A new plateau? 2025 box office revenues surpass £1bn for third year running while advertiser interest soars

Cinema’s total box office in 2025 grew 1% year on year to £1.07bn, according to the latest figures from Comscore.

It marks the third consecutive year the UK and Ireland box office has surpassed £1bn in revenue, after three straight years of failing to meet that mark due to the Covid-19 pandemic.

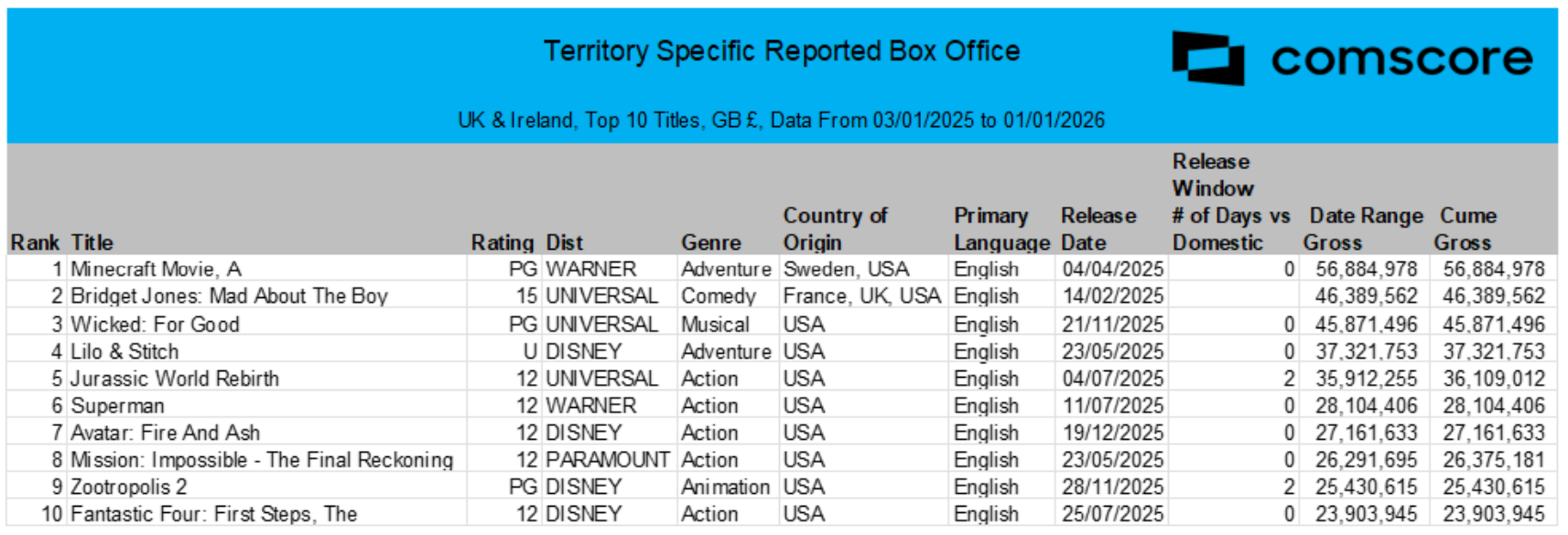

The top film of the year was Warner Bros’ A Minecraft Movie (£56.9m). This was followed by Universal’s Bridget Jones: Mad About The Boy (£46.4m) and Wicked: For Good (45.9m), which underperformed its predecessor (£55.7m).

None of the top 10 films of 2025 derived from original IP. Six were sequels, two were comic-book reboots (Superman, The Fantastic Four: First Steps), one was a live-action remake (Lilo & Stitch), and A Minecraft Movie is an adaptation of the popular video game.

The year ended with a December box office haul of £104.2m, a 10% decline from December 2024.

James Cameron’s Avatar: Fire and Ash was the top film of December despite its mid-month release, grossing £27.16m and ranking as the seventh-highest-grossing film of the year. However, its performance is 27% behind its predecessor, Avatar: The Way of Water, at the same time of release.

Other top performing titles in December included November debuts Zootropolis 2 (£17.92m in December; £25.43m lifetime gross) and Wicked: For Good (£11.44m in December; £45.87m lifetime). These were followed by thriller The Housemaid (£8.5m) and horror sequel Five Nights at Freddy’s 2 (£6.69m).

Double-digit ad revenue growth

Despite the relative consistency in year-on-year box office and attendance, advertisers’ interest in the media channel jumped substantially this year.

According to Tom Linay, content business director at Digital Cinema Media (DCM), the UK’s largest cinema ad sales house, the company’s full-year revenues grew 12% year-on-year.

This included a particularly eye-popping 26% year-on-year growth in H1, followed by a more modest H2 (+4%).

Advertiser demand for cinema came as marketers increasingly sought to use the medium as a launch pad for their wider AV campaigns, leveraging key cultural moments and citing cinema’s high-attention environment and effectiveness at driving price premiums relative to other channels.

The channel has also benefited from the launch of “cinema TVRs“, which DCM debuted in 2023. Rather than selling purely on metrics such as box office and admissions, DCM also converts audiences into an equivalent TV rating, enabling agencies to more directly compare film and TV audiences when compiling and analysing their AV plans.

Cinema TVR data is available on Adwanted’s Connected Platform. (Adwanted is the parent company of The Media Leader.)

Why cinema is becoming more prominent on AV plans — with DCM’s Karen Stacey

Reflecting on 2025, DCM’s Linay said it was “positive” to be up year-on-year, after experiencing both “peaks and quieter moments” in the film slate.

“The first part of the year was excellent,” he told The Media Leader. “We had a period from October to Wicked that was quieter than everyone would’ve liked.” A lack of strong summer family films after the release of Disney’s Lilo & Stitch remake in May also contributed to a dampened box office performance in the back half of the year.

A new plateau?

The meagre 1% year-on-year box office growth suggests a post-pandemic plateau in cinema attendance. Full-year box office growth was similarly flat between 2023 and 2024.

Has the pandemic habit of streaming films at home become so ingrained that cinemas will struggle to grow their business significantly?

According to Linay, this narrative oversimplifies a complex industry.

“Admissions in the 21st century have fluctuated from 155m to 175m,” he noted, adding that while cinemas are unlikely to reach the top end of that range anytime soon, the lower end is reasonable. While full-year admissions will not be released until later this month, Linay predicted admissions may be “down very slightly” compared to 2024.

The immediate pre-pandemic period of 2019 also presents a difficult comparison for cinemas, he argued. At the time, Disney rushed to release an unusually large number of blockbusters to get ahead of its Disney+ launch in November of that year. Subsequently, the pandemic and strike action led to a dearth of films in the early post-pandemic years.

“It’s product-driven,” Linay added. “The big films are performing.”

Pre-Covid, Linay explained, studios and cinemas had become overly reliant on a large volume of comic-book films to drive consistent audiences. But an oversupply led to consumer burnout, and studios have been left “figuring out what works” to entice consumers back to cinemas.

Some new ideas land, while others fall flat. Many of the overperforming films of 2025 have been original IP, including Sinners, Weapons, and One Battle After Another, among others. All of these were produced by Warner Bros Studios, which took risks that paid off. In its Q3 earnings, Warner Bros. Discovery reported that theatrical revenue surged 74% year over year, driving a 23% jump in its Studios segment to $3.3bn.

But now Warner Bros is likely to be sold to Netflix, and Hollywood leaders have publicly warned that the streaming giant could undermine theatrical releases by prioritising titles for streaming, where Netflix can more directly monetise them through its subscription and advertising models.

Michael O’Leary, CEO of the American movie theatre trade organisation Cinema United, has called the acquisition an “unprecedented threat”, warning that “theatres will close, communities will suffer, jobs will be lost” because of Netflix’s penchant for only giving films “token” theatrical releases to qualify for major awards.

Netflix co-CEO Ted Sarandos parried such concerns by stating: “You should count on everything that is planned on going to the theatre through Warner Bros” to “continue to go to theatres”.

When asked whether he was concerned that the deal would affect UK cinema attendance, Linay declined to answer, noting that questions about Warner Bros.’ ownership likely won’t be fully resolved until 2027. He added that Netflix appeared to have its best year in cinemas based on admission data (Netflix does not publicise box office revenue from its theatrical releases, part of a wider culture of opacity into its current business operations).

‘A seismic shift’: Netflix’s deal to acquire Warner Bros will remake the entertainment industry

The real concern is that while tentpole films drive cinema attendance, consumers appear to be staying home to watch smaller genre films. A comedy that might have earned £20m a decade ago will earn £5m today, Linay explained. Still, studios continue to invest in such titles because they are relatively inexpensive to produce and have high potential.

The cost-of-living crisis is also challenging studios to increase output or better market their films to mass audiences.

“You have to have a specific reason to get out of your house and do anything,” Linay said candidly. “I think we’re really in a battle for people’s attention. […] The right films, that are marketed well — and I don’t think studios have quite cracked that yet — when they get it right, it works.”

2026 preview: Expect a muted Q1 and a massive summer and Q4

In January, 2026 kicks off with the release of awards-season contenders including Chloé Zhao’s Hamnet (Universal) on the 9th, followed by zombie horror-sequel 28 Years Later: The Bone Temple (Sony) on the 14th and comedy-drama Rental Family (Disney) on the 16th.

Meanwhile, Park Chan-wook’s thriller No Other Choice (Mubi), Chris Pratt’s sci-fi film Mercy (Sony), and period romance The History of Sound (Universal) all debut on the 23rd.

Timothée Chalamet’s table-tennis drama Marty Supreme will also see an expanded release in January after earning £3.23m in December.

Looking further ahead, titles like Wuthering Heights (13 February), The Devil Wears Prada 2 (1 May) and Verity (2 October) are slated to provide brands with access to large, female-skewed adult audiences throughout the year. The same is true for male audiences with the likes of Project Hail Mary (20 March) and Tom Cruise’s black comedy Digger (2 October)

Upcoming tentpole event films include The Super Mario Galaxy Movie (3 April), Christopher Nolan’s The Odyssey (17 July), Spider-Man: Brand New Day (31 July), The Hunger Games: Sunrise on the Reaping (19 November), Dune: Part III (18 December) and Avengers: Doomsday (18 December).

Linay said many of these titles “feel bulletproof” due to their mix of popular established IP and bankable filmmakers. While he conceded that the Q1 schedule could fall behind 2025 in box office revenue, the jam-packed summer and Q4 will likely see major lifts.

“I think it’s the highest-quality set of blockbusters we’ve had in a while,” he offered.

Advertisers have taken note. DCM has already sold its gold-tier ad slots for Avengers: Doomsday and Dune: Part Three, despite both films currently slated for the end of the year.