Omnicom's Flywheel deal will change adland forever

Opinion

Digital commerce will change the face of the marketing industry and Omnicom has gone for a land grab in this fast-expanding sector.

Last week saw the completion of Omnicom’s groundbreaking but under-appreciated acquisition of Flywheel, the digital commerce and retail media specialist business being sold by Ascential.

The purchase is noteworthy for three reasons.

First, it has rarely made a substantial standalone acquisition since its foundation in the 1980s. Its growth has been sure and steady rather than dramatic and it has opted out of the kind of transformational data acquisitions that Publicis has made, for example, with Sapient, Epsilon and CitrusAd.

Secondly, Omnicom has created an entirely new entity (still called Flywheel) to sit horizontally within an organisation that has usually been structured vertically, with cross-pollination as a target.

Thirdly, it paid $835m for a company with $300m of revenue — a handsome price. Ascential had paid an initial $60m for Flywheel in 2018, with further earnout payments and the cost of several bolt-on acquisitions, such as Perpetua. Even allowing for these, the consideration is toppy.

Why Omnicom has broken the habits of a lifetime

Simply put, Omnicom has gone for a land grab in the fastest-growing sectors in marketing: digital commerce and retail media.

The key to this is the US and China.

The US ecommerce market is estimated to be worth $1.2tn in 2024, growing to $1.7tn by 2027, with growth rates of circa 11% per annum.

Retail media in the US is estimated at $55bn this year and $106bn in 2027, growing by 20-25% each year. It is increasingly moving from being an extension of trade and shopper marketing to being a full-blown channel in its own right, increasingly attracting budget from traditional media as well.

Given the scale and growth of US ecommerce, it’s easy to see why Omnicom wants its share of the market.

The deal also gives the company a bridgehead in China, where ecommerce is highly developed.

Digital commerce growth

Digital commerce platforms are already growing massively. Amazon continues to dominate the US scene, accounting for nearly 40% of all ecommerce. Its international footprint continues to grow.

The Amazon Marketing Cloud is becoming rapidly embedded in brand owners. The immediacy of results reporting is seductive compared with the time it takes to build marketing mix models and to assess their accuracy.

Amazon’s entry into paid advertising on Prime Video is another step in its journey to the transformation of digital commerce and the development of “shoppability” through the TV screen.

But its Chinese rivals are catching up — TikTok, Shein and Temu are snapping at its heels.

The launch of TikTok Shop in the US moves the social commerce needle significantly. But perhaps the bigger news is the success of Shein and Temu in the US.

These two Chinese businesses have introduced an on-demand model that shortens the fulfilment chain and uses data analytics to respond quickly to supply and demand, although this model does have its drawbacks.

Shein has ploughed a particularly lucrative furrow in fast fashion, accelerating growth from $1.3bn in 2018 to $22.7bn in 2022, and is mooted to be floated this year for $100bn.

Meanwhile, Temu has overtaken Shein to become the most downloaded app in the US, with 130 million installations in one year. Downloads of Temu’s app have also set records in the UK, France, Germany and Australia.

Its owner, PDD, is worth $196bn, with Q3 2023 sales up 94% — making even Shein look small.

Shein and Temu are pouring money into Facebook, Instagram and TikTok. The Chinese ecommerce players are driving large ad revenue increases in the large digital platforms.

Temu alone is reckoned to have spent $1.2bn on Meta properties in 2023. Brian Wieser of Madison and Wall estimates that Chinese companies now account for $10bn of ad revenues across social platforms.

Not to be outdone by Chinese competition, Amazon has exercised its clout through a partnership with Meta whereby Facebook and Instagram users will be able to buy on Amazon through their social feeds.

As digital commerce expands, with AI playing a key role, the gap between interest, discovery and purchase has never been shorter, collapsing funnels as never before.

Variation on a theme

The relatively new sector of retail media has disproportionately hogged the marketing headlines over the last two years.

There is no question that retail media is a very important layer within the new marketing mix, but the transformation of digital commerce by Amazon and its Chinese peers will become a much bigger story.

Digital commerce is much further-reaching in that it has implications across the entire marketing spectrum, embracing brand, product, distribution, fulfilment, CRM, search, social, analytics, influencer and media. Good old-fashioned email is an intrinsic part of the mix.

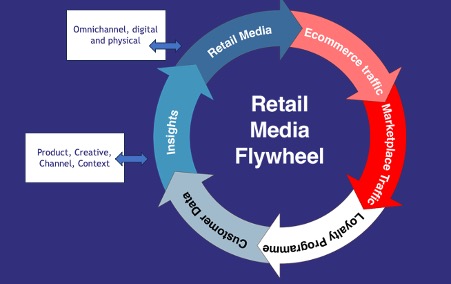

The driving force is the classic “flywheel”, as described best by this graphic from Colin Lewis, one of the most advanced thinkers in this market.

Within the flywheel, retail media plays a key role, but as part of a virtuous circle that is founded on data analytics that influence the whole process, enabled by AI and machine learning.

We are witnessing the full-scale emergence of a new way to drive business and new marketing models, and this will have a profound influence on the marketing services industry and thus the agency world.

It is advertising, Jim, but not as we know it; it will affect the flow of promotional budgets and who gets to handle them.

The components of all of this have been coming together for some time, but they are now being linked up like Lego bricks into new structures that are scaling rapidly, thanks to new technology.

Impact on agencies

So, what does this mean for agencies? The answer was, perhaps inadvertently, addressed at The Media Leader‘s Future of TV Advertising Global conference in December.

One of the starker points to emerge was the contrast between the powerful advocacy by Peter Field of the enduring power of TV (and its offshoots) to build brands and the strong contention by Wieser that the traditional TV-led model is rapidly waning as the digital commerce model takes hold.

Paraphrasing Brian slightly, brand-building matters less in the rapid new ecommerce environment and it could be said that Amazon, TikTok, Shein, Temu and other marketplaces are the brand if the product and customer experience is good enough.

Meanwhile, TV itself has to get to grips with the transition from linear to the hybrid linear/digital world, where revenues from the former greatly outweigh the latter.

One of the standout presentations from Future of TV Advertising Global was by Kate Waters from ITV. She convincingly described the ways that ITVX is adding digital functionality to TV’s unrivalled storytelling capability (as evident by Mr Bates vs The Post Office).

TV has to demonstrate its capability to drive the flywheel faster and better.

We’re entering a hyper-hybrid world where the established verities of brand-building are having to work hard to compete with the immediacy of digital commerce. This is brand versus performance on steroids.

The challenge for agencies is to be able to operate with equal facility in this hybrid world where every company, brand, product or service requires an entirely unique approach that draws on the full spectrum of options.

Equally challenging for agencies is the fact that digital commerce is shortening customer journeys, flattening funnels, changing the role of brand and making selling easier. The future roles for creative agencies and media agencies are less obvious as the path to purchase changes. It is much easier for companies to take the “flywheel” in-house, aided by specialist practitioners.

In October 2023, the World Federation of Advertisers and MediaSense reported that only 11% of major advertisers felt their agency model fits their future needs.

It is easy to see why Omnicom needed Flywheel and how the new world of digital commerce will have a profound effect on agencies of all kinds, leading no doubt to an ever bigger arms race.

The Omnicom acquisition may not have attracted much attention from an industry still dominated by traditional models, but it will be seen in time as a pivotal moment in the evolution of the agency model and the traditional holding companies.

Nick Manning is the co-founder of Manning Gottlieb Media (now MG OMD) and was chief strategy officer at Ebiquity for over a decade. He now owns a mentoring business, Encyclomedia, offering strategic advice to companies in the media and advertising industry, and is non-executive chair of Media Marketing Compliance. He writes for The Media Leader each month.

Nick Manning is the co-founder of Manning Gottlieb Media (now MG OMD) and was chief strategy officer at Ebiquity for over a decade. He now owns a mentoring business, Encyclomedia, offering strategic advice to companies in the media and advertising industry, and is non-executive chair of Media Marketing Compliance. He writes for The Media Leader each month.