Covid recovery one year on: growth gulf widens for agency groups

Analysis

A year after Covid-19 lockdown restrictions lifted across most of the world’s major economies, the major media and ad agency networks are beginning to show markedly differing rates of growth.

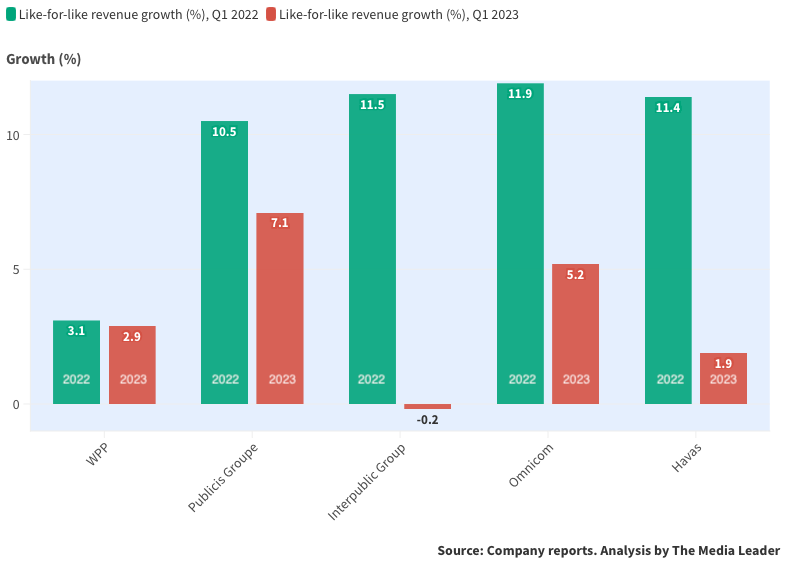

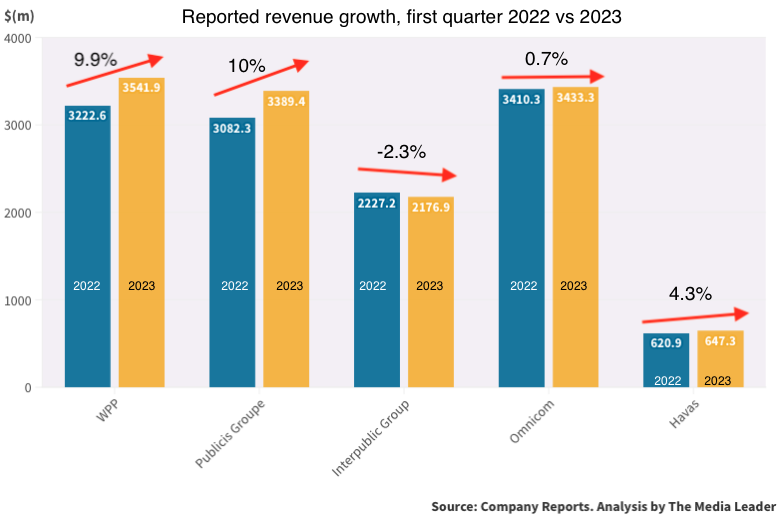

The spread of revenue growth reported by the agency holding companies this week ranged between slightly negative (Interpublic Group, -0.2%), and robust (Publicis Groupe, 7.1%). Vivendi-owned Havas posted 3.5% organic revenue growth to €588m ($645m) and WPP grew 2.9% on a like-for-like basis to £2.83bn ($3.53bn).

Meanwhile Omnicom Group only provided gross revenue ($3.43bn) rather than net revenue organic growth, which it reported as up by 5.2% for the first quarter of 2023.

Dentsu, the owner of media agencies Carat, iProspect and DentsuX, could not be compared as it has scheduled its first-quarter financial report for 15 May.

With the exception of WPP, all of major agency groups’ like-for-like growth rates are significantly down on the same period in 2022, when the global ad market was recovering from the economic shock of the pandemic.

Most of the agency groups upheld their previous full-year guidance forecast of between 3% and 5% growth.

Brian Wieser, ex-GroupM global president of business intelligence and founder of consultancy Madison & Wall, described in his newsletter how these earnings results were positive given “difficult comparables”.

“Of course, media was responsible for a disproportionate share of growth, while references to creative agencies generally conveyed persistent weakness,” Wieser said. He also highlighted “particularly favourable” Europe results for all of the holdcos given concerns about “greater economic weakness”.

On such regional differences, media and martech analyst Ian Whittaker highlighted WPP’s “greater weighting” to China and India than other groups, which may have “dragged down group organic revenue”.

Digital-focussed acquisitions

Over the last quarter, WPP acquired influencer marketing companies Obviously and Goat, as well as 3K Communication, a healthcare PR agency in Germany.

Since February 2022, as part of its “accelerated growth” strategy, WPP has also acquired Village Marketing, Fēnom Digital, Diff, Passport, JeffreyGroup and Newcraft. These companies specialise in influencer marketing agencies, digital transformation, commerce, creative and design, communications and ecommerce consulting.

In its quarterly report, Publicis announced the acquisition of Yieldify, Advertise BG, and Practia.

Yieldify is a London-based marketing technology company which will become part of Epsilon. Advertise BG is a leading performance marketing agency in Bulgaria. Practica is based in Buenos Aires and is an independent technology company offering digital business transformation services which will position Publicis Sapient to enter the Latin America market.

In 2022, Publicis finalised the acquisitions of six companies; Tremend, Profitero, Wiredcraft, Changi Consulting and Retargetly. These ranged from software engineering, software as a service ecommerce intelligence, digital product consultancy and technology, digital transformation, cloud solutions and data and tech companies from Bucharest to Latin America.

Havas has acquired two new digital-focussed international agencies in this most recent quarter; HRZN, a German social media and content agency, and Noise Digital, a Vancouver-based media performance and data analytics agency.

Last year, Havas pursued what Vivendi called “an aggressive external growth policy” that led to the acquisition of eight majority interests, the most since 2015.

These included: Bastion Brands, Expert Edge, Additive+, Search Laboratory, Front Networks, Frontier Australia, Inviqa and Tinkle. These companies spanned health communication, media performance, data-driven creation, digital media, creative, performance marketing, and strategic communication from Australia to the UK, China, and Spain.

The other network agencies have not listed specific acquisitions in their quarterly results.

At-a-glance: what the leaders said

Mark Read, WPP CEO, said: “Our focus on AI over the last five years is paying off, with many examples of our work with clients, using the main AI platforms, in-market today.”

Arthur Sadoun, chairman and CEO of Publicis Groupe, highlighted strong performance from its tech-focussed entities Epsilon and Publicis Sapient, alongside its differentiated model growing market share.

Vivendi, the parent company for Havas Media Group, said it had “strong commercial momentum”, “significant budget gains and the continuation of targeted acquisitions”.

John Wren, Omnicom Group chairman and CEO, said: “Despite many macroeconomic, technological and social factors facing our clients, Omnicom is guiding the world’s top companies and their brands to continued growth with highly-specialized marketing and communications services driven by leading analytics, creativity, data, and digital media solutions.”

In a similar vein, Philippe Krakowsky, CEO of IPG, said the company’s “substantial multi-year growth” in media, healthcare and data-informed practices had continued to “perform well”, but that this strong growth was offset by “certain areas of softness”, notably among marketers in the technology sector, which led to the slight decline in first quarter organic revenue.