Isba: Advertisers’ media budgets shift toward brand building

Media budgets are expected to grow “confidently” in 2026, with UK marketers signalling a shift back to brand investment to rebalance years of performance-driven focus.

That is one of the takeaways of this year’s 2026 Media Budgets Survey, conducted by Isba in partnership with Ebiquity and the World Federation of Advertisers (WFA).

The survey found that 65% of UK marketers plan to ‘slightly’ or ‘significantly’ increase their media budget next year, compared to just 10% who said they would ‘slightly’ or ‘significantly’ decrease it.

While a plurality (49%) of UK marketers said they intend to maintain their current media mix, more than one-third (37%) said they will increase their share of brand advertising investment, compared to just 14% that said they would increase their performance budget.

Several global survey respondents noted that current budgets are “unbalanced” in favour of performance marketing, highlighting a need to “increasingly support a balanced mix” or otherwise “keep to 60-40 principles”.

Reflecting on the positive reported growth in media budgets for 2026, WFA CEO Stephan Loerke said: “We can be encouraged by the cautious confidence shown” in the report, especially given the macroeconomic pressures throughout 2025.

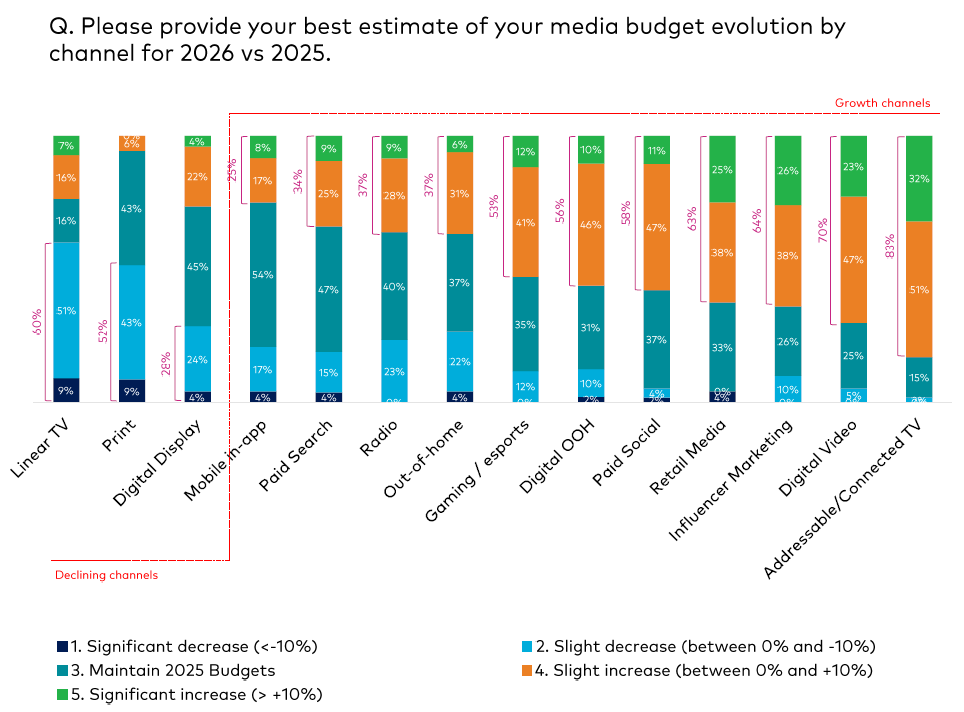

Breaking expected media spend down by channel reveals that marketers are increasingly favouring connected TV, digital video, influencer marketing, retail media, paid social and gaming.

OOH (including DOOH), radio and paid search are likewise viewed as growth channels, albeit marginally.

In contrast, linear TV, print and digital display were all evidenced to be channels with anticipated declines in media budgets in 2026. Globally, the UK is expecting the second-highest decrease in linear TV spending, after Germany, according to the survey.

“UK marketers are demonstrating confidence in their budgets for 2026, with a strong shift back to brand-building and investment in impactful channels like Connected TV,” commented Ebiquity UK and Ireland MD Michelle Morgado. She added that the findings “highlight an opportunity to prioritise strategic alignment and long-term growth”.

In addition, the survey asked marketers how they intend to evolve the agency remuneration model next year. In the UK, 23% of marketers expect to move toward some form of outcomes-based pricing.

“As UK marketers adopt varied pricing approaches, the focus must remain on aligning agency partnerships with business outcomes,” Morgado added, noting that in her opinion, “outcome-based models can help ensure accountability while fostering efficiency and collaboration in a competitive, tech-driven environment.”

The 2026 Media Budgets Survey study included responses from 518 marketers globally, including 60 based in the UK, with UK respondents collectively representing over £2.9bn in advertising investment.