CMA suggests Google has abused dominant positions in adtech

An investigation by the Competition & Markets Authority (CMA) provisionally ruled that Google has abused its dominant positions in open-display adtech, potentially harming “thousands” of UK publishers and advertisers.

In a statement of objections issued to Google on Friday, the CMA acknowledged that the vast majority of publishers and advertisers are using Google’s services to both buy and sell advertising space.

Notably, the CMA has expressed concern that Google is using anti-competitive practices to “preference” its own services and preventing others from operating on a level playing field.

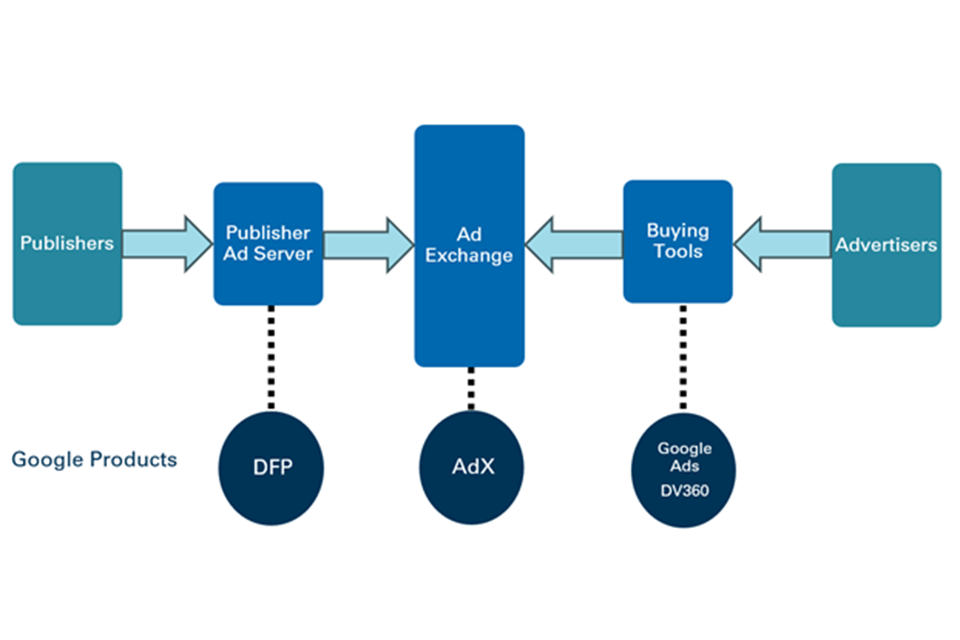

The investigation focused on Google’s role in three parts of the digital ad supply chain: the Google Ads and Display & Video 360 ad buying tools; the DoubleClick for Publishers ad server; and the AdX ad exchange.

It has provisionally found that, since at least 2015, Google has abused its dominant position in both its ad buying tools and its publisher ad server to strengthen AdX’s market position. The CMA also suggested that Google’s behaviour has prevented other publisher ad servers from competing effectively with DoubleClick for Publishers.

In other words, the CMA is alleging that Google not only owns the buy-side tools for advertisers, the sell-side tools for publishers and the ad exchange itself, but it has also abused its ownership of those products to its own benefit.

Google purchased DoubleClick, which owns DoubleClick for Publishers and AdX, for $3.1bn in 2007, almost double what it paid to buy YouTube a year earlier.

A 2019 digital advertising report by the CMA estimated annual spend on open-display ads at £1.8bn.

Under the new digital markets competition regime, passed in the wash-up period this summer through the Digital Markets, Competition and Consumers Act, the CMA may impose a financial penalty on any business found to have infringed upon competition laws of up to 10% of its annual global turnover.

‘Fair deal’

Juliette Enser, the CMA’s interim executive director of enforcement, said: “We’ve provisionally found that Google is using its market power to hinder competition when it comes to the ads people see on websites.

“Many businesses are able to keep their digital content free or cheaper by using online advertising to generate revenue. Adverts on these websites and apps reach millions of people across the UK — assisting the buying and selling of goods and services.

“That’s why it’s so important that publishers and advertisers — who enable this free content — can benefit from effective competition and get a fair deal when buying or selling digital advertising space.”

Dan Taylor, vice-president of global ads at Google, told The Media Leader: “Our advertising technology tools help websites and apps fund their content and enable businesses of all sizes to effectively reach new customers. Google remains committed to creating value for our publisher and advertiser partners in this highly competitive sector.

“The core of this case rests on flawed interpretations of the adtech sector. We disagree with the CMA’s view and we will respond accordingly.”

CMA urged to move against Google following US antitrust decision

Publishing leaders had previously urged the CMA to move swiftly against Google.

In reaction to the latest news, News Media Association CEO Owen Meredith said in a statement: “The Competition & Markets Authority’s provisional findings today state explicitly that Google’s self-preferencing of its own ad exchange causes harm to advertisers and publishers, and in turn consumers.

“In order to tackle these damaging impacts on our creative sectors, we need the new digital markets regulator to start its work investigating the large tech platforms as quickly as possible, with Google Search and Google adtech as top priorities for designation.

“Robust conduct requirements will be critical to the success of the regime and the Digital Markets Unit should be able to use pro-competitive interventions where needed. By levelling the playing field, we can create a digital economy for the UK which fosters genuine competition, powering growth in these critical markets.”

On the other hand, Paul Bainsfair, director-general of the IPA, stated that the CMA’s decision was in fact harmful to its own members.

He said: “Noting they are provisional, the CMA’s findings… are at odds with the best interests of our members and the advertisers they operate on behalf of.

“As the CMA has said, they will now decide what they deem may be required to ensure these anti-competitive practices cease; and what final representations from Google are made before they reach their final decision. We shall continue to monitor this closely.”

In a separate statement, Phil Smith, director-general of Isba, added: “The £2bn programmatic sector of the open web, digital advertising market is characterised by its multiple actors and supply chain complexity, and can be extraordinarily difficult to navigate.

“Isba has sought to help our members find their way via the publication of our Financial Audit Toolkit and with our Programmatic Supply Chain Transparency Studies, published alongside PwC in 2020 and 2023. These have enabled our members to achieve greater clarity and control, and improve the effectiveness of their spending.

“As those studies demonstrated and as the CMA has reaffirmed, Google is indisputably the biggest actor in the sector. We hope that the findings of the CMA’s investigation will add to our overall understanding of this system and enable advertisers to navigate its complexities with even greater confidence.”

Keep an eye on next week’s US trial

The decision from the CMA comes days before Google is set to go to court against the US Department of Justice (DOJ) in its second antitrust trial this year.

The DOJ has similarly alleged Google illegally monopolised the adtech market in violation of US antitrust laws.

That lawsuit is separate from another antitrust case, launched in 2020, that accused Google of illegally monopolising the search engine market. Last month, a federal judge found that Google was in breach of antitrust law for maintaining a search monopoly.

The DOJ is currently considering options on how to punish the tech giant, including potentially breaking up the company. However, media analyst Alex DeGroote has called this outcome “very unlikely”.

In the meantime, the legal finding has opened Google up to further potential legal action. Last month, competitor Yelp accused the tech giant of abusing its dominant position in the search engine market to stifle competition and harm consumers.

The EU has also previously investigated Google’s adtech practices and has already fined Google more than €8bn since 2021 over various anti-competitive practices.

Last summer, it found the company to be in breach of its antitrust rules and preliminarily argued that “only the mandatory divestment by Google of part of its [adtech] services would address its competition concerns”.