M&A today’s hot topic, tomorrow’s winning strategy

The Future of TV Advertising Global 2025

Consolidation has been the hot topic of the year. At The Future of TV Advertising Global 2025, held at Kings Place earlier today, Ampere Analysis director Richard Broughton revealed that consolidation is necessary to remain relevant and competitive.

Broughton’s insight comes after Netflix agreed to purchase Warner Bros and its film and television studios, including HBO Max and HBO for $82.7bn.

‘A seismic shift’: Netflix’s deal to acquire Warner Bros will remake the entertainment industry

The recently merged Paramount Skydance had offered to buy the entirety of Warner Bros. Discovery’s business for $108.4bn.

This is just one of a series of mergers and acquisitions (M&A) deals and partnerships over the last 18 months.

For instance, in Q4 2024, NBC Universal announced plans to split into two divisions: streaming and cable networks.

In Q1 2025, Warner Bros. Discovery bought a 30% stake in OSN, a pay-TV and streaming service in the Middle East and North Africa (MENA) region.

In Australia, DANZ acquired Foxtel, and in Europe, RTL acquired Sky Deutschland.

Roku also acquired Virtual Multichannel Video Programming Distributor (VMVPD). This internet-based streaming service delivers live TV channels and on-demand content, similar to cable TV but without physical wires.

Netflix and TF1 agreed a partnership, allowing Netflix subscribers in France to access live channels and on-demand content from TF1+ directly on the streaming platform, starting in summer 2026.

Also in Q4, ITV has confirmed reports that it is in talks to sell its Media and Entertainment business to Sky, owned by US broadcaster Comcast.

What is driving consolidation?

Broughton explains that consolidation typically occurs when the market is “challenged”, or the industry is facing “clear negative trends,” for instance, when consumers are cutting back, or advertisers are reducing their spending.

The other explanation is when a market is in the early stages of development, and small companies merge to drive scale.

Notably, in assessing TV’s numbers at a headline level, neither is the case here.

Global sector revenues in 2025 totalled $578bn, marking continued growth since 2021, when revenue was $501bn.

However, Broughton underlined “structural shifts” which have driven “significant” changes in the “composition of that revenue.”

For instance, paid television has declined from $190bn in 2015 to $170bn in 2025, while commercial broadcasting has fallen from $160bn to $130bn.

Conversely, subscription streaming has seen significant growth: 10 years ago, its value was $10bn globally, but now it is “about the same size as the entire global activity landscape.”

Video on demand (VOD) and Free Ad-supported Streaming TV (FAST) are also fast-growing markets.

The winners and losers

Broughton highlights it’s not “just about structural changes,” but “the types of companies that are winning this battle.”

He adds: “If we think about who they are, increasingly, we’ve seen a shift towards globalised entities.”

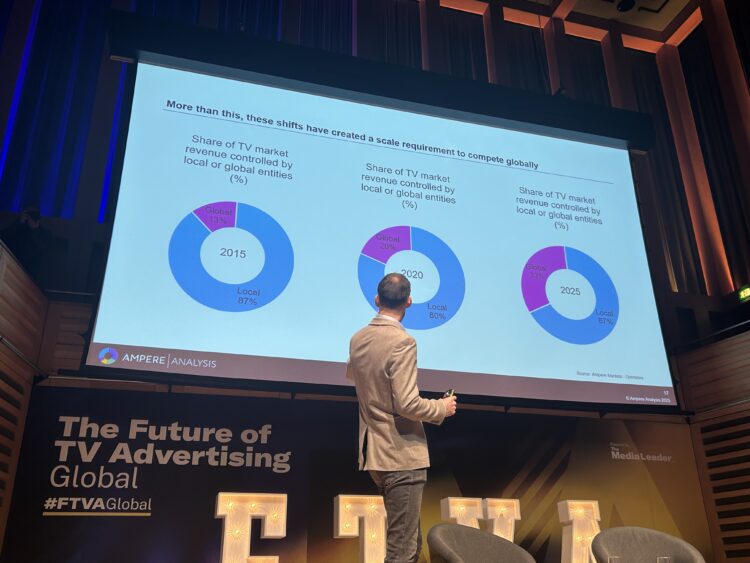

The global TV market is divided into two segments: revenue controlled by local players, such as commercial broadcasters, and revenue controlled by large global entities, such as multinationals, pan-regional groups, and entities covering multiple markets.

In 2015, the share of TV market revenue controlled by local or global entities was 13% and 87% for local players; 10 years later, the global entities’ share is 33% and 67% for local players.

Reflecting on this change, Broughton said: “There’s an imperative for scale.

“If you’re looking to stand out in this global marketplace, monetise your platform and services on a global basis, you’re not competing just with local entities anymore, you’re competing with the massive global giants.”

Broughton further underscored that M&A is necessary to drive scale and competition in this globalised landscape, with mono-market, mid-scale companies set to become increasingly isolated.

Along with scale, content was also identified as a key component of success, alongside IP control in an increasingly fragmented landscape, making IP-rich businesses key targets for acquisition.

“Audiences are driven by content; whoever controls the content, controls the audience, and given how many different media channels consumers are choosing to pick, it’s increasingly hard to stand out,” concluded Broughton.