Search and online display formats now account for four-fifths of UK adspend

The UK ad market is set to grow 7.3% year on year to £12bn in Q4, as “Golden Quarter” investment is predicted to rise even amid continued macroeconomic uncertainty.

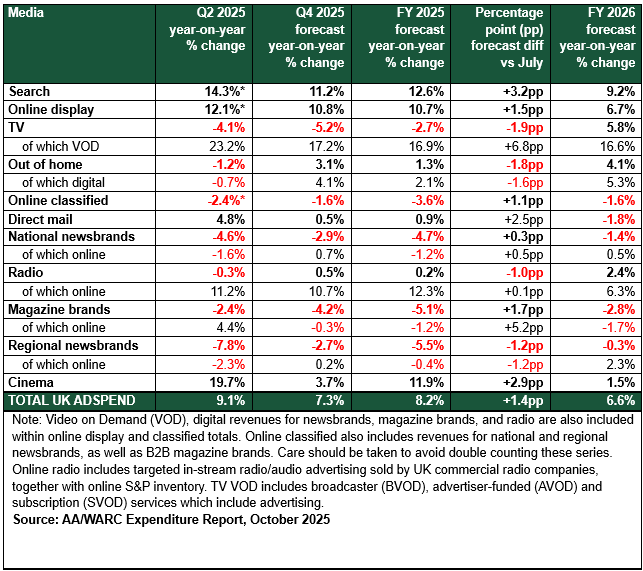

That is according to the latest Advertising Association (AA)/Warc Expenditure Report, which now forecasts total adspend will rise 8.2% throughout 2025 to reach £46bn.

In 2026, AA/Warc now expects adspend to grow a further 6.6% to £49.1bn.

“Despite ongoing economic uncertainty and caution in the run up to the November budget, the advertising market is still expected to see growth this year,” commented AA CEO Stephen Woodford.

Adspend grew 8.9% year on year in H1 2025 to reach £22bn. Warc estimated that search and online display formats (inclusive of retail and social media) accounted for more than four-fifths (81%) of adspend.

The report suggested this is likely due to ongoing investment in AI being used to drive performance across digital ad platforms.

It comes even as experienced ad industry execs recently warned at this month’s Advertising: Who Cares? conference in London that a “consolidation of power” in ad revenues has led to less effective results for advertisers, who often conduct automated media buys through platforms.

SMEs drive growth to digital

At that conference, new research from Thinkbox research director Anthony Jones and his team of industry volunteers suggested that small- and medium-sized enterprises (SMEs), which are driving a substantial proportion of ad market growth, are operating without marketing plans, let alone ways of linking adspend to “anything resembling ROI”.

“Half of them don’t even have any defined KPIs,” Jones said. “They get stuff done without necessarily worrying about the long- and medium-term impacts.”

As such, most SMEs are turning to tech platforms, such as Google and Meta, that offer low-cost, AI-driven solutions to help boost business outcomes.

“Ease of use overruled anything resembling technical rigour,” Jones noted. “A few facts and figures that may or may not be true is better than nothing.”

While the total ad market grew 9.1% in Q2 specifically, this was felt across just four main media categories: search (+14.3%), online display (+12.1%), direct mail (4.8%) and cinema (+19.7%).

The rest saw varying degrees of decline, albeit with strong digital shoots of growth for TV (23.2% growth in VOD), audio (+11.2%) and magazine brands (+4.4%).

Warc director of data, intelligence and forecasting James McDonald commented that the latest figures further demonstrate how advertisers are seeking to tap into consumers’ digital consumption habits.

“Growth in video-on-demand services and search — particularly on retail platforms — underscores a prioritisation of digital engagement and its influence on the path to purchase,” he said.

Cinema, meanwhile, displayed strong growth in Q2 off the back of major releases like A Minecraft Movie, Lilo & Stitch and Mission: Impossible – The Final Reckoning. As of September, year-to-date box office is running 9% ahead of 2024 and 1% behind the Barbenheimer-fuelled 2023, and advertisers have been lured back to the medium by growth in attendance and cinema-equivalent TVRs based on ticket data.

Ending 2025 on a high

The ad market is expecting to receive an £814m boost in Q4 this year compared to last year, with advertising playing an ever-vital role during the holidays.

Big brands are set to release their festive campaigns in the coming weeks, with VOD and online formats the biggest beneficiaries.

VOD is forecast to see a 17.2% year-on-year increase in adspend to £430m — the largest of any channel in Q4. However, AA/Warc is predicting “fluctuation” in the total TV market amid a decrease in advertiser confidence. As such, total TV adspend is expected to decline 5.2% in Q4.

Meanwhile, festive footfall is set to benefit cinema (+3.7% anticipated growth) and OOH (+3.1%). Smaller increases are expected for radio (+0.5%) and direct mail (+0.5%).

Online formats will account for 83% of all adspend during Q4, including 40% for search and retail media alone.

McDonald added the latest figures suggest a “stable trajectory for the UK’s ad market despite a languid economy”.

The winning formula for Christmas ads is changing, says Lumen