Les Binet: Big Tech moving away from simplistic attribution

Big Tech companies are adding econometrics and modelling to “provide a more balanced point of view” and move away from simplistic digital attribution.

That’s according to Les Binet, global head of effectiveness at ad agency Adam&eveDDB, who has outlined two main reasons why econometrics is more important now than ever in new IPA research.

Econometrics refers to the study and application of statistical methods to economic data.

In the introduction to Econometrics and the C-suite – evidence-based decision-making for business, Binet argued rising inflation rates and growing “disenchantment” with digital evaluation techniques are two factors behind why econometrics has “new relevance” for those wanting to make marketing “more accountable, more effective and more profitable”.

“The economy is no longer a gentle escalator — it’s a roller coaster. Ratcheting interest rates mean investors increasingly want profits not purpose and they want them now,” explained Binet.

“Rising inflation means analysing the impact of price is firmly back on the marketing agenda. Econometrics is the perfect tool for this new environment, allowing you to measure set prices and fine tune marketing plans to maximise profit. No other research tool can do those jobs as effectively.”

He added that increasingly “smart firms”, even including the likes of Big Tech companies, are adding econometrics and modelling to “provide a more balanced point of view” and move away from simplistic digital attribution.

“Insiders at both Google and Meta say that they are tilting away from simplistic digital attribution towards more sophisticated econometric analysis. And if the world’s most influential tech firms think econometrics is the way forward, it’s probably worth a look, isn’t it?” said Binet.

Over five chapters in the paper, other experts argued for the importance of econometrics in explaining the past and predicting possible futures, assessing the impact of outside world factors and previous company choices on business outcomes, quantifying the incremental contribution of marketing and media activities, and building up the industry’s effectiveness knowledge. As well as how AI can make the use of the methodology quicker, easier and more accessible.

Laurence Green, director of effectiveness at the IPA, said the publication sought to address a “planning gap” between econometrics as a proven discipline in advertising and communications and its value as a predictive tool across the wider business from pricing, distribution, portfolio management to budgeting.

Binet concluded: “[T]he ultimate goal, for commercial firms at least, is always the same: to generate incremental financial value. This is where the value of econometrics lies, it enables us to identify the effect each variable has on sales and profit, even when everything varies at once. ”

How do financial analysts see marketing impact on company value?

In more research debuted at the IPA Global Effworks conference this week, the IPA/Brand Investment Analyst Survey surveyed 200 financial analysts looking at publicly listed companies in the UK and US.

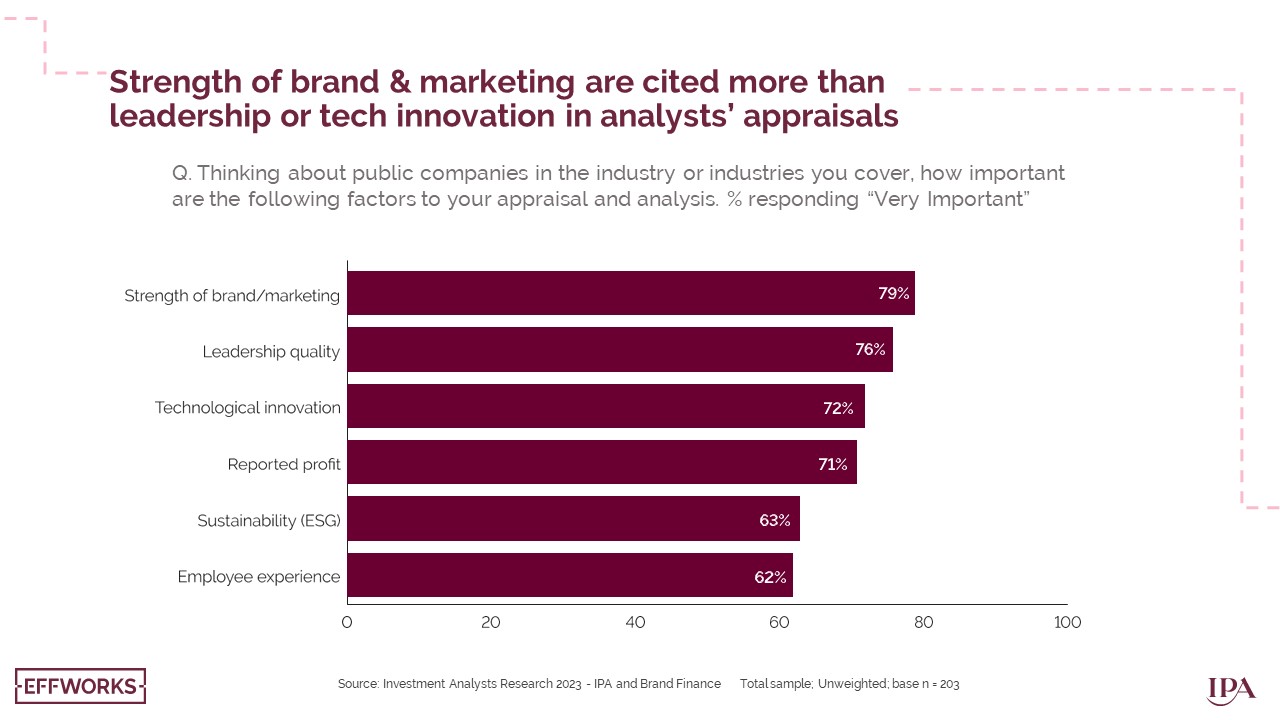

This analysis was completed by and founder and managing director of Liberty Sky Advisors, Ian Whittaker, who found “strength of brand/marketing” was most frequently cited as an important factor by analysts (79%) when asked how they appraise and analyse the companies they cover.

This was followed by leadership quality (76%) and technological innovation (72%).

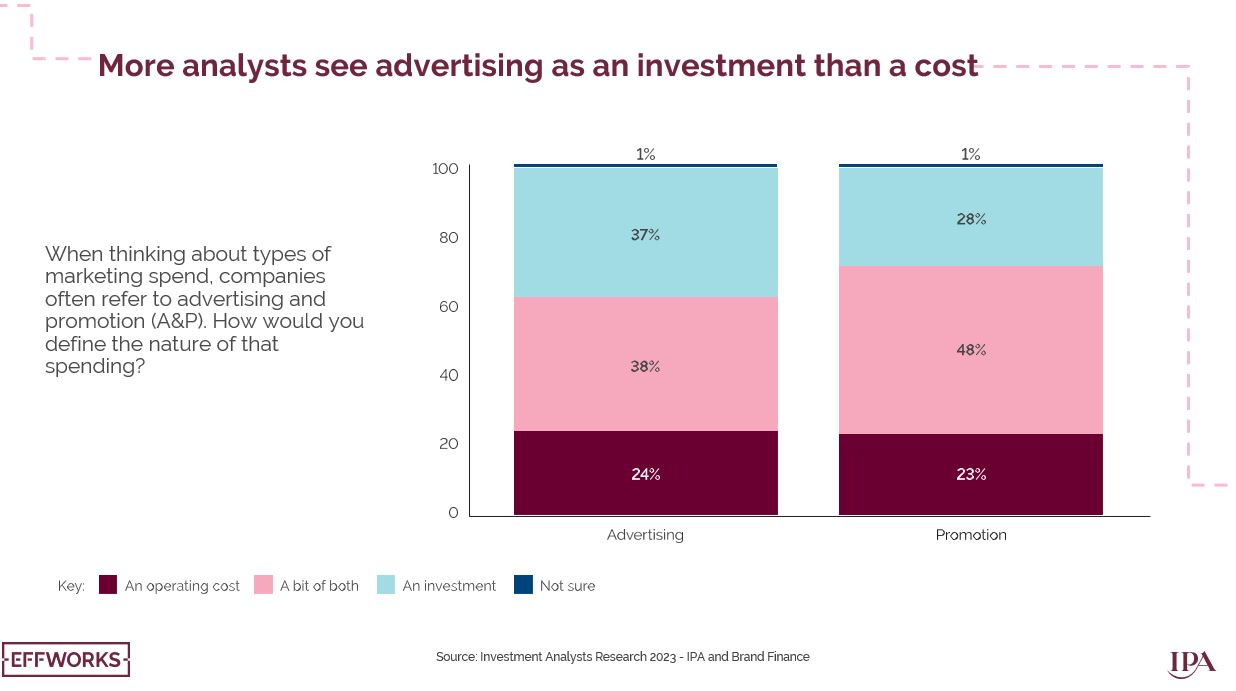

Meanwhile, 37% of respondents saw advertising as an investment, 24% as an operating cost and 38% as a combination of both.

This changed for promotion as 28% saw it as an investment, 23% as an operating cost and 48% a bit of both.

The survey found analysts who examined both advertising and promotions were “significantly more likely” to believe marketing is an investment and that it drives organic growth.

More than three-quarters of those surveyed saw marketing contributing most to “profit margins” (77%) and “sales volume” (71%) compared to “sales price” (54%) and “share price” (44%).

Two-thirds of analysts said they wanted to changes on how “intangible assets” as a a whole are reported and accounted for.

As a result, Whittaker made recommendations to marketers, some of which included that marketers needed to make the argument that marketing is more an investment than a cost, provide “more information” to the investment community on marketing spend and educate analysts over the link between marketing and price premium and other long-term levers.

Green said this survey was “welcome news” investors are placing increasing interest and importance on investment in brands.

He added: “To facilitate this and to improve understanding, it is incumbent on brand owners to provide the relevant data and evidence to investors, and to engage with them using their language in order to make the most compelling case for marketing as a long-term investment.”