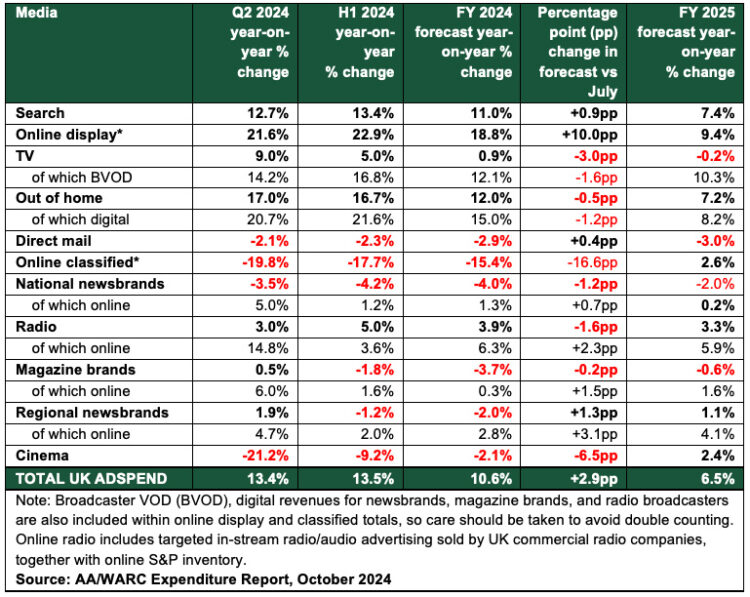

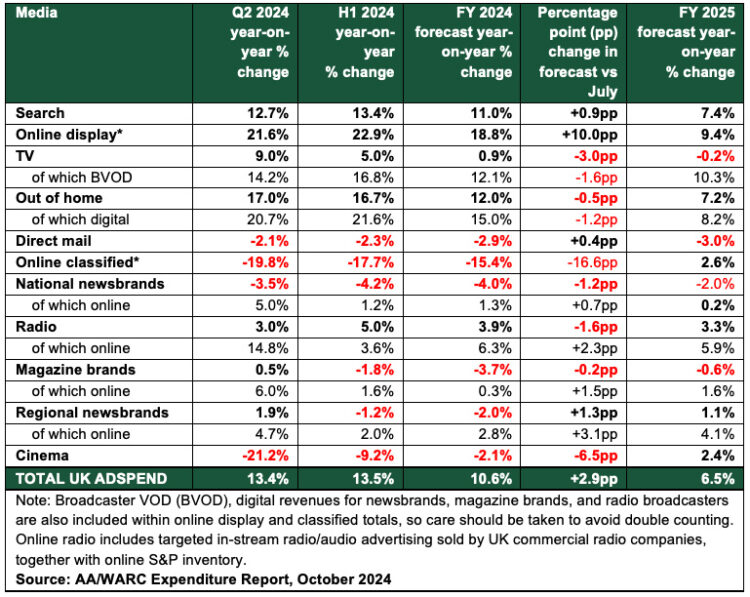

The UK advertising market reached £10bn in Q2, up 13.4% year on year and four percentage points ahead of forecast.

That is according to the latest Expenditure Report from the Advertising Association (AA) and Warc, which attributed the estimate beat to stronger-than-expected digital growth and a relatively weak 2023.

For H1, the ad market was worth £19.6bn, up 13.5% year on year.

As a result of the latest figures, the AA and Warc have upgraded their full-year 2024 forecast and expect the market to surpass £40bn for the first time to reach £40.5bn.

This represents a 10.6% year-on-year increase, putting the UK ahead of growth in European counterparts including France (8%) and Germany (4%) at current prices.

The full-year growth forecast for 2025 has also been raised by one percentage point from July’s estimates to 6.5%, or a total of £43.1bn.

TV bounceback

Growth in Q2 was led by online display (21.6%) — an acceleration from 12.8% in Q1. This puts H1 growth at 22.9%.

This is in line with the IAB’s latest Digital Adspend study, also out this week, which put display growth at 22% in H1.

OOH (17%) and search (12.7%) also grew strongly.

TV staged a recovery in the three-month period thanks to the men’s Euro football tournament, increasing by 9% — the strongest quarter in two years. Much of the growth was led by broadcaster VOD, which went up by 14.2%.

“Nothing unites audiences, both as viewers and as people, like a big football tournament,” said Josh Dickins, head of consulting at creative agency Modern Citizens (formerly known as Creature). “Certainly, as marketers, we shouldn’t forget that when big cultural unifiers come along, it pays to pay attention.”

That said, the AA and Warc expect full-year TV growth to be lacklustre at 0.9%, a three percentage point forward revision from July’s forecast. Furthermore, the report predicts a 0.2% decline in TV in 2025.

Two other broadcast segments also saw a recovery in Q2, albeit more marginally: regional news brands and magazines posted growth for the first time since Q2 2022, at 1.9% and 0.5% respectively.

Among the channels the Expenditure Report covers, the biggest decline in Q2 was in cinema, which fell 21.2%. This was closely followed by a 19.8% drop in online classified.

Stephen Woodford, CEO of the AA, said: “Advertising has a vital role in funding culture, media and sport – and the results of Q2 show how advertising can play a fundamental part in supporting the success of events such as the Men’s Euros, the Olympics and the Paralympics.”

Last week, the latest IPA Bellwether Report found that marketing budgets had been “put on ice” in Q3 as businesses awaited word on Labour’s autumn Budget. That said, adspend forecasts for 2024 and 2025 were revised upwards and “main media” growth remained strong.

Video adspend outpaces total digital growth in H1

IPA Bellwether: Media budgets to expand despite total marketing ‘on ice’

UK adspend hits Q1 high as optimism continues

Adwanted UK is the trusted delivery partner for three essential services which deliver accountability, standardisation, and audience data for the out-of-home industry.

Playout is Outsmart’s new system to centralise and standardise playout reporting data across all outdoor media owners in the UK.

SPACE is the industry’s comprehensive inventory database delivered through a collaboration between IPAO and Outsmart.

The RouteAPI is a SaaS solution which delivers the ooh industry’s audience data quickly and simply into clients’ systems.

Contact us for more information on SPACE, J-ET, Audiotrack or our data engines.