Podcasting needs its own JIC – Jack Davenport, Goalhanger CEO

The podcast industry has a big weakness: the data it uses to sell audiences to advertisers.

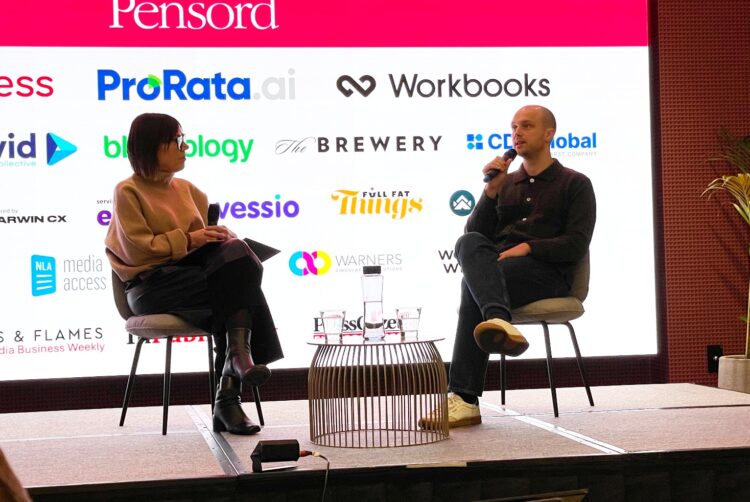

That is according to Goalhanger CEO Jack Davenport, who lamented last week that podcasting does not currently have an equivalent to trusted joint-industry currencies (JICs) such as Rajar (radio) and Barb (TV).

“There’s no industry standard of what the metric is that everyone accepts,” he told a crowd at the Professional Publisher Association’s (PPA) Independent Publishers Conference. “So each platform has their own definition of what a ‘play’ is or what an ‘engaged listener’ is. That’s something that’s quite difficult for us to manage.”

Goalhanger, one of the UK’s most popular podcast companies with shows like The Rest is History and The Rest is Politics, is actively growing its advertising business while also seeking diversification through subscription revenue.

It currently counts 200,000 paying subscribers across its 14 shows, but since subscriptions are administered entirely through third parties like Apple, the company “essentially get[s] no data” about a substantial tranche of its subscribers, including a lack of insight into how they engage with the various benefits of the subscription service.

The lack of audience standards has led Goalhanger, one of the UK’s most popular podcast companies, to conduct surveys of its own audience, including qualitative efforts it can communicate to a growing pool of potential clients.

Chasing volume

Goalhanger was founded last decade as a sport documentary production company by Davenport alongside broadcaster and ex-footballer Gary Lineker and ITV sport controller Tony Pastor. The group expanded into podcasts in 2018, though its commercial operation was “incredibly remedial” for its first several years, Davenport admitted, with early efforts entirely outsourced to Acast.

Taking a “learn-by-doing” approach with the podcast platform, Davenport realised that the more shows Goalhanger produced, the more ad revenue it could generate, leading him to prioritise a strategy that sought volume and scale. This was distinct from how the podcast industry had operated before the Covid-19 pandemic, when the “predominant” business model was producing podcasts with the aim of optioning popular series to TV or film producers.

“We leaned into what we had,” Davenport said. “We had to make high-volume shows because we were ad-funded.”

Since 2022, the podcast industry has “turned our way”, he continued, noting that most podcasts are now centred around high-volume, always-on productions with ad-supported models.

Apart from advertising, Goalhanger is also leaning into other methods of monetisation through “pure trial and error”, including live events, livestreaming, and the aforementioned subscription model.

“We have iterated and essentially fumbled towards what is now clearly the dominant and the right business model for podcasting in 2025, which is to be majority ad-funded, but still have a really significant direct audience monetisation engine as well,” Davenport described.

Now at 60 employees, Goalhanger is “strongly profitable” and continuing to launch new shows. The latest, The Rest is Science, debuts today.

Netflix and Spotify form video podcast partnership as concept of ‘podcast shows’ grows

Its growing direct sales team is primarily focused on inking and developing brand partnerships and sponsorships, while Spotify is employed as a third-party sales partner.

While there lacks an industry standard for audience reporting, according to Davenport, Goalhanger’s shows reach a combined audience of 60m people who consume episodes in full length on a monthly basis, with an average listen (or watch) time of 35 to 45 minutes. “That combination of time spent and reach puts us up there with streamers, with the way people watch TV”, he argued, adding that the attention the shows command is Goalhanger’s “biggest selling point”.

Moving forward, Davenport is keen to “optimis[e] the business around” events and subscriptions, while developing more direct relationships with advertisers.

“Over the last couple of years we’ve taken a lot more control over our own commercial business,” he said. As such, the company is talking about itself more in conversations with clients.

“Up until quite recently, we’ve never really foregrounded Goalhanger as a brand. Our instinct being that people interact with the shows and the hosts and we want to encourage them to build that relationship with the shows themselves. We didn’t want to insert something into the middle of that relationship unnecessarily.

“It’s become clear to us, from a B2B perspective, that what Goalhanger is has become more and more important to explain when we’re talking to agencies or brands, that there isn’t just two historians that rocked up and started doing a podcast. There’s a network behind it. There is an engine. There is a methodology. So it’s becoming more relevant to talk about Goalhanger.”

Unlocking video and social budgets

When speaking to clients, Davenport noted there is still a significant education piece with agencies regarding Goalhanger’s audiences — something that would be aided by trusted third-party measurement.

He admitted: “The Rest Is History, if you haven’t listened to the show and you’re a 26-year-old media buyer in a big agency, you could understand how they might say, ‘This is two middle-aged blokes talking about something in Africa 500 years ago, why is this relevant to my brand in 2026?'”

For Goalhanger, success with agencies comes down to proving audience engagement and explaining key demographic signifiers. Across its podcast portfolio, he relayed, the average age of listeners is between 35 and 36, with most listeners belonging to “much higher-than-average earners”, implying significant disposable income.

Acast CEO bets on independence and scale during podcasting’s prime

What has really moved the dial for Goalhanger’s commercial efforts, however, has been its recent embrace of video production and taking a social-inclusive strategy for distribution.

“When we were going into media agencies and when we were talking to brands, suddenly when we had social inventory and video inventory, you’re just talking to much bigger teams with much bigger budgets,” he described. “Instead of the podcast buying team, which might be one person who’s in a corner of the office, you’re talking to digital budgets, which are much bigger. And agencies are much more used to the metrics and to buying social campaigns and social inventory.

“So for the same content, it massively increased our average deal size, and it just makes it a lot more efficient in monetising the same content.”

Davenport is “platform agnostic”, wanting a presence wherever people are consuming content. While the podcast shows are a “core product”, Goalhanger is increasingly focused on tailoring output for YouTube and social media.

He revealed that 45% of The Rest Is History‘s audience on YouTube, for example, are watching the show on TV sets. He described this as a “stunning” statistic that made him realise Goalhanger must “think a lot more about the visual products” for that platform, such as by making the show more visually interesting by splicing in relevant archival video content or commissioning animation studios to create scenes.

Talent as ‘advocates’

Davenport chalked up much of Goalhanger’s recent growth to the company’s unique talent model.

Chuckling, he called the likes of Tom Holland and Dominic Sandbrook (The Rest is History), Richard Osman and Marina Hyde (The Rest is Entertainment), Robert Peston and Steph McGovern (The Rest is Money), and Alastair Campbell and Rory Stewart (The Rest is Politics) “essentially well paid.”

He explained: “We have very generous profit sharing, so they are heavily incentivised on the success of the show”.

Such a business model came out of necessity, as Goalhanger “didn’t have any money” when it was starting out, but it knew attracting top editorial talent was key to developing a loyal audience.

The system works well, Davenport argued, because it causes hosts to be more closely involved in directing their show, and provides transparency around how much everyone is earning.

“It’s really, really difficult to get someone to read an advert that they’re not bought into, that they’re not earning a good portion of the revenue from,” Davenport said.

“Obviously, it requires the shows being a success and generating significant revenue, but when it works, it’s massively powerful. Our talent become advocates for us.”

Asked to advise other publishers on how they should go about designing their own multimedia efforts, Davenport replied there is no one-sized-fits-all podcast model; B2C publishers might be tempted to chase scale, but sometimes quality engagement is more important than big numbers.

He acknowledged that even as Goalhanger has grown into a successful business, he barely knows how to define what it is they do. What started as a podcast production company has evolved into what he referred to as “a digital media network”, with a wide variety of shows (rather than just merely “podcasts”) that live on a variety of platforms and in a variety of formats.

“I think the word ‘podcast’ doesn’t really describe the breadth of what we’re doing now. We’re moving back heavily into video. We have a lot of live events, we have written editorial. Lots of different touchpoints.”

Female-focused video podcast network is more than a business, it’s a ‘movement’