Global adspend will grow by 10.5% to $1.07tn this year, crossing the $1tn mark for the first time, according to Warc’s Global Ad Spend Outlook 2024/25.

Warc’s 2024 growth forecast is 2.3 percentage points higher than its previous projection and is the best performance in six years, discounting the post-pandemic recovery in 2021 (+27.9%).

In June, GroupM’s forecast had anticipated global adspend to surpass $1tn in 2025.

Warc expects growth to slow slightly in the next two years, at 7.2% for 2025 and 7% for 2026, when global adspend will reach $1.23tn.

GroupM: Global ad market to hit $1tn a year early

US election year boosts North America

North America, the biggest market in terms of adspend, is expected to show the strongest growth this year, increasing 8.6% to $347.5bn.

This is partially inflated due to a US election year. While total US adspend is expected to grow 8.9%, this reduces to 4% expected growth when excluding political spend, which is expected to top $15.8bn this year. However, this is still more than double last year’s 1.4% growth rate.

In Europe, adspend is forecast to rise 5% to $164.9bn. The UK, the biggest by spend in the region, will grow 8% to $47.5bn, as previously forecast in the Advertising Association/Warc Expenditure Report.

France, Italy and Germany are all expected to post strong growth (8%, 5.4% and 4%, respectively) with France in particular boosted by the Olympic and Paralympic Games.

UK adspend hits Q1 high as optimism continues

The other three world regions are all expected to also post growth this year. Latin America is predicted to increase 6.2% ($32.1bn), while the Middle East is not expected to be severely impacted by ongoing regional conflicts, with Warc predicting growth of 4.2% to $12.6bn.

Asia-Pacific, the world’s second-largest market by adspend, will see growth slow to 2% to reach $272bn.

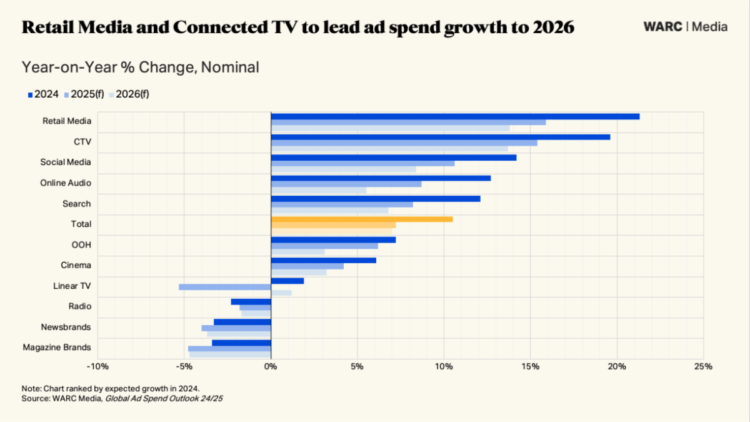

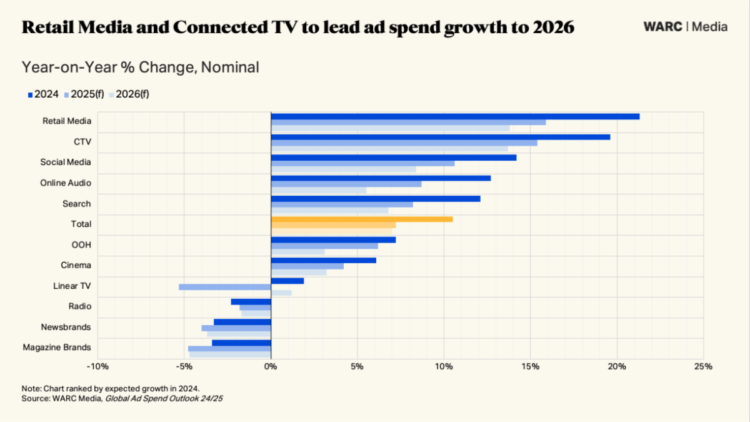

Retail media leads growth

By channel, social media is the biggest in 2024 in Warc’s study, totalling $241.8bn, having overtaken search (excluding retail media) last year.

It will account for 22.6% of global adspend this year.

Meta remains the biggest player here, with a share of 62.6%. That said, TikTok is growing strongly. Parent ByteDance now accounts for 20.1% of spend in social media, up from just 9.3% five years ago.

Search will account for 21.8% of global adspend this year at $223.8bn. While it has increased consistently since Warc began monitoring this channel in 2013, growth is expected to plateau by 2026 as retail media gains further prominence among consumers and social commerce gathers momentum outside Asia, according to Warc.

Retail media, meanwhile, is forecast to have a 14.3% share of global adspend at $152.6bn. This is double the share in 2019 and retail media is expected to be the fastest-growing channel in the next three years at over 21%.

The second-strongest growth channel is expected to be connected TV. It is predicted to be responsible for $35.5bn in 2024, growing by 19.6%.

Print publishing, broadcast radio, linear TV, cinema and OOH will collectively account for 25.3% of global adspend at $270.5bn — a 1.5% rise from 2023.

That said, much of this growth is attributed to US political spend; excluding that, legacy media channels together will record a 0.5% decline.

Linear TV will grow by 1.9%, or a marginal 0.1% excluding US political spend.

Warc’s global projections are based on data aggregated from 100 markets.

Big Tech dominance

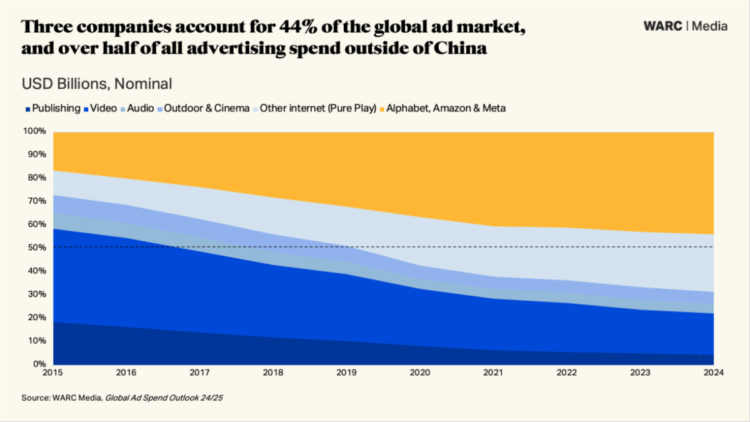

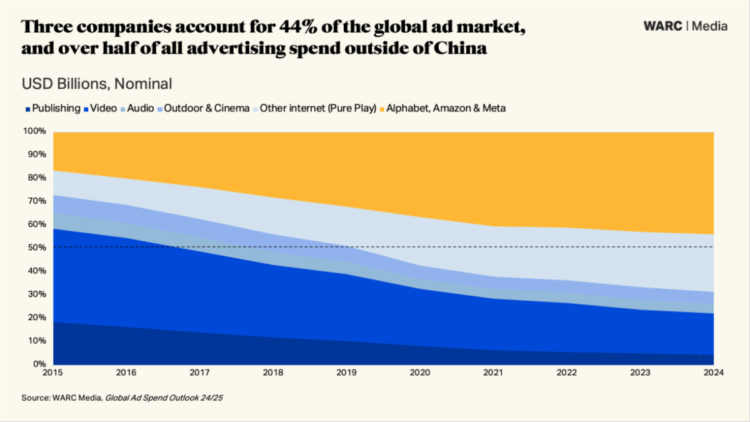

Notably, Alphabet, Amazon and Meta are forecast to account for 43.6% of global adspend this year and reach a 46% share by 2026, as the global ad market continues to coalesce around a handful of dominant Big Tech media owners.

Warc expects online-only companies to grow ad revenue by 14% in 2024 to $735.7bn. In fact, almost $9 in every incremental $10 spent on advertising this year will go to online-only companies, with Alphabet, Amazon and Meta accounting for 52.9%.

Adwanted UK is the trusted delivery partner for three essential services which deliver accountability, standardisation, and audience data for the out-of-home industry.

Playout is Outsmart’s new system to centralise and standardise playout reporting data across all outdoor media owners in the UK.

SPACE is the industry’s comprehensive inventory database delivered through a collaboration between IPAO and Outsmart.

The RouteAPI is a SaaS solution which delivers the ooh industry’s audience data quickly and simply into clients’ systems.

Contact us for more information on SPACE, J-ET, Audiotrack or our data engines.