Media budgets flat for third consecutive quarter amid turbulent Q4

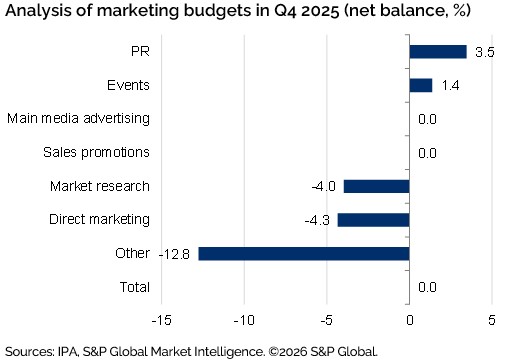

Total marketing budgets were flat in Q4 2025, as were main media budgets and sales promotions budgets, according to the latest Bellwether report by the Institute for Practitioners in Advertising (IPA).

It is the third consecutive quarter that main media budgets have remained unchanged, with an equal share of survey respondents (16.9%) reporting both increases and decreases in media spend.

The “dour holding pattern” described last quarter by Rik Moore, managing partner of strategy at independent media agency The Kite Factory, continues.

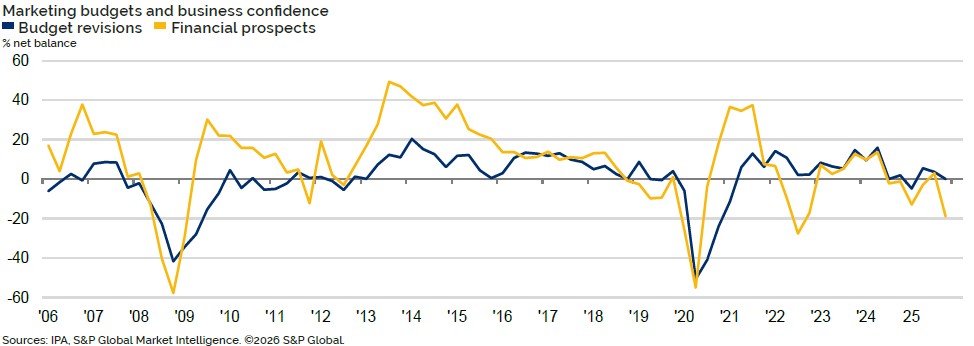

Given this reality, marketing leaders have become more pessimistic towards the category moving forward. A net balance of -3.1% of firms surveyed now say they anticipate making cuts to their media budgets during the 2026/2027 financial year.

IPA director general Paul Bainsfair suggested Q4’s flatlined growth “reflects a wider confidence problem” in the macroeconomy.

“Global instability continues to unsettle markets, while domestically there appears to be limited faith in the Government’s grip on the economy,” he said. “Until that changes, caution is understandable.”

Still, Bainsfair insisted that organisations that continue to spend on advertising, even through more muted economies, “stand to gain greater visibility and, over time, increased market share”.

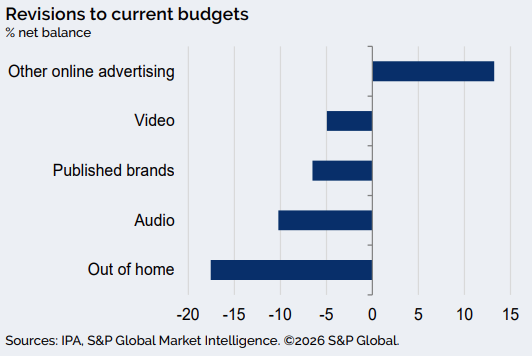

A familiar story: Online advertising investment increases, others fall

Breaking media spending down by category reveals a polarisation in investment: a net balance of 13.2% of businesses increased their “Other Online” media spending, including channels such as search, social media, and display advertising. In contrast, the other four categories measured by the Bellwether (video, audio, publishing, and OOH) were all downwardly revised to varying degrees.

As the report advises, where budgets were expanded, businesses “sought to strengthen their online presence and reach wider audiences”.

OOH recorded the steepest decline in Q4, with over one quarter (25.7%) of Bellwether panellists cutting budget for the channel. In contrast, only 8.1% of firms reported increasing their investment in the channel (net: -17.6%).

The sharp decline in OOH investment in Q4 follows a similar -15.2% net decline in Q3.

This was followed by audio, with a net balance of -10.2% of panellists decreasing investment in the medium. One-fifth (20.5%) of respondents said they reduced their audio budget last quarter, nearly double the number who increased it. Audio also saw a 13% net decline in the previous quarter.

Meanwhile, publishing (-6.5% net balance) and video (-5.0% net balance) both saw budget contractions.

For OOH and publishing, these were the worst results in the past three quarters; for video, this is the first time in three quarters that a negative net balance of firms has reduced investment.

While total marketing budgets remained flat, a net number of businesses reported increased investment in two areas: PR (+3.5% net balance) and events (+1.4% net balance).

In contrast, market research (-4.0% net balance) and direct marketing (-4.3% net balance), as well as the Bellwether’s “Other” category (-12.8% net balance), saw declining investment.

Optimism or pessimism?

Looking ahead, Maryam Baluch, economist at S&P Global Market Intelligence and author of the Bellwether report, added that the economic climate “remains challenging” in 2026, with marketers under continual pressure to deliver return on investment as firms scrutinise spending decisions amid a “subdued macroeconomic outlook”.

It’s a familiar refrain in a post-Covid economy that has suffered from a cost-of-living crisis and signs of a K-shaped recovery.

As one Bellwether panellist stated, the cost of living could result in “less discretionary spending for households”, negatively impacting retail businesses. Likewise, one automotive brand marketer warned that the “impact of government fiscal policies on company operating costs, consumer confidence and spending” could threaten its business over the next year.

Looking on the bright side, “budgetary stasis points to some resilience,” Baluch noted. If inflationary pressures ease and interest rates decline further, business investment could improve in 2026.

Brand marketers likewise pointed to a “potential stabilisation of US tariffs” and “leveraging AI for efficiencies” as possible ways growth prospects could improve this year.

Mark Howley, COO at Publicis Media and chair of the IPA Media Futures Group, commented that the sentiment expressed in Q4’s Bellwether may “prove to be a little downbeat for main media and advertising growth”, particularly if the US market continues its return to growth that began in Q2 2025.

“Many companies now operate and budget globally and are centred out of the USA,” Howley noted. “A strong US economy emerging (or continuing) in 2026, I think, may drive more optimism and growth than perhaps the current survey is reflecting”.

However, the US political and economic situation remains uncertain. The Trump administration this week escalated its pressure on the Federal Reserve, issuing grand jury subpoenas and threatening the central banking system with a criminal indictment.

Fed chairman Jerome Powell responded with a video in which he called the legal manoeuvre a “pretext” and a “consequence of the Federal Reserve setting interest rates based on our assessment of what will serve the public, rather than following the preferences of the President”.

As Economist deputy editor Tom Standage noted at The Media Leader’s Year Ahead event last week, pressure on the Fed has eroded confidence in the US bond market, which could have significant implications for the global economy.

“There’s no hiding from this being one of the weakest preliminary outlooks in Bellwether history, with no growth anticipated in main media advertising,” said Jim Kelly, Scotland’s IPA chair and deputy MD and head of planning at creative agency Story.

“Perhaps that’s no surprise given the continued lack of confidence amongst both businesses and consumers.”