UK adspend expected to surpass £50bn for first time in 2026

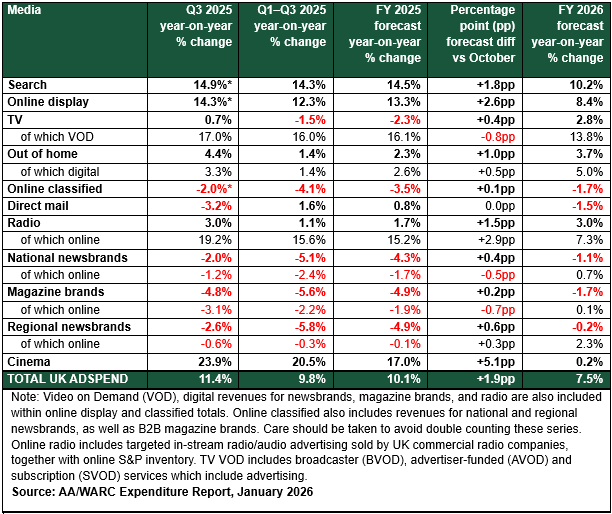

Total UK adspend rose 11.4% in Q3 2025 to £12.5bn, according to the latest figures from the Advertising Association (AA) and Warc.

Throughout last year, UK adspend is expected to have reached £46.9bn (+10.1%). AA/Warc now expects it to grow a further 7.5% to exceed £50bn for the first time in 2026.

The latest Expenditure Report, however, betrays a polarised growth picture for the industry. Search and online display formats accounted for 83% of total adspend during the period from last July to September, up 14.6% year on year.

Likewise, online spend for other media channels saw substantial growth in adspend, even amid relatively modest growth for their linear counterparts. Online radio, for example, grew 19.2% (compared to 3% for total radio). Video-on-demand (VOD) adspend also grew 17% (compared to 0.7% overall).

AA/Warc attributed the Q3 TV boost to major sporting events, namely the FIFA Club World Cup, the UEFA Women’s Euro Championships, and the Rugby World Cup.

Among non-online channels, cinema again showed substantial growth during the quarter (+23.9%), driven in part by advertisers seeking placement alongside major cultural releases such as Marvel’s The Fantastic Four: First Steps and Downton Abbey: The Grand Finale.

Publishing, both newsbrands and magazine brands, both continued to see declines in ad investment, however.

James McDonald, director of data, intelligence and forecasting at Warc, commented that the figures reflect “an enduring resilience” across the UK’s advertising market, “despite a challenging economic backdrop marred by subdued household incomes, a softening labour market, and ongoing geopolitical turmoil.”

The anticipated double-digit growth for full-year 2025 likewise “reflects a continued focus on performance, reach and association with culturally relevant moments, from major sporting events to unmissable live concerts,” he continued.

“That UK adspend is on track to surpass £50bn for the first time this year underpins this conviction, with brands continuing to invest to stay competitive, build trust and engage audiences, even as the wider macroeconomic picture remains unfavourable”.

Beneficiaries in 2026 are projected to be TV VOD (+13.8%), driven primarily by sporting events such as the Winter Olympics and the FIFA World Cup. This is followed by search (+10.2%), online display (+8.4%) and online radio (7.3%).

The Expenditure Report warns, however, that “the wider economic backdrop is muted” amid “ongoing domestic headwinds” like slow real household income growth and a “loosening” labour market. Likewise, international and domestic political uncertainty could weigh on business confidence throughout the year, particularly as US President Donald Trump continues to regularly threaten European nations with higher tariffs.

Considering the report, Jade Raad, chief growth officer at Jungle Creations, told The Media Leader that the latest AA/Warc figures lend credence to the idea that performance marketing “hasn’t killed brand building; it’s forced us to be honest about what actually works”.

“The retreat into measurable channels isn’t timidity, it’s accountability finally catching up with decades of wasteful spend justified by ‘brand awareness'”, she argued.

But Raad warned against the possibility that “we’re building an advertising ecosystem optimised for efficiency at the expense of impact”, noting that cinema’s resurgence is evidence that “consumers are starved for experiences that actually interrupt their day” even as advertisers are “obsessing over micro-conversions”.

She added: “The real question facing 2026 isn’t whether we’ll hit £50bn. It’s whether that spend will build brands people actually care about, or just fuel an attribution arms race”.