Bellwether Q2 2022: marketing budgets grow despite economic concerns

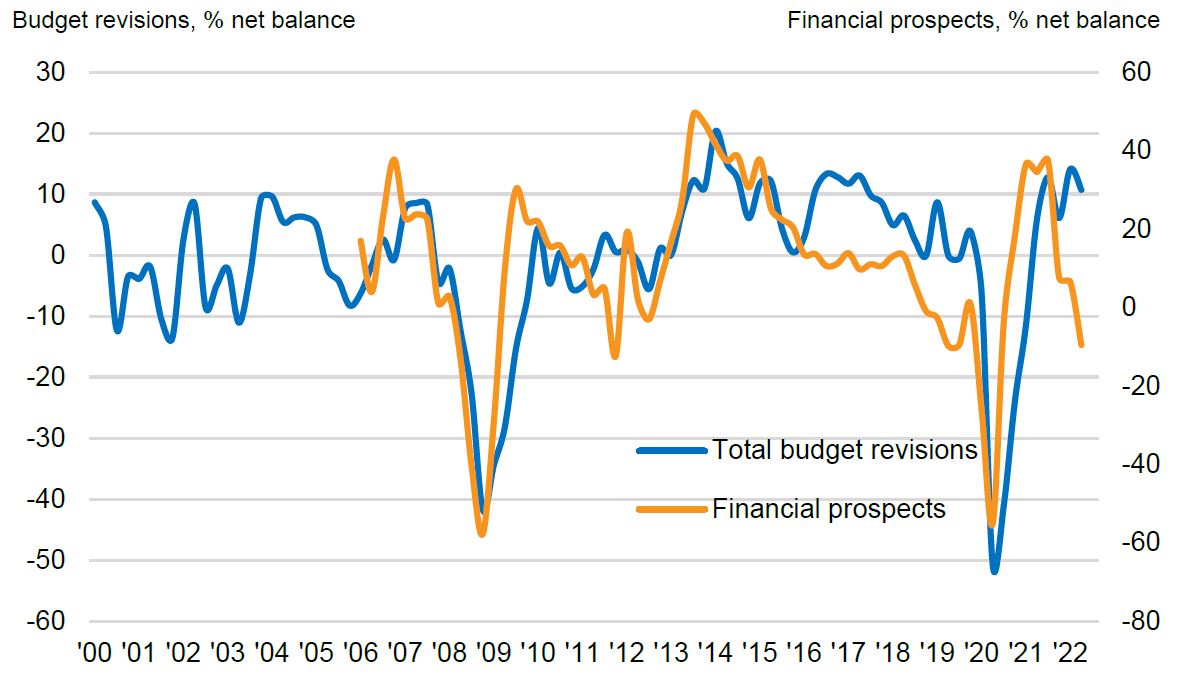

The latest quarterly IPA Bellwether report for Q2 2022 revealed financial prospects dropped sharply because of “growing economic headwinds”, while marketing budgets remained “resilient”.

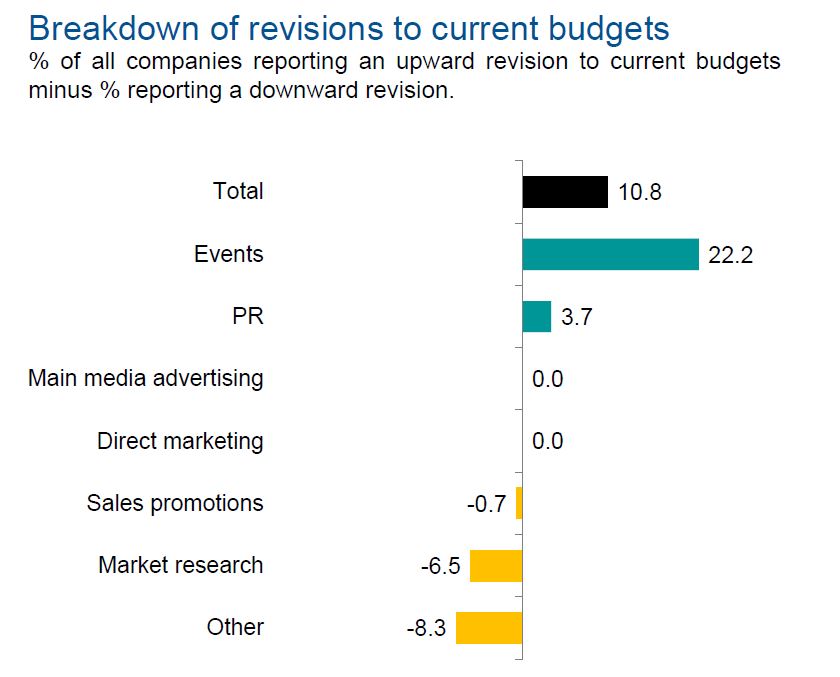

Total marketing budgets “continued to grow at a solid pace” registering a positive 10.8% net balance (compared to 14.1% last quarter), with 24.2% of surveyed companies raising total marketing spend, and 13.4% cutting their budgets.

However, a net balance of -26.7% of companies were “more pessimistic” about the financial outlook for the industry, down from -3.6% in Q1 2022, and “the most pessimistic outlook” since Q3 2020.

A net balance of -9.5% companies were pessimistic about their own company’s own financial prospects, down from 6.6% the previous quarter, the most “downbeat” in two years.

Matt Dailey, chief performance officer, Havas Media Group UK, told The Media Leader: “The overall picture is positive, with budget forecasts showing that the majority of brands are not going to try and “cut” through hard times, and that they seem to have learnt some lessons of the past and from their peers. That respondents are still very cautious about financial prospects is not a surprise, and is a sensible attitude to take considering the current context.”

Fears of recession and rising cost-of-living

The report said while a key source of optimism for panellists was a more confident outlook with regards to the pandemic with a return to face-to-face activities and interactions, there were concerns about the economic outlook with “fears of an imminent recession” driven by the rapidly rising cost-of-living’s impact on business and consumer spend, the ongoing war in Ukraine, supply-chain fragmentation, increased energy and transportation costs and higher interest rates deterring investment.

Not only that but skills shortages and rising wages were cited as “a challenge” for companies to overcome. To tackle this, businesses said they intended to upskill existing staff to help with productivity and retaining employees.

The report noted there were “numerous” businesses that signalled their intent to market aggressively, while others were also planning for challenges by positioning their businesses to “support customers through difficult times”, with the aim of gaining market share from less-prepared competitors.

Paul Bainsfair, IPA director general, described this approach as: “usually a wise and canny move.”

“All the IPA’s analysis on who does best in a downturn shows that the companies that recover fastest are the ones that either maintain or increase their marketing spend during difficult economic times,” Bainsfair said. “Equally, cutting ad budgets — relative to competitors’ spend — in a recession undermines companies’ ability to grow future market share and profits.”

Main media advertising and direct marketing ‘stagnant’

Events registered the biggest growth out of any sector with a net balance of 22.2%, while sales promotions, market research and other budgets declined (-0.7%, -6.5% and -8.3%).

Marketing budgets in main media advertising, including “big-ticket” advertising campaigns on TV, along with direct marketing were flat after a year of consecutive growth.

Within main media advertising, audio and out-of-home experienced deeper budget cuts and registered a net balance of -16.4% and -15.9% each, down from -8.5% and -4.6%.

Joe Hayes, senior economist at S&P Global Market Intelligence, said: “Amid a deteriorating economic outlook for UK businesses, sustained growth in total marketing activity is encouraging. However, the stagnation in main media marketing budgets is a disappointing result from the Q2 survey and suggests concerns around the outlook are weighing on decision making.

“Risks are clearly skewed to the downside as the intensifying cost of living crisis weighs on disposable incomes, while firms face difficult decisions regarding their spending at a time when their cost burdens continue to inflate.”

Published brands also shifted to negative territory with a net balance of -2.6% compared to 1.3% in Q1 2022.

Meanwhile, other online and video advertising were in positive territory with net balances of 4.4% and 0.8% respectively, a decrease from 18.6% and 9% last quarter.

Ian Daly, head of AV at Bountiful Cow, commented: “On the face of it, a 10.8% net increase in marketing budgets seems like a positive result, especially given the current circumstances. However, look deeper and media budgets are beginning to stagnate (0% net balance). Look deeper still and existing budgets are being re-weighted towards online.

“The shift towards online is no bad thing in and of itself, though it is symptomatic of a broader shift away from demand generating to demand harvesting media. Clearly, seeking efficiencies in the current climate makes sense for many businesses, but those chasing ROI today must be careful not to damage profitability tomorrow.”

Downgraded adspend forecasts for 2022- 2025

UK economic growth prospects and adspend forecasts were also downgraded amid building cost-of-living and inflation pressures and the “intensified” risk of recession.

The adspend forecast for 2022 was revised from 3.5% to 1.6% and GDP forecast for 2023 was cut from 1.2% to 0.5%, which in turn brought down the adspend forecast for 2023 down from 1.8% to 0.8%.

Looking further ahead, adspend forecasts for 2024, 2025 and 2026 were also “trimmed” respectively from 1.7% to 1.4%, from 2.2% to 2.0% and from 2.4% to 2.3%.

Havas Media’s Dailey added that the report reflect a “good mix of confidence and caution,” with marketers making sensible decisions.

“Continued investment in brand building, rather than knee-jerking to a short-term view by over reliance on sales promotions, shows that brands have an eye on future growth,” Dailey explained. “Moving out of traditional media (with the exception of TV), longer lead times, higher production budgets, and opting for online channels, offers greater flexibility and adaptability in terms of budgeting and messaging, in the face of a changing landscape.”

The Bellwether Report is researched and published by S&P Global on behalf of the IPA based on a survey of 300 UK marketers representing key business sectors mostly from the country’s top 1,000 companies.