Cost, value and how we should plan today’s TV

Thinkbox’s Matt Hill explains how TV viewing has affected the price of advertising, what this means, and how advertisers now need to approach the medium

People know the cost of everything and the value of nothing these days, don’t they?

Well, certainly, cost has been a massive issue during the recent years of economic uncertainty – which partly explains the well-documented and concerning drift towards short-termism in marketing. Short-term survival has been more important than long-term growth.

Cost in TV has also become a talking point. This is because the cost of reaching some TV audiences via linear TV has increased, particularly younger audiences, because they are watching less linear TV. This has been an unwelcome development for advertisers wanting to reach younger viewers.

That said, TV’s value, even with a higher price tag in places, is unquestionable. TV has been ridiculous value for years. Look at the effectiveness evidence – 71% of total profit generated by advertising on 54% of the budget, and it does this at the greatest efficiency (a profit ROI of £4.20), and for the least risk.

But TV is changing, questions are being asked and they need addressing. So, in this article, I will set out how TV viewing has affected the price of advertising, what this means, and how advertisers now need to approach TV.

The fact is there is no replacement for what TV advertising does. Luckily, though, TV still does what TV does.

TV’s digital transformation

TV is not alone in having seen a decade of disruption, but its disruption gets a lot of attention. Perhaps this is because everybody watches TV, so everybody has a view. It is also the most famous form of advertising, so change is very public.

There has been more change in TV during the last ten years than in the previous 50. The sheer amount of TV there is to watch is one thing, but also the way we watch it. TV has been digitally transformed.

Subscription VOD arrived and went from zero penetration in 2010 to 58% in 2019 (it is around 10% of all video viewing). Connected TVs had a similar trajectory, from less than 20% of households in 2010 to over 70% in 2019. Broadcaster VOD services, too, have soared: ITV now has over 30 million registered users, for example. And YouTube – not TV, but relevant to TV’s story – has further carved out roles in our lives, being used for an average of 5 minutes a day in 2010 to over 30 minutes a day in 2019.

The re-distribution of TV

All this has had consequences for linear TV viewing to commercial TV channels. The headline story is that some linear viewing has been re-distributed online, mainly to SVOD services like Netflix and to the broadcasters’ own VOD services.

We shouldn’t forget that the broadcasters themselves have driven this change, making it possible for people to watch TV however they like.

As 2020 unfolds this will be a fascinating space to watch. Following BritBox’s launch late last year and with Disney+ launching in March, we’ll see the most valuable back catalogue content being taken back by the rights holders and the streaming wars will have begun.

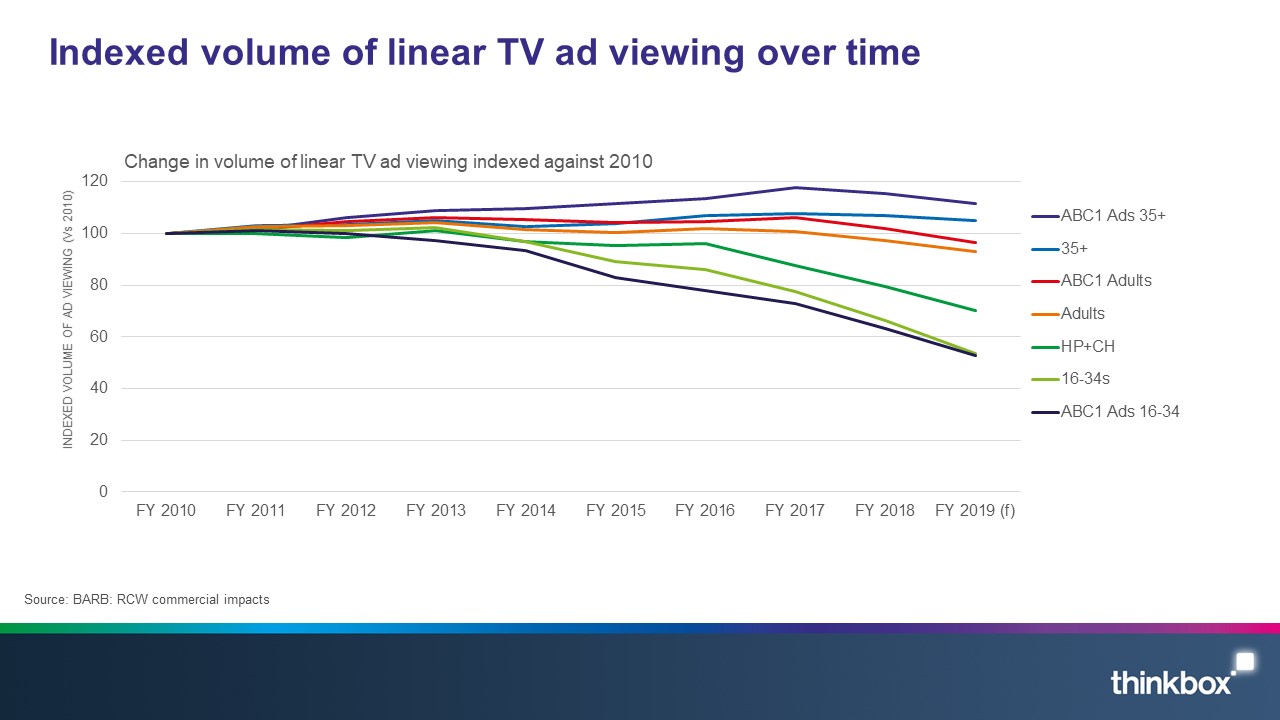

The headline for advertisers is that this re-distribution of viewing has resulted in declines in the number of TV ads viewed through linear TV. Crucially, though, this has been restricted to younger demographic groups. Older (and richer) audiences are watching pretty much the same number of TV ads they were 10 years ago.

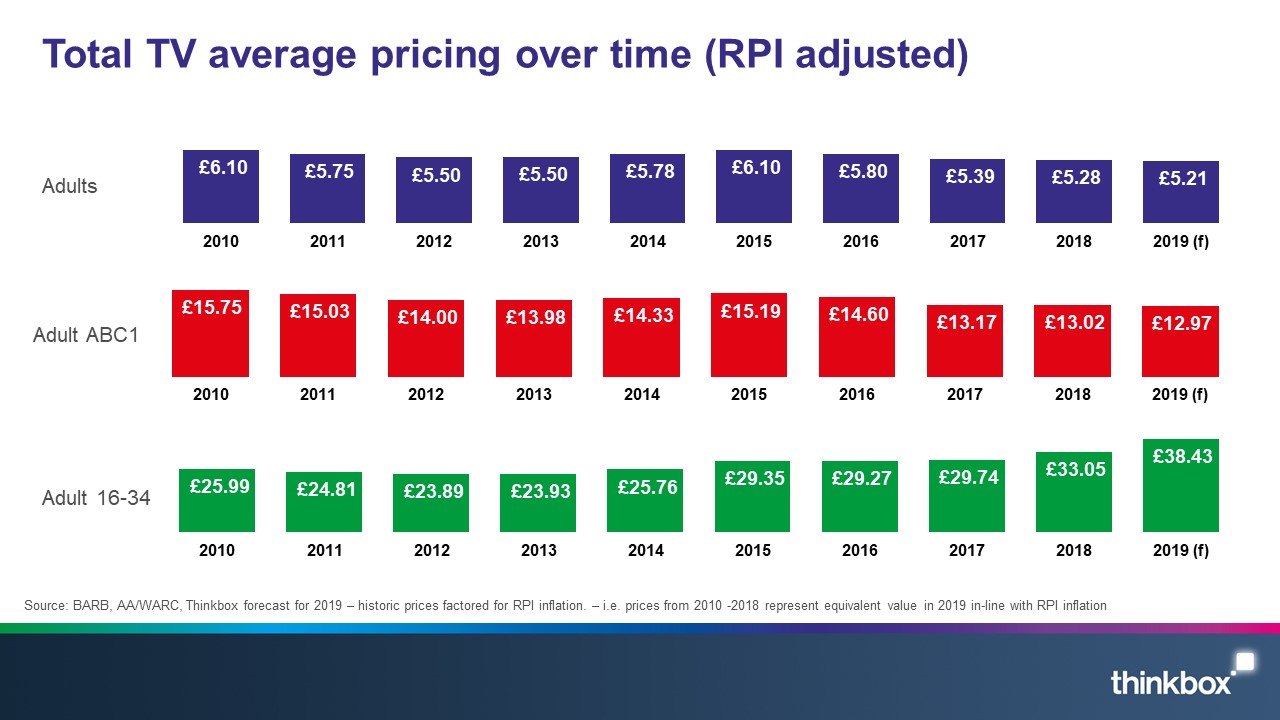

Some TV audiences are cheaper now

Linear TV advertising is priced on a supply and demand basis, so changes in either affect the price paid by advertisers. With RPI outpacing TV investment (£10 in 2019 is equivalent to £13 in 2010 according to ONS RPI data, while linear TV spot revenues in 2019 are pretty much on a par with 2010) and TV’s broad audience holding up, prices for audiences such as Adults and ABC1 Adults are in fact deflating. No one is complaining about that obviously (or really mentioning it at all).

Some TV audiences cost more

However, with young audiences migrating to VOD at a faster rate than 35+ audiences, we’ve seen increases in the price for linear TV audiences such as 16-34s over the last few years. For advertisers, the frustration of supply-driven increases in the price of younger linear TV audiences is understandable.

But the uncomfortable reality for advertisers looking to target younger audiences through AV advertising is that there isn’t a substitute for TV. TV advertising hasn’t been replaced. Most of the viewing that has been lost from TV has moved to non-commercial, less viewed or less effective advertising environments.

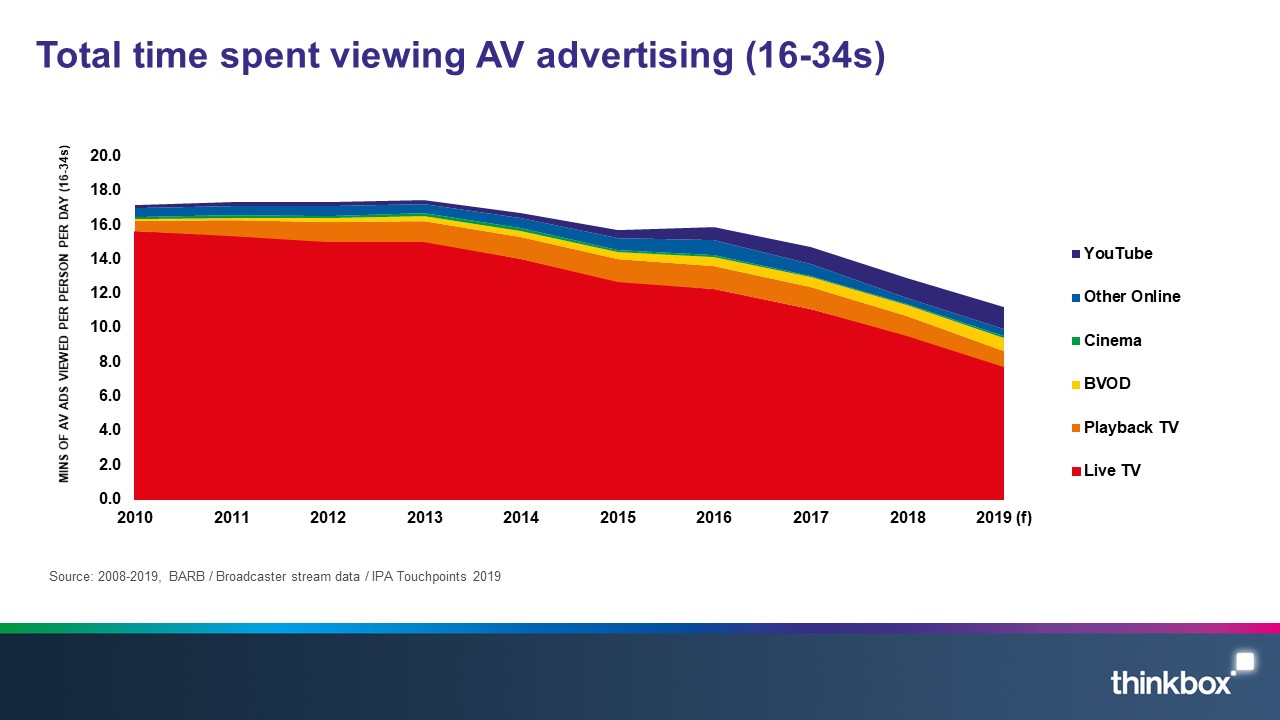

Total video advertising time is declining

TV accounts for 85% of 16-34s’ video advertising viewing. TV is unrivalled in its ability to convert viewing of content to viewing of advertising. Broadcasters are unique in that their content is valued to the point where it’s possible to interrupt it with advertising, without deterring audiences.

Online video competitors don’t offer that same proposition – think of YouTube’s skippable inventory or the ads glimpsed in a Facebook feed – and so total video ad viewing time is in decline.

What should advertisers targeting young audiences do?

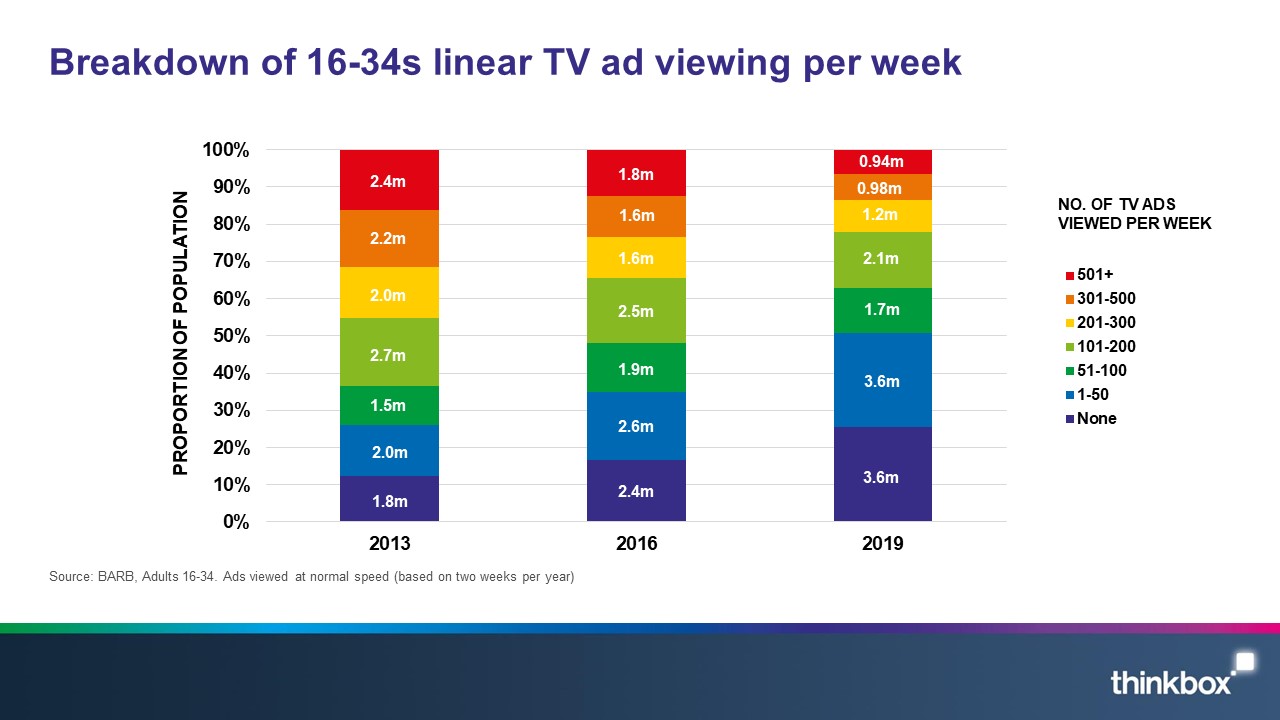

First, don’t assume that because linear TV viewing is declining for 16-34s that it’s no longer a powerful destination to drive reach.

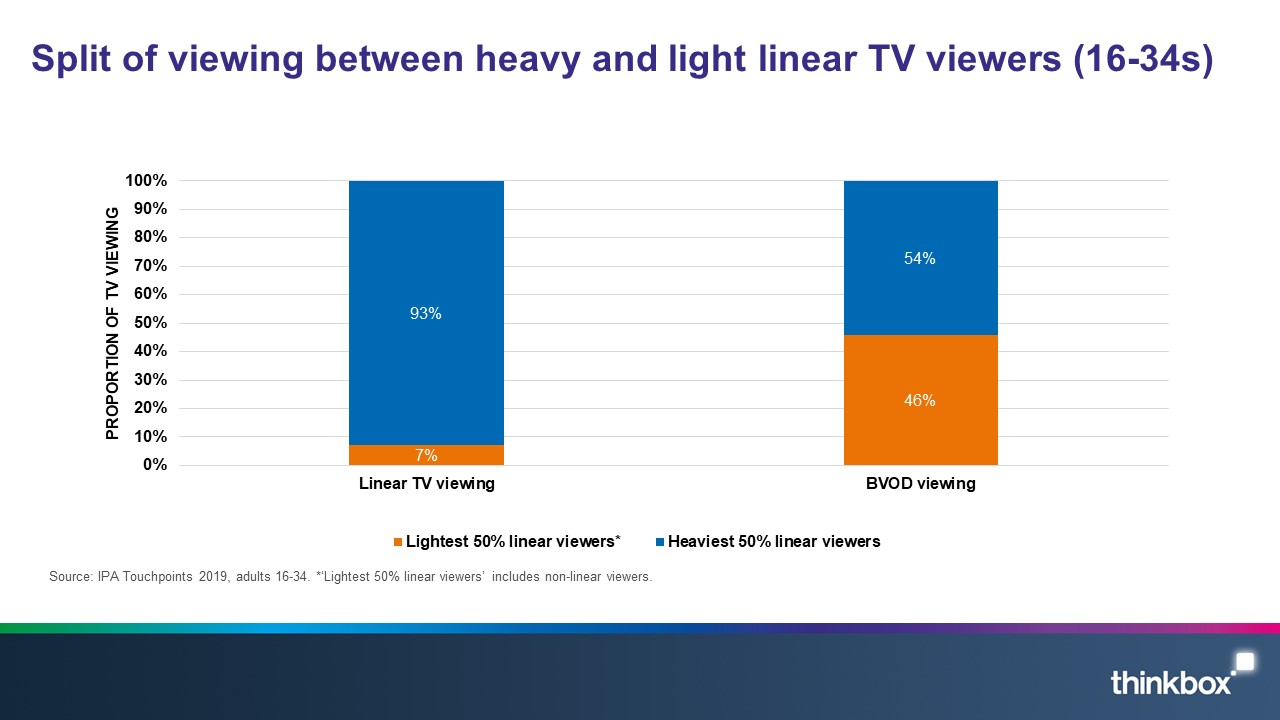

The analysis below splits 16-34s into groups based on the number of ads they see on linear TV in a week. With almost 50% watching 50 or more linear TV ads in a week, it shows linear should very much be a principle means of driving fast, scaled reach of this audience.

If we look at the lightest half of 16-34 linear TV viewers – i.e. those who see fewer than 50 linear TV ads a week or no ads at all – and use the IPA’s Touchpoints to analyse their viewing to Broadcaster VOD, it shows that BVOD is where we’re much more likely to reach them.

The odds of the average spot on linear TV reaching the lightest half of 16-34 TV viewers is 1 in 14. In BVOD it is just over 1 in 2. This is why we need to plan across both linear and Broadcaster VOD in order to drive high levels of cost-effective reach.

Total TV planning

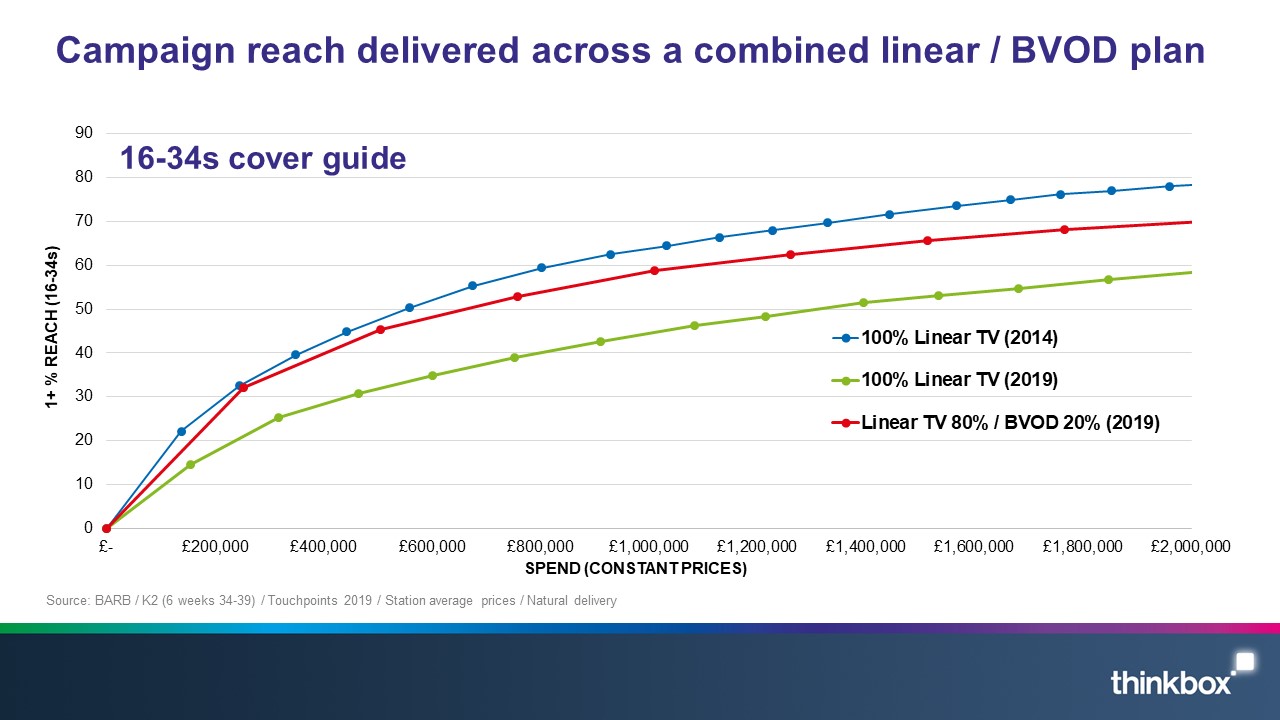

No advertiser bases their sales performance on just high street sales; TV shouldn’t be judged on the performance of linear alone. It would be like judging Lionel Messi solely for his goals. While TV doesn’t quite deliver the reach it did for 16-34s back in 2014, before the establishment of the SVOD players and the re-distribution of our TV viewing, it’s very close.

£1 million planned 80/20 across linear TV and BVOD will today get you 60% 1+ reach for 16-34s (it was 65% 5 years ago). £2 million will get you 70% 1+ reach (compared with 80% 5 years ago).

This means that there must be new TV planning fundamentals. For 16-34s, BVOD advertising is now cheaper than linear TV advertising, so for smaller budgets targeting 16-34s, advertisers should look at BVOD-only plans, or certainly start with BVOD.

And, to maximise potential reach, BVOD campaigns should be planned over a longer period, i.e. two weeks before linear TV starts and continue for two weeks after. This is the best way of reducing frequency and reaching lighter viewers.

Let’s not focus solely on the youth

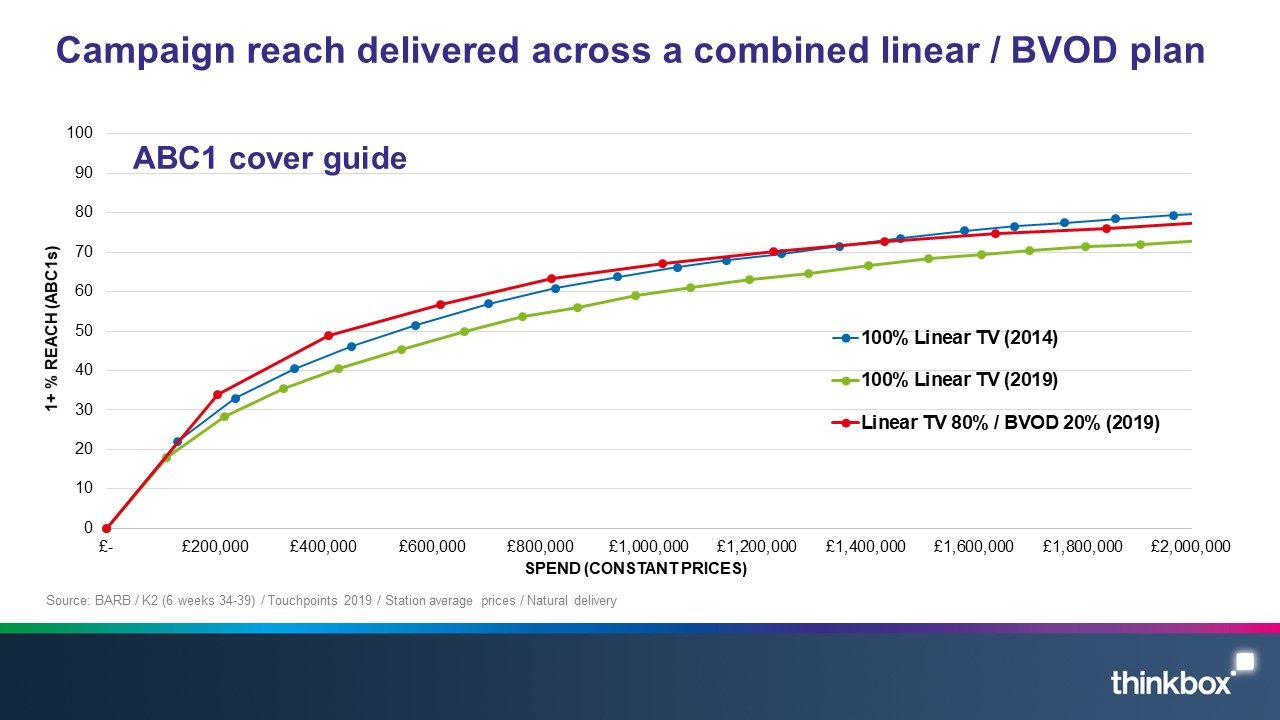

Our industry spends a lot of time focusing on younger audiences, mainly as this audience is the group which has seen the biggest change in viewing behaviour. But commercially they’re not the most important audience for advertisers, so it is worth also spending a bit of time looking at the TV advertising landscape for ABC1 Adults, who hold the majority of expendable income.

As I said earlier, the total volume of TV ad exposure among ABC1 Adults is relatively stable. The headline-grabbing rise of SVOD services like Netflix over the last 4 years has only had a small impact on the volume of TV ads seen. With total TV investment slightly lagging behind RPI, this audience’s price is deflating with the station average CPT across all TV standing at £13, down from £16 in 2010.

However, this doesn’t mean that cost-effective reach has remained stable. Some ABC1 viewers are also part of the 16-34 demographic. This younger half of ABC1 Adults has seen a decline in linear viewing (with viewing moving to VOD), whilst the older half’s viewing has increased (partly due to an ageing population).

To continue to drive the highest level of cost-effective reach, as with 16-34s, the solution is to plan across both linear TV and BVOD.

Proving BVOD’s effectiveness

It’s clear that in order to drive campaign reach, BVOD has now become a fundamental part of planning. And we can now also demonstrate the need for BVOD in terms of its effectiveness.

BVOD is not just a nice to have. It is now a need to have.”

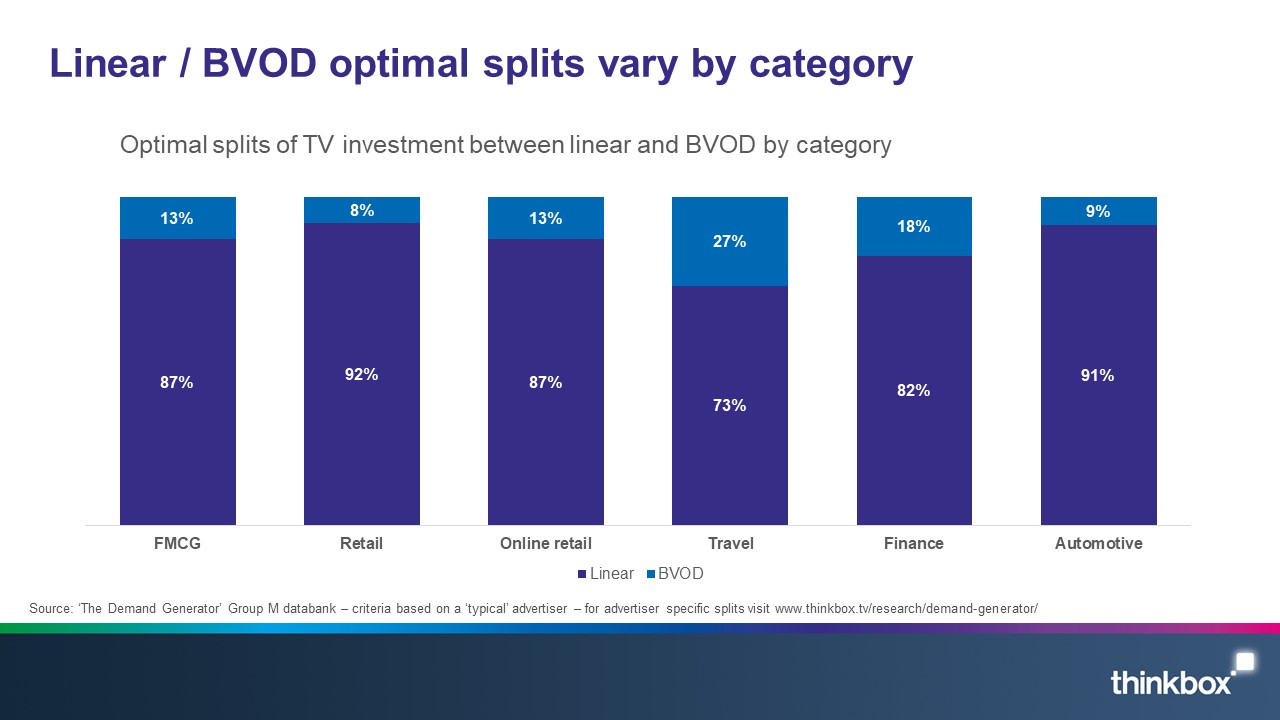

In December, Thinkbox launched The Demand Generator, a cross-media optimisation tool developed by Gain Theory, MediaCom and Wavemaker. It is based on an econometric analysis of £1.4 billion of media spend by 50 brands across 10 forms of advertising over 3 years.

More details of the study can be found here but, in short, The Demand Generator provides a view on the optimal media mix for an advertiser based on the context of their business and budget.

The chart below uses criteria for a typical medium-sized advertiser and looks at the suggested optimal splits for linear TV and BVOD across the six categories within the study:

Change can be improvement

Things change. Football is no longer about lumping it up to the big lad up front. Shopping is no longer all about going to the high street and paying in cash. And TV is no longer just about linear viewing.

Changes are challenges, but they can also be improvements. Certainly, viewers have never been happier. But we want happy advertisers too and, through smart, informed planning using industry tools, there is no reason not to have them.

If the TV industry can crack total TV measurement – and it is in the pipeline – then advertisers will be even happier.

Reaching TV’s high-quality audiences cost-effectively and driving business growth is still readily available to all advertisers. Some key audiences are even cheaper than they were, but it isn’t all as straightforward as it once was.

That said, TV advertising is still by far the best investment in town – and is set to get even better as its advanced solutions increasingly come into play this year. So, I’ll end with what I said at the start: there is no replacement for what TV advertising does. Luckily, TV still does what TV does.

Matt Hill is Research & Planning Director at Thinkbox