UK suffers first Q4 adspend decline in 14 years

The latest Advertising Association/Warc Expenditure Report has revealed that UK adspend in the last quarter of 2022 decreased by 5.8% – the first time Q4 spend has fallen since 2009. Between October and December of last year UK adspend dropped to a total of £8.6bn.

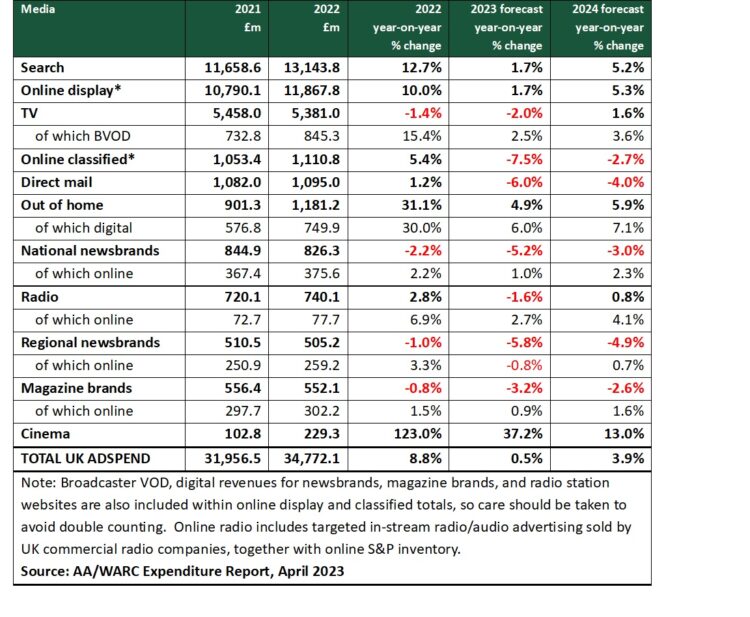

Despite the dip, the UK’s ad market grew by 8.8% overall in 2022 to reach £34.8bn total. AA/Warc predicts minimal growth in 2023 with spend set to grow just 0.5% reaching £35bn.

This is a downgraded forecast from the trade body’s January projection, which predicted a 3.8% rise in adspend this year.

AA/Warc said the figure was revised as the downturn recorded in H2 2022 has persisted so far this year, with high inflation, low national economic growth and talent shortages impacting forecasts across all sectors of advertising. Out of the top 10 ad markets in the world, the UK is expected to show the slowest growth.

The UK is still the third-largest advertising market in the world and despite the downturn in H2 2022, experienced the third-fastest growth rate out of the top ads market last year, behind only Brazil (9.7%) and Australia (9.4%)

The trade body predicts spend will climb a further 3.9% in 2024 to reach £36.3bn total.

James McDonald, director of data, intelligence & forecasting, at Warc said: “The latest verified media data reveals that the UK’s ad market entered recession in the second half of 2022, with clear signs that the downturn has continued into the opening months of this year.

“Sharp and sustained falls in social media spend – the first time this has been recorded in the UK – are likely to have been instigated by reduced advertising activity among the SMEs who comprise a ‘long tail’ of ad volume on social platforms and whose margins are under incredible stress as inflation bites. One in every 202 UK companies entered liquidation in 2022 – the highest rate in seven years – and it is unsurprising to see these pressures reflected to some degree within advertising trade.”