Ad-funded SVOD reach in UK triples

The weekly reach of ad-funded subscription VOD (SVOD) services tripled over the past year, according to the latest edition of the IPA’s Making Sense: The Commercial Media Landscape report, which draws on TouchPoints data.

Ad-funded streaming now reaches 30% of UK adults each week, up from 11% in 2024 and 10% in 2023.

The growth has been driven by a combination of factors including price hikes for ad-free options and Amazon Prime Video’s decision to auto-enroll existing customers into its ad tier when it launched in January 2024.

Breaking down ad-funded SVOD reach by generation, such services now reach more than one-third of 16-34s (36%) and 35-54s (36%). For over-55s, reach is closer to one-fifth (21%).

This is a substantial increase from the same period in 2024, when ad-funded SVOD services only reached 12% of 16-34s, 13% of 35-54s and 9% of over-55s.

The new advertising imperative: How ad revenue is reshaping content strategy

Simon Frazier, head of TouchPoints marketing and data innovation and author of the report, described the jump as a “major change”, with weekly reach “rising considerably”.

The study found the most popular ad-funded SVOD platform is Netflix, which reaches 16% of UK adults. This is followed by Amazon Prime Video (15%) and Disney+ (7%).

While popular, such reach is still dwarfed by the top five commercial media properties by weekly reach: Facebook (52%), YouTube (45%), ITV/STV (44%), Channel 4 (39%) and Instagram (39%).

Caroline Manning, chief design officer at Initiative, said the report shows that “the consumer need for video hasn’t diminished one bit, but the fragmentation of the video landscape means holistic planning is more vital than ever”.

Older consumers overlooked

While ad-supported SVOD has provided a substantial new opportunity for marketers, according to Frazier, “the biggest missed opportunity in advertising today” is failing to target the over-55 demographic.

This is because, whereas adults aged 16-54 more quickly adopt new, digital-centric consumption habits via streaming services and social platforms, there is still scope for over-55s to digitise their media consumption.

As Frazier explained, while media consumption has broadly fragmented, “we’re [now] seeing increases in similarities between the commercial media usage habits of different age groups”.

He concluded: “By a huge margin, 55+ have the most scope for new media opportunities of any of the audiences we’ve looked at.”

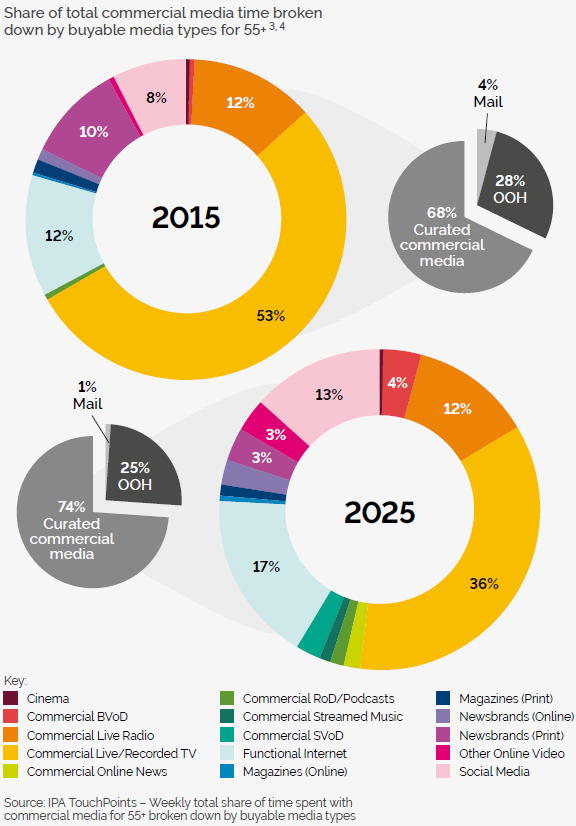

The TouchPoints study found that, compared with 2015, over-55s’ share of time spent with commercial live/recorded TV dropped from 53% to 36%. On the other hand, time spent with SVOD, social media and the internet increased.

Earlier in the summer, a separate IPA TouchPoints release found for the first time that UK adults now spend more time on their mobile phones than watching TV sets.

However, TV sets notably still account for a significant portion (46%) of device usage for over-55s, compared with just 19% of time spent with smartphones. In comparison, 16-34s view 50% of their curated commercial content on a smartphone and just 22% on a TV set.

Monica Majumdar, Reach’s head of client strategy and ex-Wavemaker UK strategy lead, noted that, despite the opportunity in targeting older audiences, they are “often overlooked” on media plans.

“They represent c.30% of the population, hold roughly three-quarters of the nation’s wealth and yet are named as the core audience in roughly 10% of marketing briefs,” she pointed out.

“Historically, planners assumed [over-55s] would be reached through wastage or overspill from commercial TV. But the IPA TouchPoints data shows this no longer holds true.

“Their habits have shifted toward more targeted platforms, rather than relying solely on broad broadcast channels. In fact, OOH now remains the last true bastion of overspill.”