Bronfman challenges Skydance for Paramount control

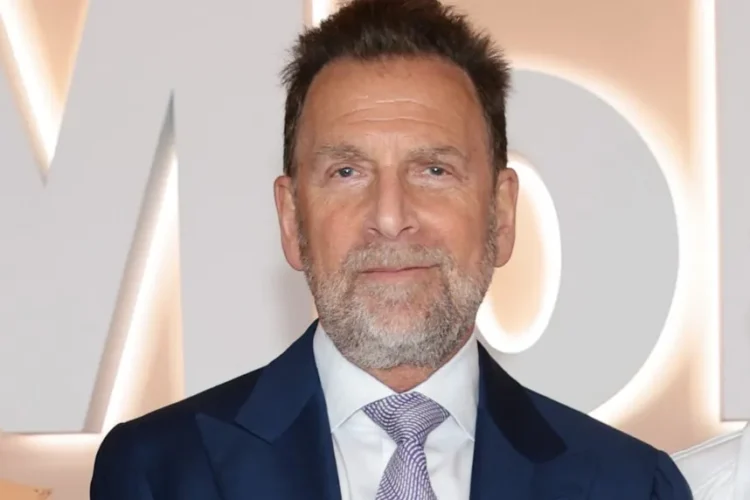

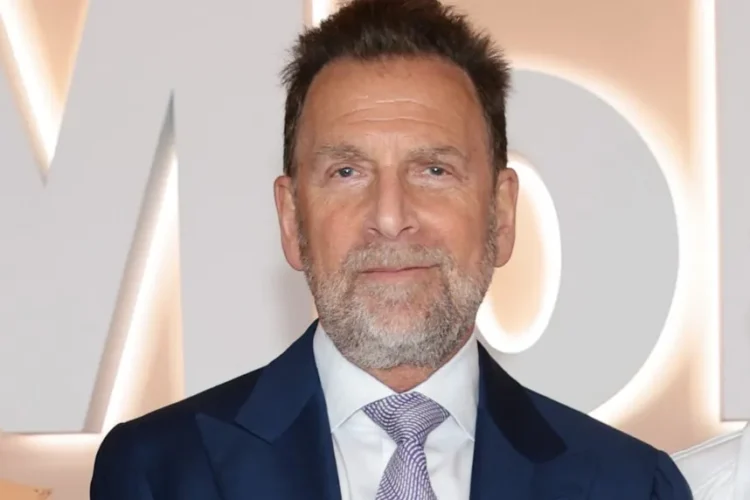

According to the Wall Street Journal, media executive Edgar Bronfman Jr. has formally submitted a $4.3 billion bid to acquire National Amusements, the controlling shareholder of Paramount, in a direct challenge to David Ellison’s company, Skydance Media.

Bronfman’s offer marks the latest twist in the effort to acquire Paramount, which owns CBS, cable networks Comedy Central and Nickelodeon, the Paramount+ streaming service and movie studio.

It includes a $1.75 billion equity valuation for National Amusements, matching Skydance’s bid, and a $1.5 billion investment in Paramount’s balance sheet, also mirroring Skydance’s commitment. Additionally, the bid includes a $400 million breakup fee to compensate Skydance should Paramount choose a different path.

Bronfman, who formerly ran Warner Music and liquor giant Seagram, has secured financing from high-net-worth individuals and family offices, said the Wall Street Journal. He’s also partnered with seasoned film producer Steven Paul, who previously expressed interest in National Amusements.

Last month, Skydance Media appeared poised to acquire Paramount after reaching an agreement with the Redstone family. The deal included a 45-day “go-shop” period, allowing Paramount to explore other offers. Until today, Skydance’s path seemed clear.

Bronfman’s bid, however, has dramatically changed the equation. While matching Skydance’s financial terms, Bronfman’s offer presents a stark contrast in terms of shareholder value. Unlike Skydance’s dilutive all-stock deal, Bronfman pledges to maintain existing shareholder equity.

The battle for Paramount is far from over. Skydance has the right to match or improve its offer, and Paramount’s special committee must decide whether Bronfman’s bid warrants extending the go-shop period. The coming days will be crucial for the future of Paramount.