IPA Bellwether: 'Defensive and offensive' tactics drive media spend rebound

Brands are shifting budgets from sales promotion to main media marketing in both “a defensive and offensive manoeuvre” to strengthen their current and future market positions, according to the latest IPA Bellwether report.

The quaterly report, which surveys marketers’ confidence and media spend decisions, revealed main media marketing was the strongest-performing category in terms of budget growth in the last quarter as brands were aiming to reinforce their positioning in the market and gain more market share before an anticipated persistent economic downturn.

Main media advertising includes video (TV, cinema and/or online), audio (radio and any other audio), published brands (print or online), out-of-home (OOH) and any other online advertising.

Overall a net balance of 7.4% of companies surveyed in the report increased their spend in this area, growing from a -2.5% net balance last quarter, “the strongest pace” of growth for the category since Q1 2021.

Specifically, other online recorded a net balance of 9.1% upping spend, video 0.9%, published brands 0.8%, audio -10.8% and out-of-home -12.1%. This is compared to other online net balance growth of 8.3% last quarter, video 3.2%, published brands -5.0%, audio -8.0% and -7.1%.

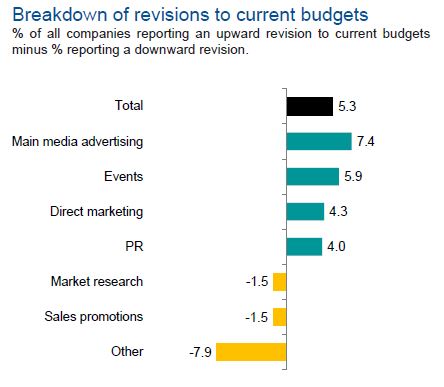

Other categories which saw budget growth included events (net balance of 5.9%), direct marketing (4.3%) and public relations (4.0%).

This is in significant contrast to the previous two quarters where more companies were shifting budgets to sales promotion activity as a response to the cost-of-living crisis and high inflation rates. Quarter-on-quarter, this category went from a net balance of 13.4% to -1.5%.

A move away from short-termism?

The report described another quarter of total marketing budget growth but qualified this was moderated by “persistent inflationary pressures, further increases in borrowing costs and a subsequent deterioration in the UK economic outlook”.

Out of those companies surveyed, 21.1% said they would be increasing spending in the three months to October, 15.8% said they would reduce budgets, resulting in a net balance of 5.3%. This is the weakest quarter for total marketing budget growth since Q4 2022.

On this, Elliott Millard, chief strategy and planning officer at Wavemaker, told The Media Leader: “While it’s reassuring to see marketers move away from what felt like short-termism in the last Bellwether report, what the data shows is that around half the industry are yet to make their mind up about the financial future. What that means is that whilst some of the industry have placed bets on lowering or increasing spend, the majority are hedging and in stasis.”

He said this “represents opportunity” to see which course is correct and spot the times when brands can diverge from the norm, which was “doubly true” in a world where data availability is universal and agility is considered the norm. Millard said “the risk of the middle ground” was increasing, so reviewing businesses and what levers can be pulled “is likely to pay back”.

He added: “What is also interesting is the fact that advertising investment is up and promo investment is down. This suggests that brands believe there is a need to leverage advertising to protect price as they are more limited (due to cost inflation across the supply chain) in what they can do with pricing/promos. In layman’s terms — products and services are going to get more expensive, so they try to use more advertising to improve price elasticity.”

Meanwhile Ian Daly, head of AV investment at the7stars, highlighted the net balance of media budgets being revised up was “a sign” of marketers heeding advice of advertising manuals during difficult economic times.

Media budgets were being revised up by 16.1% of surveyed marketers, and Daly said he knew who his “money will be on” on which advertisers will be the winners or losers approaching “the most competitive quarter of the year”.

He added: “Despite the swing in media budgets, total marketing budgets have remained more stable in 2023 than in the last four years. This confirms predictions made earlier this year that marketers would settle and acclimatise to the new socio and macro-economic environment. Again, another nod to sensible operating, guided most likely by the advertising literature.”

Commenting on the latest survey, Paul Bainsfair, IPA director-general, said: “This quarter, those companies that can are heeding the evidence that in general, investing more in main media will help to steady them through the uncertain times and help to ensure the longer term health and profitability of their brands. Crucially, they — alongside the many investment analysts we have also recently surveyed — are recognising that marketing spend is indeed an investment not a cost.”

This last point was highlighted in the recent IPA/Brand Investment Analyst Survey which found 37% of financial analyst respondents saw advertising as an investment, 24% as an operating cost and 38% as a combination of both.

Joe Hayes, principal economist at S&P Global Market Intelligence, added: “As storm clouds gather over the UK economy, it’s encouraging to see total marketing budgets hold firm in expansion territory. We saw last quarter that firms had become concerned by persistence of the cost-of-living crisis, which drove a record rise in sales promotions spending.

“In the latest quarter, however, firms have gone back to brand-building, with anecdotal evidence suggesting that this move has been made both defensively and offensively. With demand conditions coming under pressure, companies will have to position themselves strongly to stand out from their competitors.”

Opportunities and threats

The IPA report found that most Bellwether companies are concerned with the macroeconomic outlook in the UK over the next 12 months. Companies are anticipating reduced client activity levels and, in some cases, forced closure of businesses as a result of cost pressures. Some are also concerned with increased competition as consumers’ discretionary spending gets squeezed.

A separate report released yesterday by media and marketing consultancy MediaLink found that 74% of senior and executive global marketing leaders are pessimistic about the growth prospects in the year ahead. However, 45% agree there’s been too much of a focus on short-term wins, implying a substantial proportion of marketers are looking to invest through the downturn.

Many IPA respondents appeared to agree, with some seeing the macroeconomic environment as an opportunity to capitalise on struggling competitors and grow market share, especially by deploying marketing tools to “protect their brands and encourage customers to stay loyal,” according to the report.

A net balance of +5.2% of companies reported stronger sentiment than three months ago, reflecting modest optimism about their individual business prospects, an improvement over last quarter when a net balance of +2.6% was more positive. In contrast, the industry-wide outlook remained negative, with the proportion of respondents who were downbeat towards the outlook for their sector (24.9%) more than doubling the proportion who were positive (12.1%), a near-identical net balance compared to the previous quarter (-12.7% compared to -12.6% in Q2).

Concerns over the state of the economy come as the Bellwether has downwardly revised its 2024 growth forecast from 0.4% to -0.1%. The Bellwether’s 2023 estimate remains unchanged, however, at 0.3% expected growth.

The report called the 2023-2024 growth outlook “lacklustre” and said it expects the UK economy to endure a “shallow recession” over this period. Subsequently, it now expects contractions in adspend of -0.6% and -0.4% in 2023 and 2024, respectively.

“It won’t be until 2025 that we anticipate adspend will grow again in real terms,” the report reads.