JCDecaux registered 7.8% organic growth to reach €1.59bn adjusted revenue in the first six months of 2023, according to its latest financial results.

Within that the outdoor media owner reported Q2 organic revenue growth of 10.3%, which was above expectations. This was down to June seeing higher revenues than April and May, and “a good trading momentum in most geographies”, strong growth of digital and ongoing rebound of transport and street furniture activities above pre-Covid levels.

JCDecaux’s digital out-of-home (DOOH) revenues grew “strongly” by 18.0% on an organic basis compared to H1 2022. These revenues now make up 32.7% of group revenue, which is up from 30.0% previously.

Programmatic advertising revenues through proprietary supply-side platform VIOOH also experienced double-digit growth of 63.3% to reach €36.9m, or 7.1% of H1 2023 digital revenue.

When split out by inventory type, street furniture revenues grew 3.8% organically to surpass H1 2019 levels globally, while billboards were down 0.5% organically but above 2019 levels for APAC and North America regions. Transport revenues were up 19% with air travel returning to above 90% of pre-Covid levels globally, but were still lagging in Asia because of lower international air traffic with China particularly affected by non-renewal of metro and airport contracts in Guangzhou.

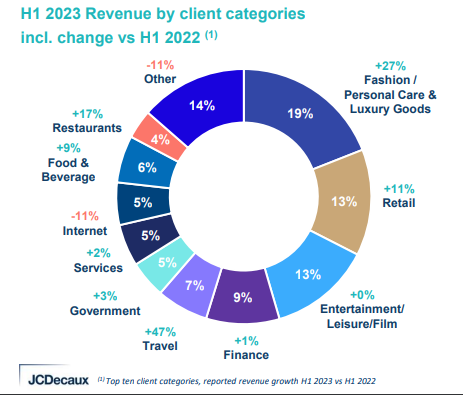

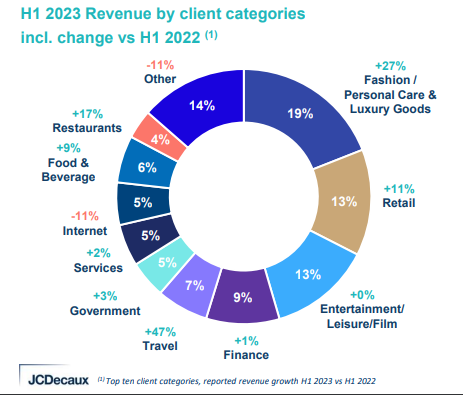

By client categories, there were notable increases globally from travel (+47%), fashion, personal care and luxury goods (+27%), restaurants (+17%) and retail (+11%), constituting 43% of total H1 2023 revenues.

By regions APAC (mostly the Australia market) and Rest of World registered double-digit growth, and France, Rest of Europe and Rest of World were close to 2019 levels. However, Asia remained “significantly behind” mainly due to China’s slow recovery from lockdowns which ended in late 2022.

Jean-François Decaux, chairman of the executive board and co-CEO of JCDecaux, explained: “Over the first half China was brought in line with the rest of the group, which implies that growth in other geographies with high single digits is good news in the current environment. We continue to bridge the gap with 2019, moving from nearly minus 20% in H1 2022 to minus 14% in H1 2023 and minus 6.5% excluding China.”

Looking forward, third quarter adjusted organic revenue growth in Q3 is expected to be around 7%.

Decaux added: “As the most digitised global OOH media company, with our new data-led audience targeting and programmatic solutions, our well-diversified portfolio, our ability to win new contracts, the strength of our balance sheet, the high quality of our teams across the world and our recognised ESG excellence, we believe we are well positioned to benefit from the rebound.”

“We are more confident than ever in the power of our media in an advertising landscape increasingly fragmented and more and more digital and in the role it will play to drive economic growth as well as positive changes.”

Analysis: a new era for acquisition, ESG and digitisation

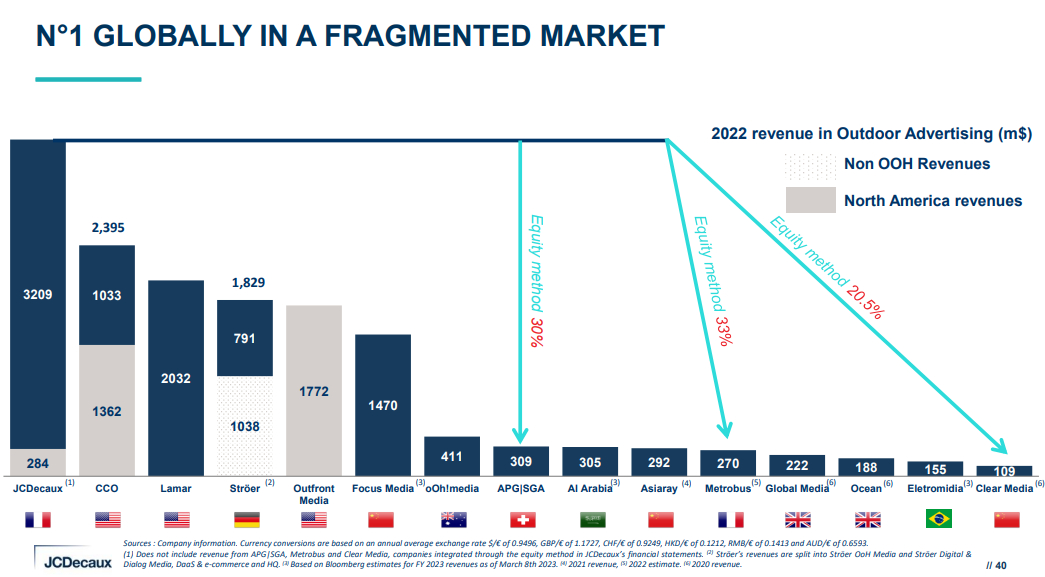

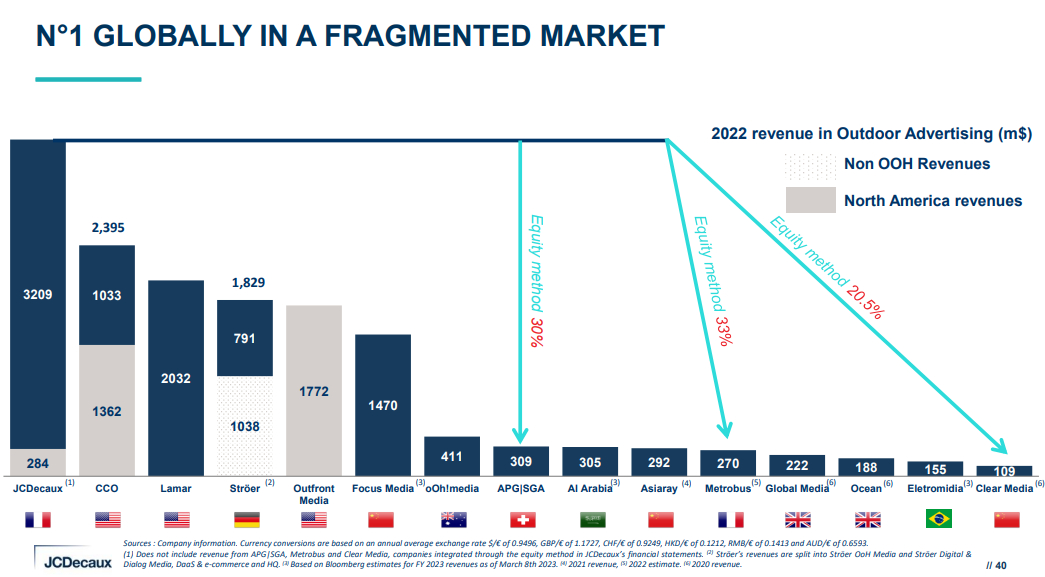

JCDecaux prides itself as being the number-one outdoor advertising network — with a daily audience of more than 850 million people in more than 80 countries. Now, it not only wants to continue its recovery from the pandemic, but to futureproof its position.

According to its co-CEO Jean-François Decaux, its growth strategy is driven by both organic contract wins and bolt-on acquisitions. Examples of these include JCDecaux’s win of the largest OOH/DOOH media franchise in Norway and its acquisition of competitor Clear Channel’s Spain and Italy businesses.

The latter purchase in the third and fourth largest markets in Europe is significant, with the Italy deal executed on 31 May and Spain expected to close subject to approval by the Spanish competition authority in 2024. On the earnings call, Decaux said these acquisitions represented a total enterprise value of €75m.

On top of this commercial focus, digitisation and ESG will also be crucial factors for JCDecaux to retain its leading position in its markets. Decaux said it was “a new era for ESG” when it comes to contract tenders, with 61% of JCDecaux’s tenders worldwide assessed on environmental criteria and 18% on social criteria, compared to 25% and 8% in 2019.

The company aims to be net zero by 2050 and has signed up to the Paris Climate Agreement, and said it had already won contracts in Toulouse and Oslo based on its “strong sustainability commitment”.

When it comes to digitisation of its inventory, Decaux said digital was “the winning formula” that could not only bring in additional revenue and visibility but also enable a reduction in the number of locations. Citing a Zenith CAGR global forecast, he said DOOH will be the fastest growing media for 2025 with predicted 10% growth.

But the digitisation project is significant and won’t happen quickly. JCDecaux’s inventory currently sits at just over 1 million panels globally across 3,573 cities which have more than 10,000 inhabitants. The company also boasts it is number one worldwide in street furniture, with 604,536 advertising panels, and transport advertising, with a presence in 153 airports and 205 contracts spanning metros, buses, trains and tramways, with a total of 333,620 panels.

At present, digital street furniture, transport and billboard revenues make up less than a third (36%) of their inventory-specific revenues.

Meanwhile, the company’s digital income is highly concentrated on five countries (the UK, America, Australia, Germany and China), which account for 63% of JCDecaux’s digital revenue. Decaux said this leaves “significant room” for digital penetration growth.

The company, whose programmatic outdoor arm VIOOH has just marked its fifth anniversary, expects programmatic to make up 20-30% of digital revenues in the future, where it now sits at 7.1%.

Adwanted UK is the trusted delivery partner for three essential services which deliver accountability, standardisation, and audience data for the out-of-home industry.

Playout is Outsmart’s new system to centralise and standardise playout reporting data across all outdoor media owners in the UK.

SPACE is the industry’s comprehensive inventory database delivered through a collaboration between IPAO and Outsmart.

The RouteAPI is a SaaS solution which delivers the ooh industry’s audience data quickly and simply into clients’ systems.

Contact us for more information on SPACE, J-ET, Audiotrack or our data engines.