Sky’s new bundle and the launch of HBO Max set to shake up UK streaming market

This week, a flurry of announcements has shaken up the UK streaming market.

On Monday, Warner Bros Discovery set an official launch date for HBO Max in the UK and Ireland. The streaming service will launch on 26 March, with four subscription tiers to choose from, plus a separate plan that includes TNT Sports.

Max, which first launched in the US in 2020, has since expanded across Latin America, Europe, and Asia and currently has 128m global subscribers. Due to its carriage deal with Sky Atlantic, its launch in the UK and Ireland was delayed until this year.

Its tiers include: Basic with Ads (£4.99 per month), Standard with Ads (£5.99 per month), Standard (£9.99 per month), Premium (£14.99 per month) and the TNT Sports plan (£30.99 per month), which can be purchased alongside other plans and includes access to TNT Sports 1-4, TNT Sports Ultimate, live event feeds and original documentaries.

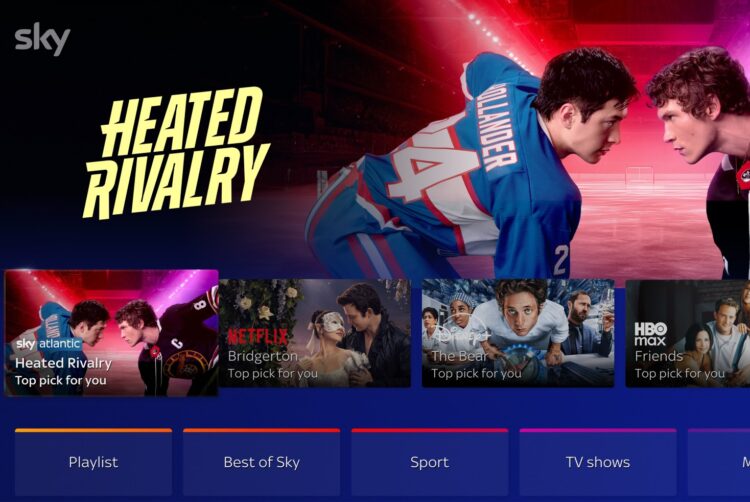

Then, on Wednesday, Sky launched an expansive bundle offering.

For £24 per month, new Sky customers will receive subscriptions to Sky, HBO Max’s basic with ads tier, Disney+’s standard with ads tier, and Netflix, which the broadcaster has offered as a package since 2018. Beginning in July, the bundle will also include Hayu, a service owned by NBCUniversal that specialises in reality TV.

Sky’s NOW customers will receive access to HBO Max at no additional cost, but will otherwise need to purchase the bundle to access the other streaming services. Those just seeking to subscribe to Sky can still choose its Essential TV bundle, which costs £15 per month.

“This marks a new era for Sky and NOW,” commented Sky chief consumer officer Sophia Ahmad. “Nowhere else offers this breadth of incredible entertainment in a fully integrated experience, with everything customers love watching side by side so viewers can jump from show to show with ease.”

Sky’s addition of Disney+ marks a substantial step change: while Sky has long carried HBO content in this market and has had a years-long partnership with Netflix, Disney+ is a significant new addition to the bundle.

Notably, existing Disney+ customers on its ad-free tiers can switch to Sky, saving £5.99 per month on their bill.

In addition to Disney+ access, Sky Cinema subscribers will receive exclusive access to a new Disney+ Cinema channel on linear.

Karl Holmes, Disney+’s EMEA general manager, noted that the UK is the streaming service’s largest European market, making Sky “the perfect partner for our next wave of growth in the UK and Ireland.”

He added that the agreement “opens up a substantial new audience for content creators and advertisers”.

Analysis: Has the great bundling begun?

The willingness of Disney, Warner Bros Discovery, and Netflix to bundle with Sky is an acknowledgement of a plateau in the total streaming subscription market, the oversupply of streaming services available to consumers, and the reality that continuing to hike prices is likely to push more consumers to churn.

According to Barb’s latest Establishment Survey, 20.6m UK homes (69.7%) had access to at least one subscription video-on-demand (SVOD) service in Q4 2025, up marginally from the prior quarter.

While total subscriptions have ticked up over the past several years, the slowdown in subscription growth has been cited by analysts as a key factor driving streaming companies to adopt advertising models and, now, consider bundles.

The Establishment Survey found, for example, that UK households with access to Disney+ were flat year-on-year, which may have led Disney executives to conclude that bundling is now advantageous to stimulate growth.

According to Richard Broughton, executive director and co-founder of market research firm Ampere Analysis, bundling is likely to be an effective anti-churn tactic that, while likely requiring an acceptable of lower revenue per user initially, would lead to higher per-customer revenues within a year given higher customer retention rates.

“The streaming industry has a problem,” Broughton said at the Connected TV World Summit last year. “It is increasingly difficult to get consumers to take more services in their stack. Of the market that does take a service, consumers are increasingly switching out their subscriptions, actively managing their stack.”

Reduced churn can counterbalance discounting and make SVOD bundling work

According to insights consultancy MTM, one-fifth (21%) of UK SVOD subscribers admitted to subscription cycling last year — the highest ever recorded — with a further 42% of Brits “open” to churning. Price hikes, MTM noted, are testing “the limits of loyalty”.

Both Disney and Warner Bros Discovery have long considered bundling a core component of their wider audience strategy. In the summer of 2024, the two entertainment giants announced a bundle for US customers, inclusive of Disney+, Hulu, and Max (later rebranded back to HBO Max).

Meanwhile, according to Ampere, Disney’s own US bundle, inclusive of Disney+, Hulu and ESPN+, led to a substantial decline in churn in that market. Warner Bros, meanwhile, committed to bundle HBO Max with Sky in December 2024 as part of its planned global rollout.

Bundling HBO Max with Sky is mutually beneficial. Whereas Sky customers would have retained access to HBO Max’s library of content produced before 2026, they can now continue to access newly produced programmes like The Pitt and the forthcoming Harry Potter series.

For Warner Bros Discovery, partnering with Sky guarantees immediate market penetration for Max, which would otherwise likely struggle to gain users as a late mover in the UK streaming market.

The bundle effort is also future-facing for Sky. Should Netflix ultimately close its proposed acquisition of Warner Bros, already having agreements with both Netflix and HBO Max makes any futher negotiations with the potential combined entity simpler.

Given the large number of potential mergers and acquisitions within the TV market (Skydance acquired Paramount which wants to acquire Warner Bros Discovery, itself a merger between Warner Bros and Discovery, of which Netflix is vying for Warner Bros; Sky is meanwhile in talks to potential acquire ITV’s Media & Entertainment division), bundling can also be viewed as another form of consolidation for consumers.

While the £24 per month offer appears to be exceptional value for consumers, it is noteworthy that the bundle defaults to the ad tiers for most of the streaming services. Depending on its popularity, the result could mean that Netflix, Disney+ and HBO Max’s ad tiers see stronger growth than their premium tiers.

Ironically, the move thus takes an industry that once prided itself on being a better alternative to the much-maligned cable package one step closer to becoming like the very villain it sought to improve upon.

If you gaze long enough at an abyss, the abyss also gazes back into you.