Comcast Ads president: Uneven measurement standards create an ‘existential’ challenge for TV

The Future of TV Advertising Global 2025

“We cannot be held to the legacy standards”.

In an interview at The Future of TV Advertising Global event in London on Tuesday, Comcast Advertising president James Rooke explained that as TV becomes easier to buy for small- and medium-sized enterprises (SMEs), the standards by which TV advertising is measured must adapt.

“We are not integrating Universal Ads into Comscore, Nielsen or Videoamp,” he said, referring to Comcast’s cross-industry ad solution aimed at making TV buying as simple as social media buying.

Universal Ads launched in beta in the US at the beginning of the year, and Rooke indicated Comcast Ads will move the project into general release “in the new year”. In the UK, a similar unnamed project is also set to launch in 2026.

Reflecting on the beta, Rooke explained that “Instagram advertisers” have pushed Comcast to work with “incrementality providers” rather than more traditional joint-industry currencies (JICs) in their requests for measurement.

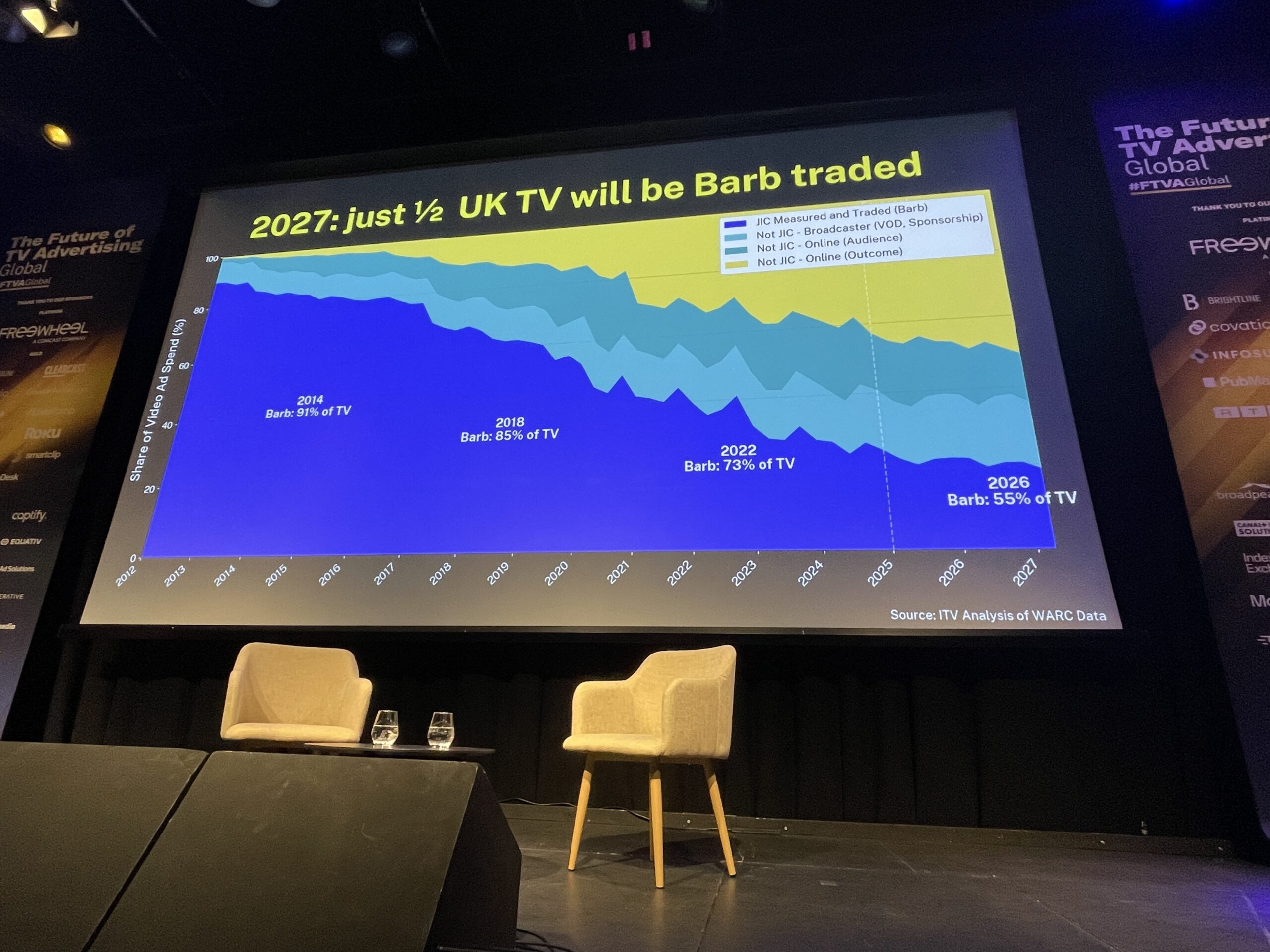

As ITV measurement innovation lead Sameer Modha highlighted elsewhere at the conference, the move away from JIC-backed measurement is an industry wide phenomenon. According to Warc data, in 2022, 95% of UK media spend was on JIC-measured channels. This declined to 69% in 2010 and just 16% in 2024.

TV hasn’t been spared this trend. By 2027, Modha predicted, just half of UK TV buying will be Barb-traded.

As Rooke explained, incrementality providers examine the incremental contribution of the likes of Meta, YouTube, Reddit and Universal Ads to a given media plan. “What is really exciting is the premium video ecosystem is showing up incredibly well in terms of the incremental impact it’s having on outcomes,” Rooke said.

“When it’s an apples-to-apples comparison of Universal Ads, which is really a proxy for the premium video ecosystem, relative to Meta or YouTube or others, performance is outstanding,” he continued. “Why? Because it’s a level playing field.”

An ‘existential’ crisis of measurement

While Rooke expressed bullishness about TV’s ability to prove its value to marketers, he spent most of his conversation with Lebbon lamenting that “the situation has got worse” in 2025, with ad budgets shifting away from TV toward tech platforms.

“If you take a big step back and look at where the growth is going, all the big media companies are competing in a shrinking pie,” he said. Amazon, Netflix and other streaming giants have created new ad-supported supply — “more supply for a shrinking pie of money” when the majority of growth is going to social video.

He argued that advertisers are still not holding platforms to the same standards as they hold traditional media to, particularly in measurement and transparency.

“What that creates is an environment where every single day, the [traditional] media companies start the racing day 30 metres behind the start line,” he said. “And because of that, the situation is getting worse, and it’s a vicious cycle.”

He warned that this has created an “existential” issue if the measurement “playing field” can’t be levelled. This is especially an issue in the US market, which Rooke referred to as a “hot mess […] that is going to get hotter”.

“What’s happening in the US is the undercounting of audiences so significantly that there are a number of broadcasters that are in real trouble based on the size of the audiences they’ve got,” Rooke alleged.

While broadcasters and advertisers can seek a “second or third source of truth” for TV measurement, Rooke warned “the other guys are playing by a different set of rules” in which they “can increasingly be more opaque and more black box”.

A path through the ‘Valley of Death’

That assessment did not stop Rooke from giving due credit to the platforms for two key things: simplifying their buying processes and providing always-on outcome measurement.

“It’s not that they’ve got a better core product per se,” Rooke argued, noting that agency buyers often privately express they are aware there’s a “massive overallocation” to the platforms because of their ease and speed of use and outcomes-based measurement.

“It’s not actually in the interest of an agency or brand to put more money into a single player,” he said. “They know there’s quality issues, they know there’s opaqueness.”

While buyers may be looking for a viable alternative, “unless it can be accessed at the press of a button, at scale, and unless they can get always-on outcomes delivered to them,” then other differentiating qualities of TV (a premium, high-attention, brand-safe environment) “don’t matter enough”.

Likening the current market to the “Valley of Death”, Rooke said there is yet hope for the TV industry, even as he admitted more consolidation is a certainty next year due to the aforementioned headwinds in the ad market.

“The challenge for the industry: solve the complexity issue, solve the outcomes issue. Which are both solvable,” he said. “And suddenly, what happens is the differentiators that are authentic to the world that we operate in start to become real differentiators again.”

He concluded that the TV industry must work together to “solve the easy button” to have a “legitimate path to go on offence”.