Lantern will serve as measurement solution for Universal Ads in UK

“We’re really fucking good, because we did it. We overcame a bunch of legal and technical obstacles to put this thing together in 15 months from a standing start.”

At Thinkbox’s Vision 2025 event on Tuesday, ITV measurement innovation lead Sameer Modha was in a congratulatory mood. A year after announcing Lantern, a new measurement panel aimed at tracking the impact of TV advertising on sales, the project is actively generating data for brands in beta.

“It’s let us measure the outcomes for hundreds of brands in glorious technicolour,” Modha declared.

As part of the first public update on Lantern since it launched a request for information in March, Modha revealed that Lantern will serve as the measurement solution for Comcast’s Universal Ads in the UK.

Announced in January, Universal Ads is a cross-industry ad solution aimed at allowing advertisers of all sizes to buy TV “as easily as they buy from social media platforms”.

The buying proposition launched in the US earlier this year. At Cannes, Channel 4, ITV and Sky announced that they had partnered Comcast to create a similar marketplace in the UK, targeting small and medium-sized businesses (SMBs). The UK initiative, which has yet to be officially branded, will launch in 2026.

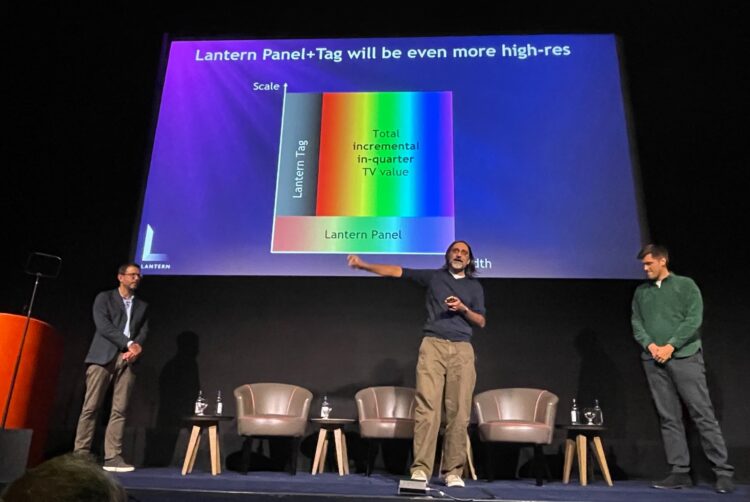

In the meantime, the panel underlying Lantern’s data collection will expand from 4,000 to over 10,000 as the cross-broadcaster team behind the project looks to improve its capability and accuracy.

That includes evolving Lantern’s methodology to take a hybrid approach to measurement. The aim, as Modha explained, is to eventually incorporate “all the responsiveness that you get from a tagging approach on web traffic” into the tool.

Additionally, Lantern has “charted a course” to pooling all of the broadcasters’ linear and VOD exposure data in one centralised database. This would allow easier links between panel data, tagging data and more.

Channel 4, ITV and Sky roll out ad marketplace to attract new advertisers

‘Kaleidoscope of data’

Lantern links TV advertising to sales outcomes by connecting panellists’ exposure to TV ads with their online behaviour. As Channel 4’s lead insight business partner Henry Vernon noted, Lantern is able to track its panellists’ “full online footprint”.

Calling the end result a “kaleidoscope of data”, he added that Lantern aims to deliver outcomes data to brands with haste so that it is “available for those Monday morning catch-ups”.

Vernon continued: “We want to know: what are they searching for? What are they seeing on their apps? What are they buying? What are they doing on social media? We get this beautiful picture of what’s going on, not just looking at small independent parts.”

The proposition also works deterministically. Because of the integration of data from Sky and Measure Protocol, Lantern can measure exposures for its panel going back three years, as well as “all the things people did” after those TV ad exposures, such as the apps they opened, the sites they visited and the videos they watched.

As such, Modha claimed Lantern can measure the in-quarter impact of TV in “unprecedented detail”.

How Lantern will bring outcome measurement to TV — with Sameer Modha and Matt Hill

Early results

For many brands, especially the digital-first brands and SMBs that broadcasters are aiming to attract, a top concern is measuring outcomes as they relate to web traffic to their own sites.

Summarising the early results of Lantern’s outcomes data, Matt Hill, Sky’s director of insight and measurement, noted that about 45% of outcomes measured by the project were within brands’ own website — meaning, crucially, they account for less than half of the totality of effects that Lantern’s panel methodology is able to capture.

“We’re able to pick up an additional 55% of outcomes that we wouldn’t normally be able to pick up without the help of a panel,” Hill said.

He described seeing a “huge diversity of outcomes” in response to ad consumption depending on brand category.

For example, food-delivery brands primarily see advertising investment drive increased in-app behaviour; FMCG brands are less likely to get consumers going to their website to find out more and tend to have a shorter journey to purchase.

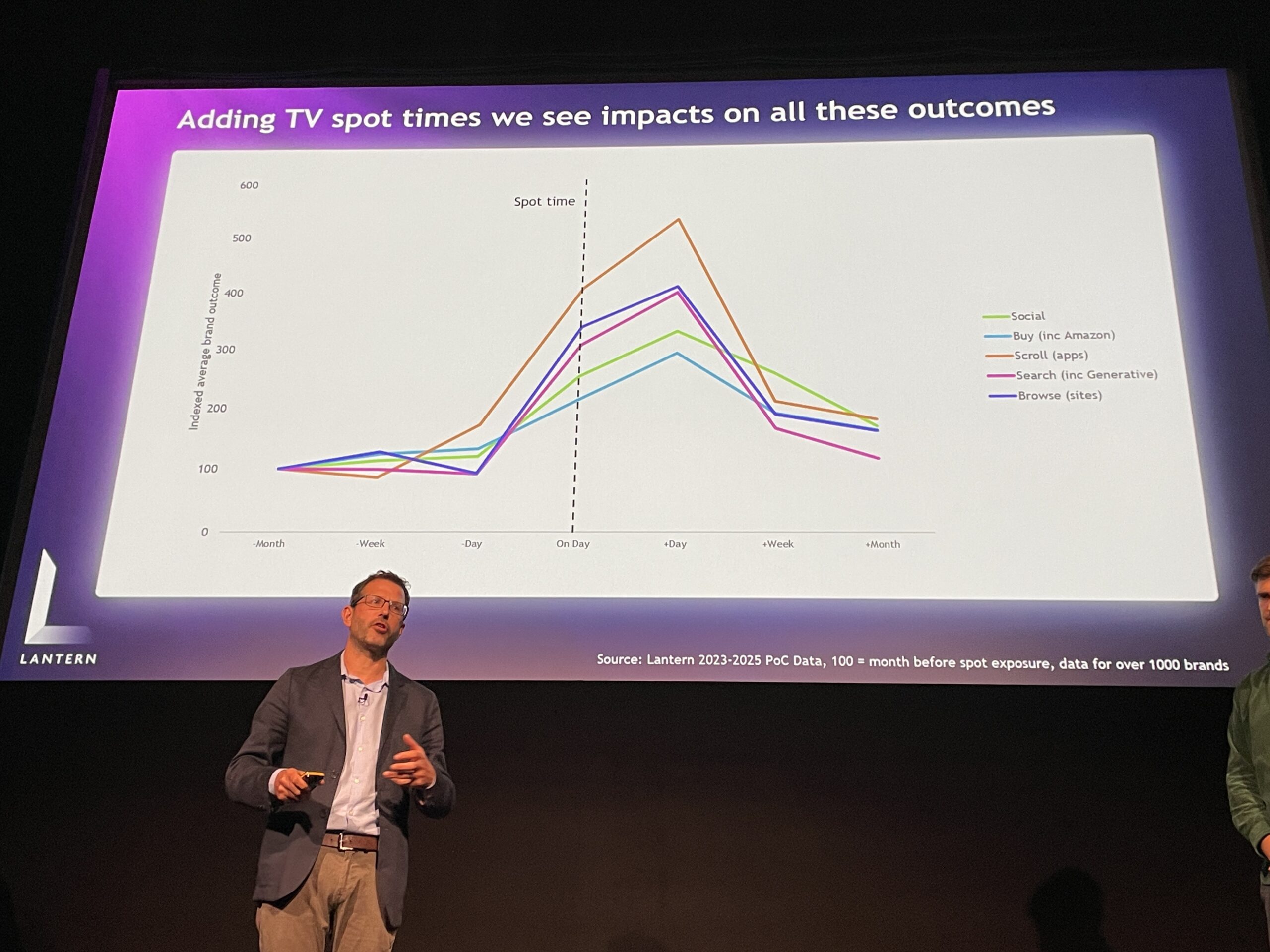

Importantly, Lantern’s outcomes data shows the impact of TV investment over time. Presenting a chart of indexed outcomes data, Hill pointed out how consumers’ relevant online activity picks up after being exposed to a TV ad.

“Across the outcomes we’re measuring, everything starts to spike,” he observed. “And we see that continue into the days, weeks, even months after exposure.”

Such data allows TV to “play the attribution game” by examining outcomes and considering the proportion of individuals that had been exposed to a TV ad in a given time frame. However, Hill suggested that the data actually lends credence to the idea that attribution is “completely and utterly useless”.

“Attribution isn’t the answer,” he said. “It doesn’t give us anything we can really use from a measurement point of view.”

Instead, what advertisers are keen to understand is the incremental impact a TV ad has on business outcomes — something that Lantern aims to provide.

Wrapping up the presentation, Modha asked brands to get involved to help test and improve the measurement proposition. Lantern is currently looking for 50-100 advertisers to “come along and have a play” — as long as marketers are willing to commit time to assist the project, share data and, of course, advertise on telly.

He concluded: “One year on, we have logins on our phones to a dataset of thousands of people, where we have all their TV exposures and we have all of the outcomes.”