TV, a traditional lynchpin of ad campaigns, has slipped out of marketers top-ranked media channels this year, falling from third place in 2022 to 12th place in 2023.

That is according to Kantar’s fourth annual global Media Reactions report, which also found preference for TV sponsorship fell from 12th place to 20th among marketers, and that just 6% of marketers say they will increase TV spend in 2024.

“People have moved to subscribe to online streaming platforms, video streaming platforms, and so maybe [for] the darling of media, the high reach days are now starting to decline a little bit,” said Jane Ostler, Kantar’s executive vice president of global thought leadership and co-author of the Media Reactions 2023 report, on this week’s forthcoming episode of The Media Leader Podcast. “We’ve seen this in younger audiences over the last few years — this is not really a new story — but perhaps this is now starting to seep in among all age groups, too.”

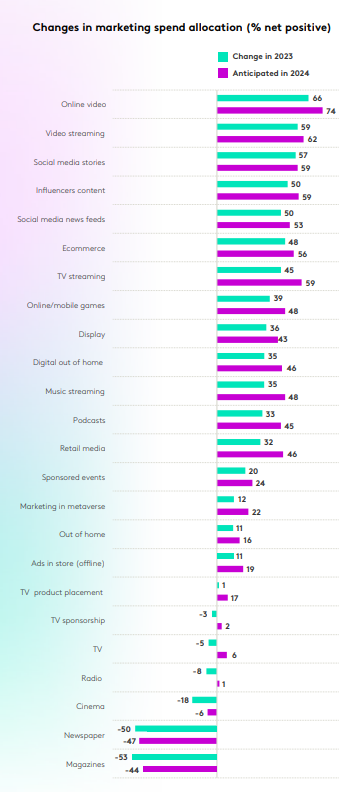

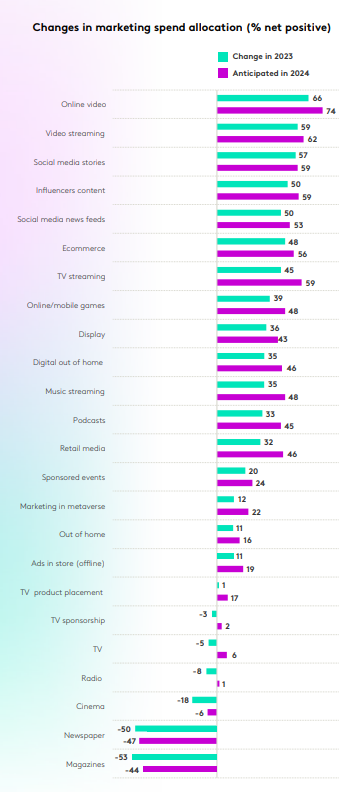

TV is still considered a highly trusted medium, but a “lack of innovation” as well as shifting consumer habits is behind the decline in preference, according to Ostler. A net 45% of marketers have increased their marketing spend allocation this year in TV streaming, for example, to meet growing demand and ad inventory in streaming video-on-demand (SVOD) services.

Meanwhile, online video, video streaming, and social media stories, news feeds, and creators have seen the biggest jumps in net adspend allocation this year, and are expected to in 2024 as well.

Ostler added that though TV can still reach large numbers of people, especially through live events, it simply has more competition now from other forms of entertainment, including short- and long-form video, social media, streaming, and podcasts.

However, declining interest in the metaverse could act as a primary example of how short-termism exists among marketers, who Ostler suggested can often chase after the shiny new thing. A net 61% of marketers claimed they would increase spend in the medium in 2023 in last year’s report, but the actual net increase this year was only 12%.

Consumers prefer channels that ’cause the least interruption to their lives’

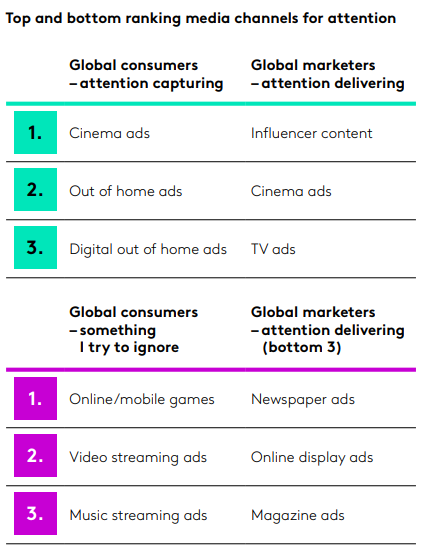

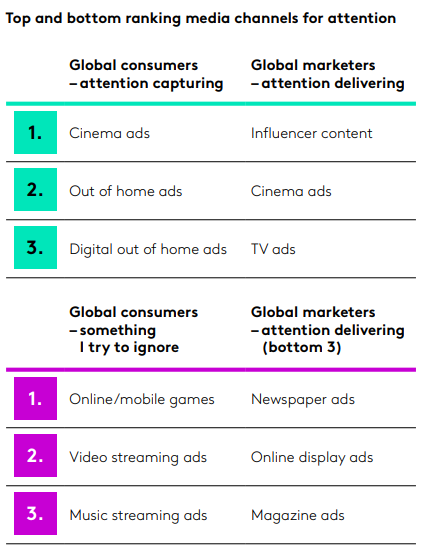

Consumers’ preferred media channels through which to receive advertising this year, however, are entirely in-person rather than online. Their top five channels include: sponsored events, cinema ads, out-of-home (OOH), point of sale, and digital out-of-home (DOOH).

This is in relative contrast to marketers, whose top five channels lean more heavily into online spaces.

Ostler noted that a disconnect between consumers’ and marketers’ preferences has always existed, though it has not before been as clear-cut that consumers prefer channels that “cause the least interruption to their lives,” as the report reads.

The splash in OOH and DOOH advertising comes at the loss of magazines, which have dropped out of consumers’ top five preferred mediums. It also comes following years of pandemic-era lockdowns, where OOH was seldom interacted with. The OOH sector is now trading just 3% below pre-pandemic levels following continued growth, especially in DOOH revenue.

Report co-author and global thought leadership director at Kantar Gonca Bubani added: “This year, consumers have spoken up and said they strongly prefer advertising that they see out-of-home, like at sponsored events or the cinema. […] We know advertising campaigns are seven times as impactful among receptive audiences, so for marketers, it’s crucial to understand the strengths and weaknesses of different ad platforms and invest their money where it will make an impact.”

Consumers and marketers found more common ground on most-preferred media brands. Google, Instagram, TikTok and Spotify all featured in each group’s top five; however, the most preferred brand for consumers this year is Amazon, thanks to its perceived relevance for users, while YouTube claimed the top spot for marketers due to an increased perception of trust in the video sharing platform.

What sets highly preferred media brands apart from the rest of the crop for consumers also appears to be a greater emphasis on entertainment, fun and humour. Such characteristics explain the growing affinity for short-form video products on Instagram and TikTok, especially.

That does not bode well for X (formerly known as Twitter), which has suffered from a decline in brand reputation and an increase in hateful speech in the past year since Elon Musk bought the social media company. X does not feature on marketers’ or consumers’ top preferred ad platforms; in fact, a decline among marketers in perceptions of innovation (now 16%, down from 28% in 2021) and trustworthiness (now 7%, down from 11% in 2021), is accompanied by a net 14% of marketers saying they will reduce their ad investment on the platform in 2024.

Preference correlates with attention

Kantar’s study notes that there is a 90% correlation between media channels that consumers claim capture their attention and those in which they prefer seeing advertising.

Meanwhile, there is also a strong negative correlation of 97% for preference with “ad formats they try to ignore.”

The findings suggest that ads that are positively engaging are in a much better position to capture and retain attention.

However, marketers remain behind the ball, with just 51% reporting that attention “highly influences” their media budget decisions, while under half do not see attention as as important as brand or sales outcomes, implying that attention metrics are not yet fully entrenched in marketing systems.

The Media Reactions 2023 report is based on interviews with around 16,000 consumers in 23 markets and 900 senior marketers globally.

Adwanted UK is the trusted delivery partner for three essential services which deliver accountability, standardisation, and audience data for the out-of-home industry.

Playout is Outsmart’s new system to centralise and standardise playout reporting data across all outdoor media owners in the UK.

SPACE is the industry’s comprehensive inventory database delivered through a collaboration between IPAO and Outsmart.

The RouteAPI is a SaaS solution which delivers the ooh industry’s audience data quickly and simply into clients’ systems.

Contact us for more information on SPACE, J-ET, Audiotrack or our data engines.