The Open Internet stages a comeback: consumers and ad dollars flocking to Premium Content

The tides are turning in the digital advertising landscape. According to a new report by The Trade Desk, consumers are spending a record amount of time on the open internet, and advertisers are following suit. This shift marks a significant change from just a decade ago, when walled gardens like Facebook and Google dominated both user attention and ad spend.

The report highlights a key finding: consumers in the US now dedicate a staggering 61% of their online time to the open internet, compared to just 39% within walled gardens like Facebook and Google. This trend coincides with the rise of premium content on the open web, including streaming services, podcasts, and trusted journalism.

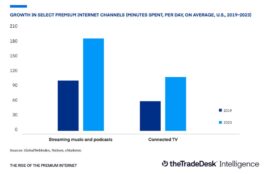

“The open internet is at a tipping point,” says Jeff Green, CEO of The Trade Desk. This surge in popularity is fueled by the explosion of engaging channels like Connected TV (CTV) and digital audio. Daily consumption of these services has doubled in the US since 2019, with viewers now spending over 5 hours a day on the open internet.

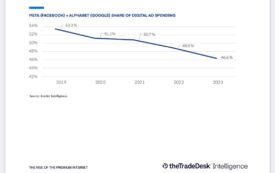

Advertisers are taking notice. For the first time in a decade, Google and Facebook’s combined share of digital ad spend dipped below 50% in 2022. This trend continued in 2023, with these giants now accounting for just 46.6% of the market. This shift is driven by a desire to reach audiences on platforms offering premium content, brand safety, and greater transparency.

The report also points to growing concerns around walled gardens’ practices. The US Department of Justice lawsuit against Google, alleging anticompetitive behavior, reflects a broader worry about the lack of control and visibility advertisers have within these closed ecosystems, explained Jeff Green, “Whether it’s the U.S. Department of Justice lawsuit against Google, questions about ad viewability, concerns around the brand safety of user-generated content or the growing war on journalism by walled gardens — marketers are looking for an alternative”.

Looking ahead, the future of the open internet appears bright. The burgeoning CTV market, with its live sports and high-quality programming, is a prime example. CTV is now the fastest-growing ad format in the US, attracting not only viewers but also coveted demographics like young adults with significant purchasing power.

This global shift in consumer behavior and advertising spend presents a pivotal moment for the open internet. As The Trade Desk report suggests, the key to continued success lies in providing easy access to this high-value content while safeguarding user privacy and fostering a healthy advertising ecosystem. The Sellers and Publishers Report is a biannual report by The Trade Desk, examining the advertising trends on the open internet.