Can a fragmented AV landscape still deliver reach and ROI?

Opinion

With the targeting capabilities available now, a less blunt media strategy can be more effective.

AV viewing is no longer purely ‘linear’ and advertisers’ media strategies should reflect that.

For some, linear TV advertising may still be the right solution, but increasingly it should be considered and weighed up alongside alternative AV options, rather than digital AV being seen as an afterthought. Relative pricing and the challenges of measurement have typically been the biggest barriers to brands extending existing TV activity into digital equivalents.

Now, thanks to C-Flight, measurement of reach is starting to become standardised across broadcaster video-on-demand (BVOD) publishers and immediate measurement of performance is improving via enhanced web attribution tools.

When combined with the ability to integrate first party client data and/or overlay relevant third-party audience segments, this presents brands with exciting possibilities and serious choices to make.

There will still be a balance to strike between using broadcast TV in its traditional guise as a cost-effective means to deliver mass audience reach, and BVOD and online video’s potential to tightly target a small pool of high value prospects.

More often than not, it’ll be a case of and rather than either/or.

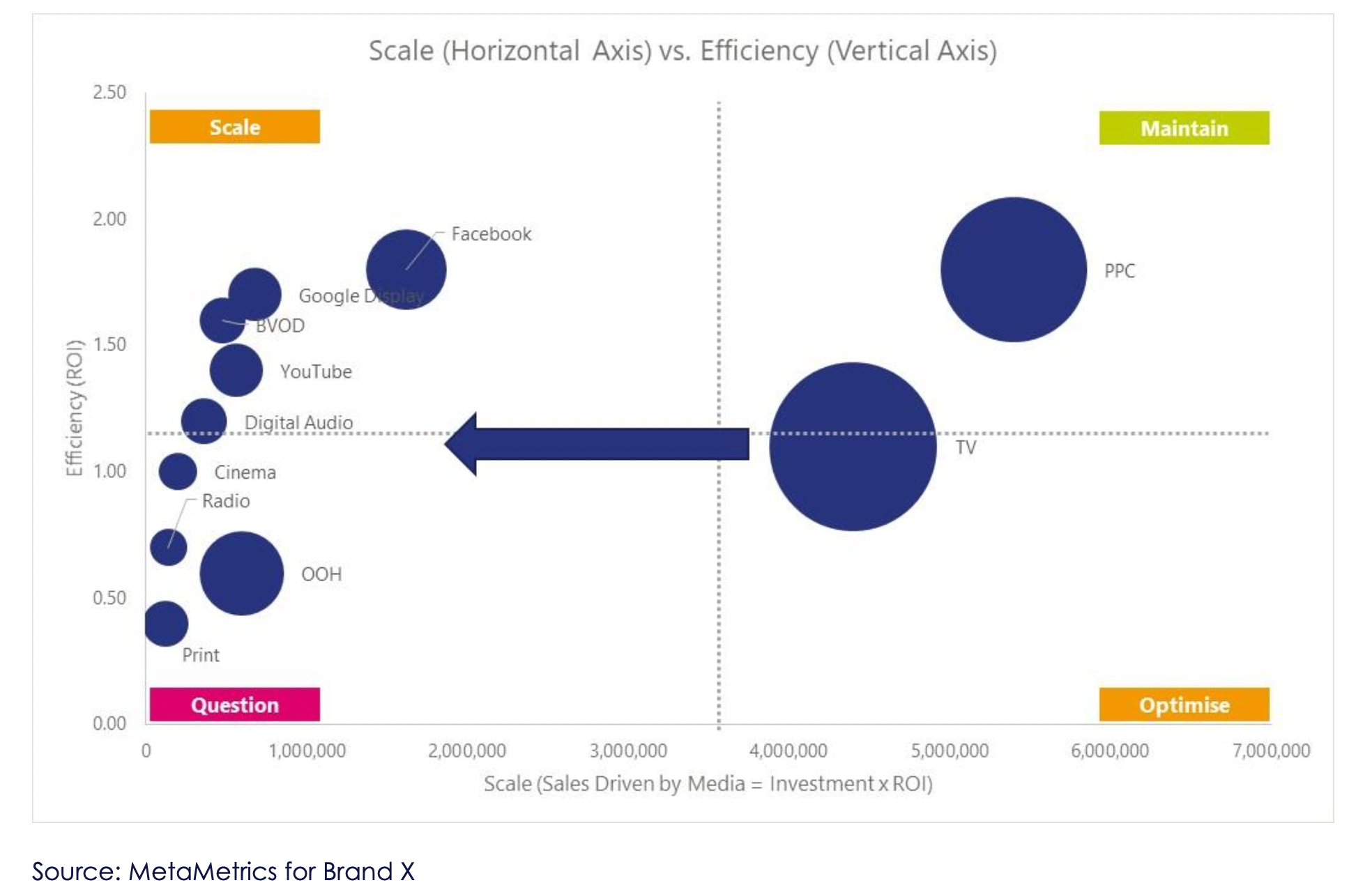

Based on analysis of effectiveness by our econometrics colleagues, MetaMetrics, the biggest impact of shrinking audiences for linear TV is reach, not ROI. In the AV universe, TV is often not the medium with the highest ROI. This implies that inherent differences between viewing experience or ad breaks of TV and AV don’t necessarily impact on effectiveness.

However, the issue with casting judgement based upon ROI alone is that it doesn’t take scale into account. TV is often justified in the advertising mix, not because it is the most effective medium, but because of the scale of effect it drives.

As Philip Gaudoin, MetaMetrics Director, explains: “We pay for TV by the thousand impressions, so if we reach a smaller number of people at the same frequency, we pay less (other things being equal) and so ROI tends to hold up.”

Gaudoin continues: “If, however, linear audiences continue to shrink, reach declines and the amount of media money we can efficiently invest in TV declines with it.”

The chart above shows a typical relationship between scale (horizontal axis) and efficiency (vertical axis, i.e., ROI). The two greatest scale media are (usually) TV and PPC. If TV audiences continue to decline, we increasingly lose TV’s potential as a scale medium (shown by the blue arrow on the chart), leaving us overly reliant on paid search (PPC) to drive scale in the business.

This is not a comfortable position to be in because of PPC’s inherent comms limitations. Gaudoin adds: “In the worst-case scenario, if budgets are not reallocated, we would continue to reach an ever-smaller number of people on TV more and more often, maintaining the number of impressions and the cost (calculated per thousand impressions) while impacting fewer and fewer people and reducing the ROI as a result.”

Realistically, many advertisers use TV to accelerate growth. If ROI between TV and AV is similar and audiences are moving seamlessly between the two, then maybe they are becoming interchangeable and the issue of TV’s shrinking reach is likely to be temporary. However, there are still crucial hurdles to overcome, not least that:

- ROI may remain stable if budgets are scaled back accordingly – this works for those prioritising only performance efficiency but will be a problem for those seeking growth acceleration.

- The pricing of TV versus other forms of AV such as BVOD is imbalanced and so at present it is typically (depending on audience) more expensive to maintain customer response volume via a combined approach.

Reduced supply (audience) is making linear TV more expensive, and closer to parity with digital video options. Advertising spend will inevitably follow the audience, and if digital AV continues to deliver ROIs which are on a par with linear TV, there will be no reason not to. Media owners are merging their offerings and we must remember that consumers see no difference between linear and digital.

The challenge is that consumers have more choice than ever before. There is a plethora of options, and we are all aware that those not watching linear TV will not simply be viewing the Broadcast VOD alternative. Brands measuring success purely on reach metrics will be in danger of restricting themselves to that which is measurable (i.e. via C-Flight).

However, the reach is there, and AV content is being consumed more than ever. With the targeting capabilities also available, a less blunt approach can be more effective overall, if delivered correctly.

Until there is a uniform solution for cross-platform audience measurement, reach metrics are going to be an ongoing challenge. But the audience is still there – it’s up to the advertiser to reach them.

Gary Revill is business director at independent media agency M.i. Media

Strategy Leaders: The Media Leader’s weekly bulletinwith thought leadership, news and analysis dedicated to excellence in commercial media strategy.

Sign up for free to ensure you stay up to date every Tuesday.