between platforms: some are measured by BARB, most make their own rules, and there is variation in content requirements. It makes it more complex to plan, deliver and measure effective results. Establishing cross-channel metrics, like reach and frequency, is increasingly difficult to calculate.

Planners need to consider what is valuable, make judgments on environments and avoid inappropriate and fraudulent content. The planner’s subjective role becomes more important; it can’t be delegated to a DSP.

This is where Thinbox’s ‘YouTube isn’t TV’ argument is valid: the vast majority of YouTube content is very low-quality and attracts only a small audience.

Marcus Chomyszyn from Amazon posted on LinkedIn that only 2% of YouTube Channels drive 80% of all views, something like 245m+ channels add zero reach and impact.

Additionally, data from UKOM shows how important established ‘broadcaster’ and media channels are in delivering reach on YouTube. YouTube is not a controlled environment; it requires media planners to determine what is viable.

The consensus at the Future of TV Advertising Global conference before Christmas was that the industry needs to focus on delivering outputs for clients.

If a core objective is to build reach, selected YouTube content with strong production values will be vital for the plan.

The opportunity is to use clients’ first-party data to plan and deliver this; TV’s role shifts from a one-to-many advertising medium to a one-to-an-identified-group medium. This makes it possible to directly attribute and analyse performance and constantly test and learn.

The issue is managing complexity; planners will need to process large volumes of incompatible data. This has been highlighted by the US AV marketing body, Go Addressable, which acknowledges that delivering effective addressable TV campaigns requires far more time, expertise and input from multi-dimensional agency teams.

The solution is partial automation, inevitably helped by AI.

This is alearning from the USA, where these tools are being developed. We need to process and model client data, attribute it against multiple channels, deliver precise investment plans (possibly defined by location or behavioural metrics), and accurately measure performance.

This needs to be optimised in real time. We’re in the process of scoping and building an AI-based planning tool with a leading tech consultancy that will allow the integration and analysis of multiple data points and provide viable AV investment strategies in an increasingly complex world.

The BARB data shows that audiences are fragmenting and spread across multiple platforms. However, ‘TV’ is increasingly important in people’s lives, and the advent of technology and new data sources should deliver great opportunities for many more advertisers.

Charlie Makin is founder and strategy director of Be Addressable

Charlie Makin is founder and strategy director of Be Addressable