Retail media ‘leaving money on the table’ with limited strategy

Retailers and brands want retail media networks to have a better quality advertiser experience, range of inventory, data collaboration, measurement and targeting capabilities, a Publicis Groupe survey has revealed.

The study, by Publicis Groupe data company Epsilon, revealed current attitudes from brands and retailers towards retail media’s inefficiencies and strengths, along with their respective priorities and concerns about the growing medium.

Five retail media ‘truths’

One finding was that retailers were “leaving money on the table” if they only offered limited channel strategies, for instance only providing on-site or off-site ads.

The study highlighted that using an omnichannel approach, rather than waiting for customers to come online, offered more opportunities to increase revenue and track the full shopper journey.

In a subset of 471 retailers, nearly half of the retailers polled (45%) currently had on-site ads as part of their strategy, and more than a third (37%) offered off-site programmatic advertising.

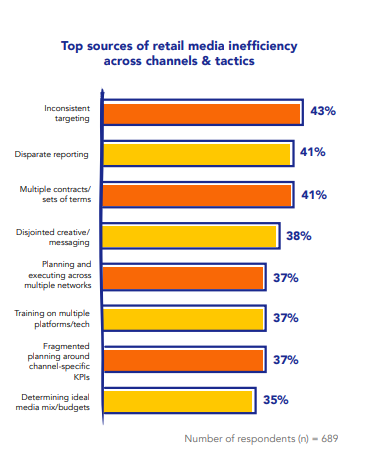

Another finding was that at least half of retail media networks did not target or measure effectively. Inconsistent targeting (43%), disparate reporting (41%) and multiple contracts or sets of terms (41%) were the top sources of “retail media inefficiency” across channels and tactics.

The study suggested retailers adopt a people-based identity solution, rather than modelling, which could cover multiple channels and devices to deliver improved personalisation, relevance and performance.

Retail media networks that offered data collaboration, like “clean rooms”, were found to be more attractive to brands with 70% of respondents saying it was “highly important” to their advertising strategy.

Nearly half (47%) of those surveyed said they were actively developing data collaboration partnerships while more than a third (37%) have existing data collaboration partnerships.

Retail media networks should reduce the number of tech partners they work with to avoid wasted impressions and frustrated shoppers as 64% of those surveyed said retail media networks that worked with too many tech providers had a “negative impact on shoppers”.

On this point, 38% had experienced disjointed creative or messaging across tactics, and 41% considered multiple contracts or sets of terms to be “extremely or very frustrating”. Minimising the number of providers improved consistency, measurement and the ability to sequence messages.

The quality of the advertiser experience, amount of inventory available and online and in-store attributable sales reporting were the top priorities for both retailers and brands registering above 68% for each category for both groups.

Top retail media priorities and concerns for brands

When measuring retail media campaigns, total sales (47%), return on adspend (47%) and total reach (41%) were the most important metrics for brands in a subset of the survey group of 218 executives.

This was followed by brand lift (37%), purchase intent impact (37%), incremental reach (28%) and category share (22%).

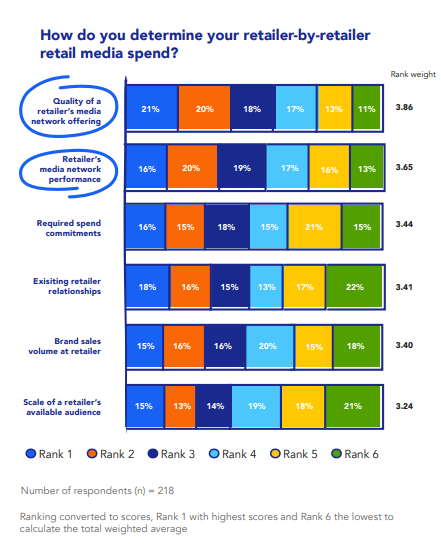

When deciding between retailers on where to spend their ad budgets, quality of a retailer’s media network offering and its performance were ranked top by brands. By rank weighting this was followed by required spend commitments, existing retailer relationships, brand sales volume at retailer and sale of a retailer’s available audience.

The risk of data leakage and privacy was the top barrier to entry for retail media adoption for brands, cited by 72% of those in this survey group. This was followed by developing or expanding first-party data (69%), budget considerations (68%), disjointed technology solutions (61%), limited staff to scale technology and operations (61%), partners are difficult to work with (56%), and not a strategic fit (50%).

Brands consistently valued control and transparency over various elements of retail media campaigns highly.

For example, 75% of brands placed transparency on up-to-date campaign performance as “extremely” or “very important”, followed by control over campaign set up (73%), control over audience selection (73%), visibility into pacing of campaign delivery (72%), brand choice to manage and service own campaigns (71%), control over campaign delivery and pacing (71%), ability to self-serve across multiple retail media networks (71%), ability to self-serve with a specific retail media network (69%) and control over creative (66%).

In terms of budgets, nearly four in ten (39%) of those surveyed said they would allocate 26- 50% of their media budget to retail media activation. Meanwhile 35% said they would allocate 11- 25%, 17% said less than 50%, 8% said between 0 and 10% and 1% said they were unsure.

According to the survey, brand, performance and shopper marketing teams were the top sources of retail media or retailer-specific campaigns registering 61%, 55% and 48% respectively of those in this part of the study.

Advertisers also expressed the desire for retail media networks to offer some self-service features (68%) and support services (71%).

Top retail media priorities and concerns for retailers

The survey found many retailers rely on traditional or indirect monetisation strategies.

For instance, out of of 471 retailer respondents, 58% said their current retail media and monetisation strategy was based on digital coupons and promotions (58%), then social including influencers (56%), email (53%), on-site (45%), audience data sales (40%), programmatic off-site (37%), clean room collaboration (34%), with 2% saying they had no current offering or strategy but were looking to change in future, and 1% with no current offering or strategy.

For retailers looking to grow their media networks, the three main challenges were isolated as the cost of new technology or partners (74%), developing or expanding first-party data (71%), risk of data leakage or privacy (71%).

This brings up the “build vs buy” debate as both routes require significant investment and carry different benefits and drawbacks.

Other potential barriers included limited staff to scale technology and operations (68%), disjointed technology solutions (64%), limited sales organisation (64%), partners are difficult to work with (56%) and not a strategic fit (55%).

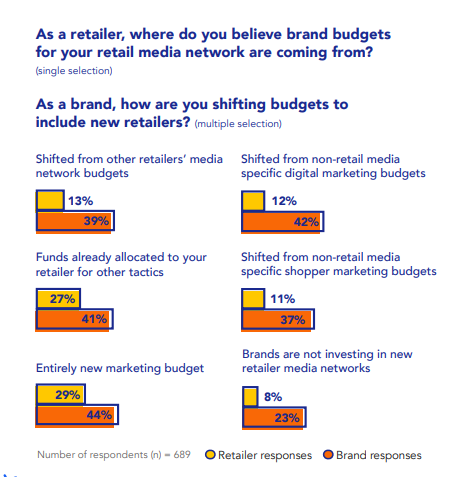

Retailers were also shown to believe brand budgets for their retail media networks came several different sources, with most saying they came from entirely new marketing budgets (29%) or funds already allocated to the retailer for other tactics (27%). This is compared to 44% and 41% of brands self-reporting in the survey, demonstrating a disconnect between in knowledge about the source of funds for retail media activations.

What’s next?

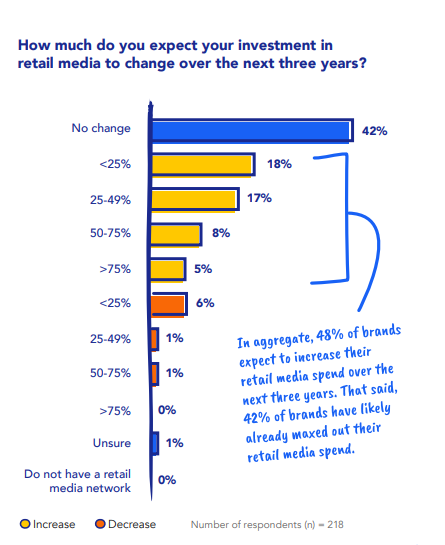

Looking forward over the next three years, 42% of brands expected no change in their retail media spend, while on aggregate 48% of those surveyed expected to increase their investment in the channel.

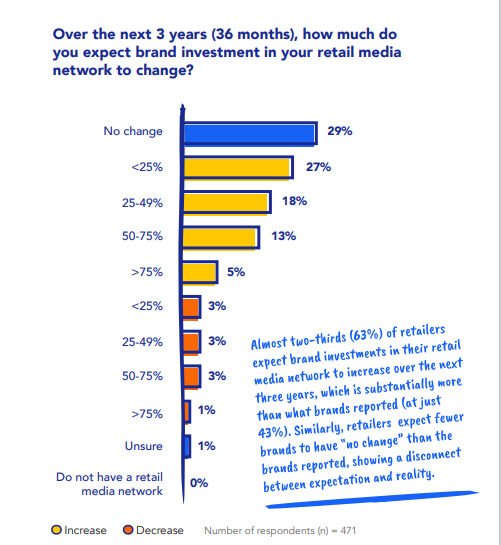

At the same time, 29% of retailers predicted “no change” in investment in the channel, followed by 27% expecting less than 25% growth, and 18% anticipating between 25 and 49% growth.

The survey was produced by Publicis Groupe agency Epsilon in a report entitled The state of retail media in 2023 with its subsidiary CitrusAd and Phronesis Partners which surveyed 689 executives at director level and above from mid to large-sized brands and retailers in 12 countries in Q1 2023.