UK TV landmark as Netflix and Disney become BARB subscribers

Netflix has signed up to BARB’s independent measurement of TV in the UK, while Disney has been a subscriber since last summer, The Media Leader can confirm.

For over 40 years, UK TV broadcasters have been joint shareholders in BARB as an independent service that gives advertisers trust in third-party audience measurement for programming and ads.

This is the first industry-owned audience currency in the world that Netflix has joined, BARB announced today. The Media Leader understands Disney has been a BARB subscriber since July 2021 but did not want the move to be publicised.

Both streaming giants are set to announce cut-price subscriptions plans that will introduce advertising for the first time on Netflix and Disney+. Netflix has been widely known to be meeting with media agencies in recent weeks to explain how trading will work alongside its ad sales partner Microsoft.

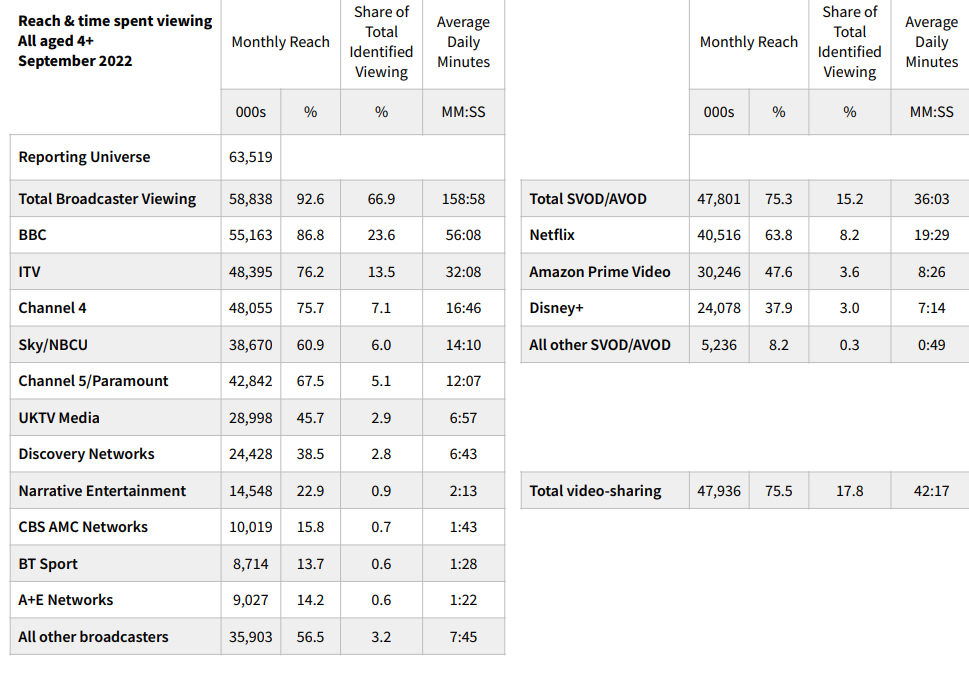

Now, BARB will publicly report monthly reach and share of viewing for broadcaster groups and SVOD/AVOD services that make up more than 0.5% of total identified viewing from the second week of November 2022.

Below is a preview of the viewing summary that will be available on BARB’s website on a monthly basis.

From the same datem, BARB will also extend its weekly reporting to include the top 50 shows across all linear channels and SVOD providers.

Reed Hastings, co-CEO of Netflix, said: “Back in 2019, at the RTS conference in Cambridge, I welcomed the idea of Netflix audiences being measured independently. We’ve kept in touch with BARB since then and are pleased to make a commitment to its trusted measurement of how people watch television in the UK.”

Streaming platforms Paramount+ and NOW TV are also BARB subscribers given their relationships with Channel 5 and Sky respectively, while Amazon remains a non-subscriber.

This update comes less than a year after BARB introduced a “once-in-a-generation” upgrade to its daily audience reporting including rating information from subscription video-on-demand services and video-sharing platforms.

Since November 2021, streaming services have been “an integral part” of its reporting of

what people watch across linear and on-demand services, with insights in to the UK’s most-watched shows, the relative reach of different platforms and channels, growth of streaming platforms quarter-on-quarter, four-screen and binge-watching viewing behaviours and more.

Daily aggregate-level viewing data and content ratings for subscription video-on-demand (SVOD), advertiser-funded video-on-demand services (AVOD) and video-sharing platforms are still available through BARB’s dashboard without those companies becoming subscribers.

BARB’s data has highlighted that while Netflix and other streamers have “clearly established themselves within the television-viewing ecosystem”, broadcasters still account for “the lion’s share” of viewing in the UK with around two-thirds of all identified viewing coming from broadcasters’ linear channels and on-demand services throughout 2022.

The average daily viewing time to broadcasters’ services was 159 minutes in September 2022, while the average for SVOD and AVOD services was less than half that at 36 minutes per day.

Justin Sampson, BARB CEO, said: “Our audience measurement continuously adapts to accommodate the new platforms and devices that are being used by people to watch their favourite television shows. We took a big step forward last year when we started reporting audiences to streaming services. Netflix’s commitment to BARB sends a clear signal that what we’re doing is valuable to new and established players in the market.”

Editor’s note: This story was amended after publication to clarify that Disney has been a BARB subscriber since July 2021.