AA/WARC: 2021 set to be ‘strongest’ year for ad growth since monitoring began

UK recovery in 2021 is expected to the be the largest across any major international ad market, according to the latest quarterly Advertising Association/Warc Expenditure Report.

The report, published today, revealed “an even greater recovery” for the UK ad market in 2021 than previously forecast, with an estimated growth of 26.4% to £29.7bn. This is better than previous predictions in October of 24.8% growth.

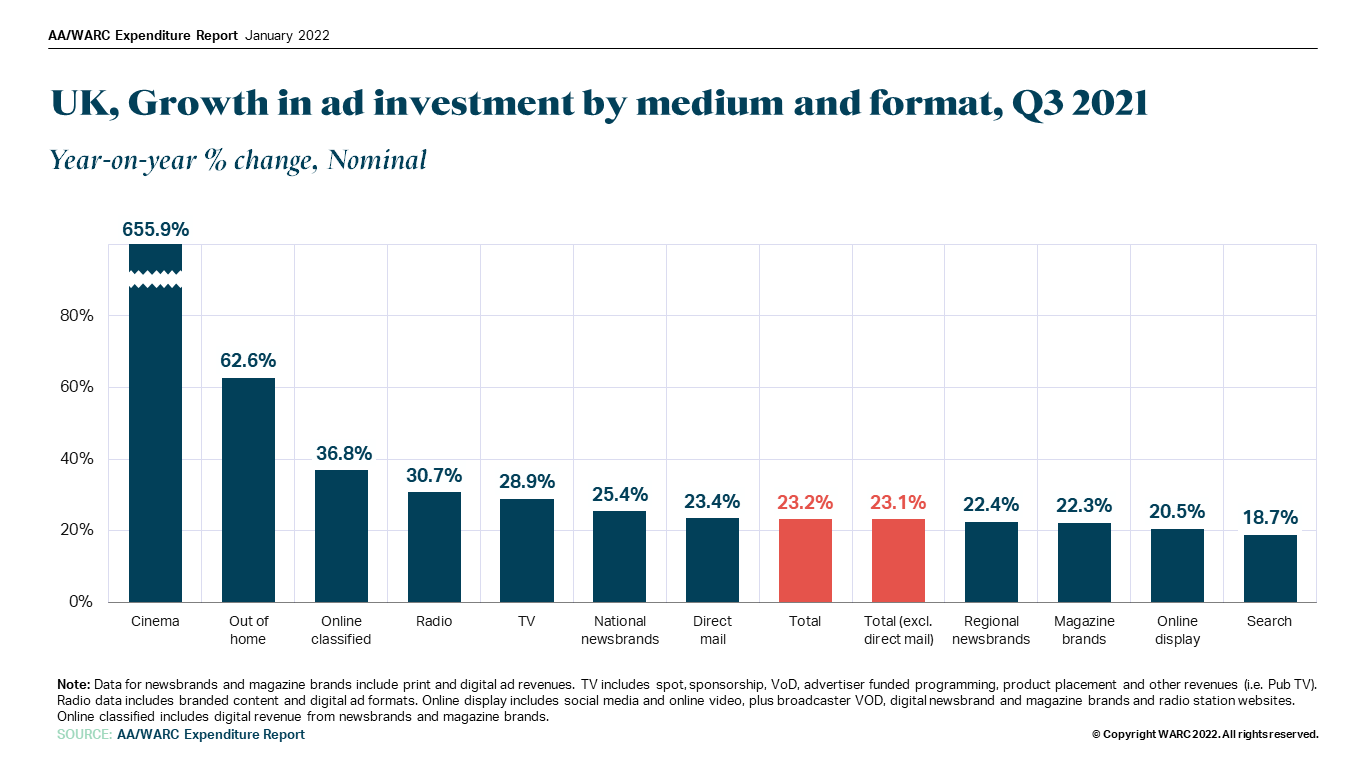

AA/WARC data show actual adspend in Q3 2021 was at £7.3bn, £183m ahead of its forecast with all media recording at least double-digit growth, making it the largest ever summer spend on record.

Cinema and out-of-home are big climbers after brutal pandemic

Perhaps unsurprisingly cinema recorded the highest growth of spend last year compared to 2020, as spend grew by more than seven times (up 665.9%) to £20.2m. Movie theatres were forced to close for most of 2020 and during further lockdowns last year.

Kathryn Jacob, CEO at Pearl & Dean, said: “Cinema was no doubt one of the advertising sectors that was the hardest hit from the impacts of the pandemic. However, since cinemas reopened, there has been a strong uptick in bookings and many brands have been quick to return.

“This has now been reflected in the latest AA/WARC figures, which show that cinema ad spend has experienced triple-digit growth (+655.9%) in Q3 2021 – overtaking growth at all other advertising mediums – which is incredibly encouraging and proves that brands continue to value the importance that cinema has in driving brand awareness and consideration.”

She pointed to big ticket releases like No Time to Die and Spiderman: No Way Home which have reminded audiences of “the magical and unique shared experience of the silver screen” and “an impressive slate” of films for 2022 like Nightmare Alley, The Batman, TopGun: Maverick, Sing 2 and Belfast keeping viewers engaged.

Out-of-home (OOH) also had a much improved quarter with confirmed growth of +62.6% to £270.4m respectively.

Alistair McCallum, CEO of WPP’s outdoor agency Kinetic, said: “Out of Home’s spectacular recovery is in line with our experience, most notably a very strong Q4 across our clients and agencies.

“The power of data meant OOH was able to keep reaching audiences, while wonderful creative executions generated social media buzz and earned media. The growth highlighted in today’s report is testament to OOH’s resilience and enduring appeal with advertisers.”

Dave Mulrenan, head of investment at Zenith said TV and video spend in Q4 2021 in particular outstripped all but “the most optimistic media analyst” predictions, although there were “fairly large road bumps” to this growth with changing patterns of consumers media consumption, inflation and contingency planning between client and agencies.

2022 forecasts

Investment this year is set to go up by 8.5% to £32.2bn which would mean the UK ad market has grown by more than a third since 2020 when the Covid-19 pandemic hit.

Growth is forecast for this year across every channel with cinema (+201.1%), out-of-home (+26.8%), search (+11.1%), online display (+8.3%) and TV (+5.3%) as some pandemic habits are expected to stick.

AA/WARC’s figures indicate Q1 2022 could be stronger than expected, particularly for the TV market, with overall adspend is expected to grow 12.6% year-on-year, compared with 10.5% previously.

Tim Heden, managing partner at indie media agency Electric Glue, said the main drivers of this spend growth across Q1 were “bounce-back sectors” such as travel and film releases following pent-up consumer demand along with new-to-market brands like meat substitutes and on-demand groceries bringing post-pandemic money into new and emerging sectors

He also pointed to an increase in small business fintec advertising and a developing market in post pandemic small business start ups.

With respect to TV and video growth, Heden highlighted: “The market is experiencing some turbulent inflation within linear broadcast – however clients are becoming more confident with Broadcaster Video-on-Demand (BVOD), and a positive side-effect of the streaming growth of the last two years has been to increase the eyeballs and thus audience inventory available within these areas. For some audiences this is creating a more cost-effective route to market.”

Duncan Chater, head of sales in Europe for Bloomberg Media, added: “When looking at specific sectors, it’s no surprise that channels such as online display and TV are expected to rise, where marketers are able to reach audiences effectively, even when coronavirus strikes and people are confined to their homes.

“What’s promising, is that other channels are also experiencing growth. The pandemic sparked a wave of media owners diversifying their audience reach in line with changing consumer habits. Reaching the right audience, in the right way is essential, even more so at a time when change can happen overnight.”