Advertisers upbeat on 2024 spending, retail media soars

Advertisers are feeling bullish about the rest of 2024, according to an update to the 2024 Outlook Study released today by the Interactive Advertising Bureau (IAB).

The study found that media buyers are revising their ad spend projections upwards, with a projected increase of 11.8% for the year, compared to the 9.5% forecast in November 2023.

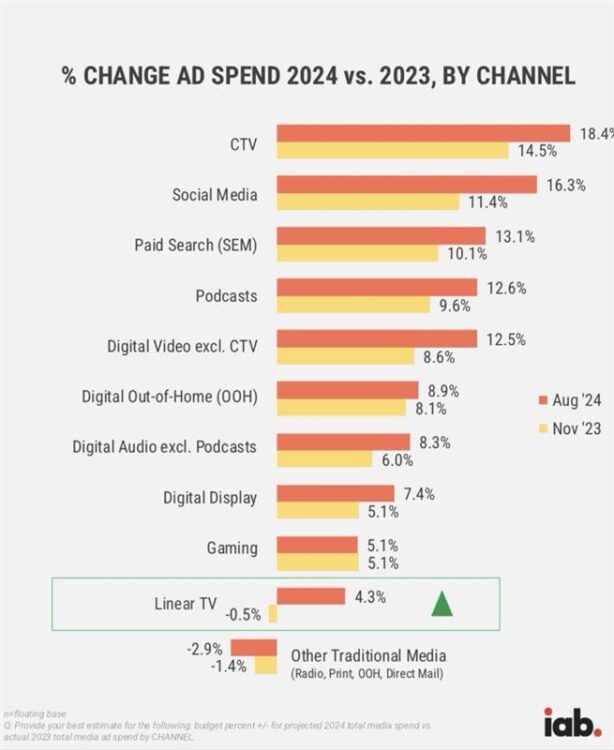

Nearly all media channels are expected to see growth, with connected television (CTV) leading the pack at a projected 18.4% increase, followed by social media (16.3%) and paid search (13.1%). Linear TV is also seeing a rebound.

This growth is likely fueled by a combination of factors, including a resilient economy and increased spending on political advertising and major events like the Olympics.

The study also highlights the continued rise of retail media. Buyers, particularly those in the CPG and beauty sectors, are significantly increasing their investment in this channel, with projected YoY growth revised to 25.1% from the previously estimated 21.8%.

Retail media is expected to capture a significant share of total ad spend in 2024, solidifying its position as a major player in the advertising landscape.

While the report finds that advertisers remain committed to cross-funnel KPIs, there seems to be a shift in focus. Interest in exploring new KPIs like attention metrics appears to be waning, with buyers instead concentrating on refining and leveraging established metrics to achieve their goals.

Optimizing reach and frequency emerged as the area with the most significant increase in buyer interest, rising by 27% compared to November 2023.

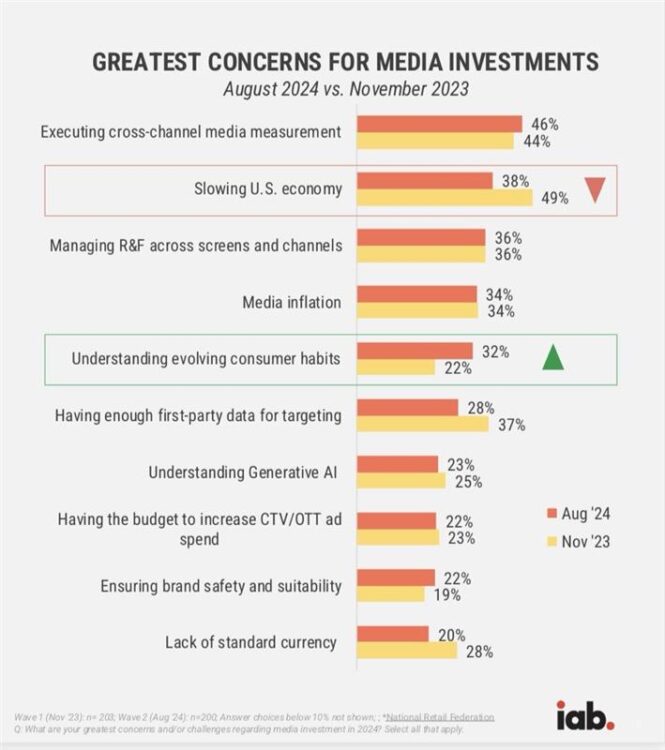

Despite the positive outlook, the report acknowledges ongoing challenges within the industry. Cross-channel measurement remains a top concern, especially for large advertisers, as media convergence continues to accelerate.

The IAB’s updated Outlook Study paints a picture of an advertising industry cautiously optimistic about the remaining months of 2024.

With increased spending projections, a focus on established metrics, and the rise of retail media, the report suggests a dynamic advertising landscape where established players are adapting and innovating.

However, the industry must also address measurement challenges to fully capitalize on this growth.

The 2024 Outlook Study updated estimates from media buyers, mostly at brands and agencies. The emailed survey was fielded between June 14 and August 12, 2024.