UK adspend growth of 8% led by digital and cinema

UK adspend grew 8% to reach £10.6bn in Q1, according to the latest Expenditure Report from the Advertising Association (AA) and Warc.

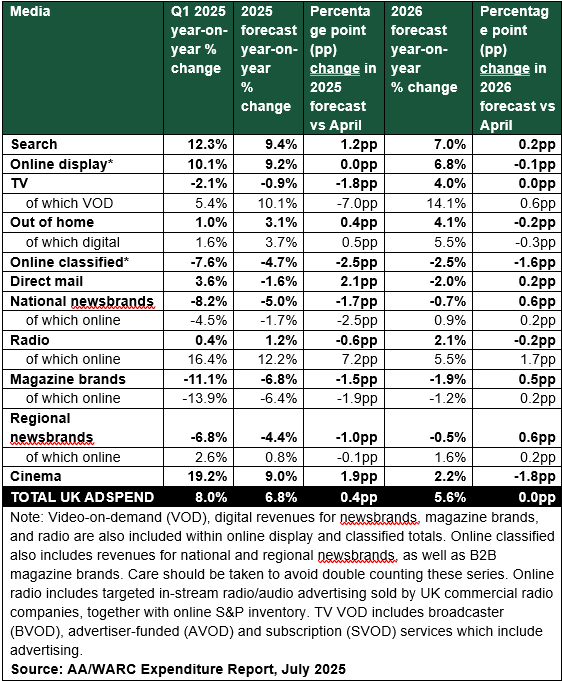

This figure is 1.4 percentage points ahead of the previous forecast, driven predominately by search (including retail media) — the biggest category for total ad investment, which grew 12.3% year on year.

It comes a week after Google parent Alphabet reported total revenue growth of 14% in Q2 to $96.4bn, with search up 11.7%.

Other digital channels with a strong Q1 included online display (+10.1%) and social media (+14.7% and which sits within the broader online display category).

James McDonald, Warc’s director of data, intelligence and forecasting, suggested the figures highlighted “buoyancy” in parts of the UK ad market, with investment growing ahead of forecast “despite a wavering economy and a sustained period of global trade turbulence”.

He noted that advertisers have “pulled budgets forward” and doubled down on the “agile formats” of search, social and retail media in response to tariff uncertainty.

The move by brand marketers to embrace short-termist strategies was similarly highlighted in this month’s IPA Bellwether Report, prompting media strategists to warn that an over-rotation into short-termist, performance-driven marketing activity risks long-term brand growth.

Cinema and online radio jump

That said, some traditional media channels typically associated with brand advertising also saw substantial growth in Q1.

Cinema led all channels with 19.2% ad revenue growth amid strong box office and attendance figures. The Media Leader previously reported that Digital Cinema Media (DCM), the UK’s largest cinema ad sales house, saw 26% year-on-year growth in H1 revenue.

According to Karen Stacey, DCM’s CEO, more brands have begun considering cinema as the “launch spot” for their AV campaigns. This has been driven in part by strong attendance, but also tools developed by DCM in partnership with The Media Leader parent Adwanted UK that allow advertisers to compare such audiences to TV ratings.

Why cinema is becoming more prominent on AV plans — with DCM’s Karen Stacey

Clare Turner, chief commercial officer at competitor Pearl & Dean, declared to The Media Leader that cinema has “found its feet after a few turbulent years” and that there is “no question that brands are returning in full force”. She noted that a superb H2 film slate is likely to continue ad revenue momentum through the end of the year.

Online radio (+16.4%) meanwhile also had a strong Q1 as it saw benefits from new technology aimed at making digital listening more accessible and easier to buy for marketers. Audion EMEA head of sales Elie Kauffmann suggested to The Media Leader this was reflective of “the growing demand for more flexible, immersive and performance-driven media channels”.

In H1, the number of digital audio ad exchanges doubled from two to four (Global’s Dax, Bauer’s AudioXi, News Broadcasting’s Octave and Spotify’s Sax), resulting in increased competition. Radio more broadly grew ad revenue by just 0.4% in comparison.

On the other hand, total TV revenue saw a 2.1% year-on-year decline. It follows growth of 3.8% in 2024.

Both national (-8.2%) and regional (-6.8%) news brands, as well as magazine brands (-11.1%), also declined, although regional news brands’ online revenues ticked up (+2.6%). Notably, both national news brands and magazine brands experienced drops in online revenues (-4.5% and -13.9% respectively).

Welcome clarity on LHF important for H2

Growth expectations for the full year have been revised upwards by 0.4 percentage points to 6.8% (£45.4bn). Nevertheless, this presents a slowdown from last year. When accounting for inflation, UK adspend is anticipated to grow 3.5% in 2025.

Meanwhile, AA and Warc’s 2026 forecast remains unchanged (5.6% to £48bn).

The major beneficiaries of adspend growth this year are expected to be TV VOD (+10.1%), search (+9.4%), online display (+9.2%) and cinema (+9%). OOH (+3.1%) and radio (+1.2%) are also expected to grow, albeit more modestly.

AA CEO Stephen Woodford said such growth is welcome, especially as the government announced a new industrial strategy that recognised advertising as a “priority sector”, with £380m in investment earmarked for the creative industries going forward.

Just as important for driving growth in H2, Woodford pointed out, is clarity on incoming less healthy food restrictions, which the government have committed to ensure will not apply to brand advertising.

While the official government deadline for implementation has been delayed (again) to 5 January, the industry has voluntarily agreed to implement changes by the previous 1 October deadline.

Channels impacted include all online platforms and news brand websites, as well as TV and VOD (from 5:30am to 9pm), although the Advertising Standards Authority is still in the process of drafting guidance on how brands should manage the ban.

Marketers have nevertheless been able to plan for the busy holiday period with confidence since May.

“Brands appear to be adapting to the current environment by reallocating budgets tactically, with the outlook for the year remaining broadly positive despite persistent headwinds,” McDonald concluded.

LHF ad ban delayed to 2026 as government commits to explicitly exempt brand activity