Disney bets on sports for streaming growth while ITVX deal is ‘off to a slow start’

Disney+’s content-swap partnership with ITVX is failing to drive substantial incremental audience reach for either broadcaster at this early stage.

As Enders Analysis head of television Tom Harrington said, the deal is “off to a slow start”, with current reach and viewing figures “relatively small”.

Citing Barb and AdvantEdge data, Harrington noted that in the first two weeks since the arrangement went live, roughly 100,000 households watched ITVX programming on Disney+, while 60,000 watched Disney+ content on ITVX.

“This means that fewer than 1% of those that used each of these platforms engaged with the ‘A Taste Of…’ content,” he pointed out, adding: “It is early days and this arrangement is probably more interesting as evidence of a positive intention from both parties to collaborate increasingly in the future.”

In search of reach and lower churn

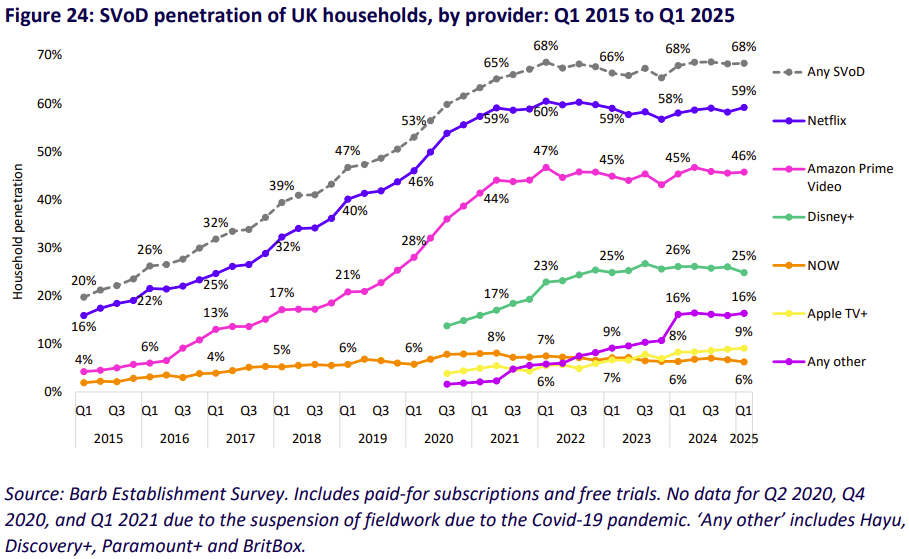

The hunt for incremental reach is key to Disney’s growth, particularly as subscription VOD (SVOD) uptake has broadly plateaued over the past several years. As Ofcom’s recent Media Nations report found, the proportion of UK households receiving any SVOD service has remained at the same level since 2021.

Since launching in the UK in 2020, Disney+ has remained the third-most-subscribed streaming service with 25% penetration, behind Netflix (59%) and Amazon Prime Video (46%).

“The streaming market has become quite settled,” said Harrington. “In terms of revenues, over the past year around half of Disney’s streaming growth has been driven by an increase in subscribers and half as a result of price rises.”

In its fiscal Q3 earnings, the entertainment giant reported total revenue growth of 2% to $23.7bn. Under its entertainment segment, while its linear TV business saw revenue fall by 15% to $2.3bn, direct-to-consumer (DTC) revenue, inclusive of streaming services Disney+ and Hulu, grew 6% to $6.2m.

Harrington noted that Disney’s streaming business is outpacing “the somewhat predictable decline” of its linear business.

Total streaming subscribers grew by 2.6m quarter on quarter across Disney+ and Hulu to 183m.

Following Disney’s purchase of full control of Hulu from Comcast earlier in the summer, that platform is being merged with Disney+. Internationally, Hulu will replace Star as a tile on Disney+ and Hulu’s existence as a standalone app will wind down next year.

“Hulu will become our global general entertainment brand,” CEO Bob Iger declared on Disney’s earnings call.

Mike Proulx, vice-president, research director, at Forrester, called the consolidation an obvious “cost-savings measure” aimed at reducing “operational redundancies” and helping make Disney’s DTC business more profitable.

But Iger also pointed out that integrating Hulu with Disney+ will “end up with a far better consumer experience”, which Disney hopes will lower subscription churn.

Further, although Disney’s ad sales team already sells Disney+ and Hulu together, according to Iger the move will “give our sales organisation the ability to package them far more effectively than they have before”.

Notably, the entertainment giant also announced it will follow in Netflix’s footsteps by no longer reporting subscriber numbers beginning in its fiscal Q1 2026 earnings.

The reduction in transparency over major streaming businesses has alarmed analysts such as Ian Whittaker, who argued in a post on LinkedIn that “subscribers and ARPU [average revenue per user] are not secondary metrics, they are core to understanding the business. If there is no visibility on the numbers, it is hard to fully understand what is going on.”

Proulx nevertheless called the move “unsurprising”, adding: “While the company will continue to report financial numbers, subscriber growth is a key comparative indicator on user behaviour which the markets will no longer have access to.”

Can sport deliver growth?

Sport is being considered one way to “invigorate the relationships that users have with [Disney’s] services”, according to Harrington.

Disney’s ESPN is launching a new streaming service in the US on 21 August, with initial pricing at $29.99 per month. It follows the confirmation of a deal between the broadcaster and NFL, with the league taking a 10% stake in ESPN in exchange for control of NFL Network and other media properties. The streaming service will also carry live events for WWE beginning next year.

Iger called ESPN’s multiple deals with the NFL “one of the most important steps” for the broadcaster since it went from broadcasting a half-season to a full season of the NFL in 1987.

However, as sports writer Mike Florio pointed out, the deal requires federal regulatory approval, providing US president Donald Trump with potential leverage over both the NFL and Disney, the latter of which also owns ABC News, which recently settled a defamation case brought by Trump that was widely considered frivolous.

Apart from the ESPN-NFL tie-up, Disney announced that it would be offering Saturday La Liga matches in the UK and Ireland to Disney+ subscribers beginning later this month.

Harrington said ESPN’s new service is “attractively priced”, especially when bundled with Disney+ and Hulu’s ad tiers ($35.99 per month). US sports fans will be able to access the full suite of ESPN channels alongside enhancements such as “multi-view” channel watching, personalisation options and integrated stats, betting, fantasy sports and commerce.

While initial consumer reaction to the service has yet to be seen, for Harrington, the closer relationship with the NFL — “the owner of the content asset that increasingly dominates live television” — bodes well, as does the possibility that ESPN “will control the official NFL fantasy game”.

Proulx agreed, expecting the forthcoming ESPN streaming service to provide “a notable lift in revenue”.

“Disney is prioritising programming with the highest ad revenue potential,” he said. “This is yet another signal that the latest battle in the streaming war is all about live sports programming.”

ITVX and Disney+ content-sharing deal to bring strong co-promotion opportunities