A lack of audience measurement and mistrust in data reported for podcasts is holding back spend in the medium despite overwhelming interest from advertisers.

That’s according to an Adwanted Audio survey of the trends and challenges in podcast advertising as seen by UK media agencies’ planners and buyers.

It found that more than three in four clients were asking media agencies about podcasts (86%) and the majority of agencies (94%) currently buy podcast airtime.

Over half (55%) buy podcasts at a vertical level and under half (45%) at a show level. Podcasts were also mostly bought with other media sectors (69%) or other audio (27%), and rarely the only media included on a plan (4%).

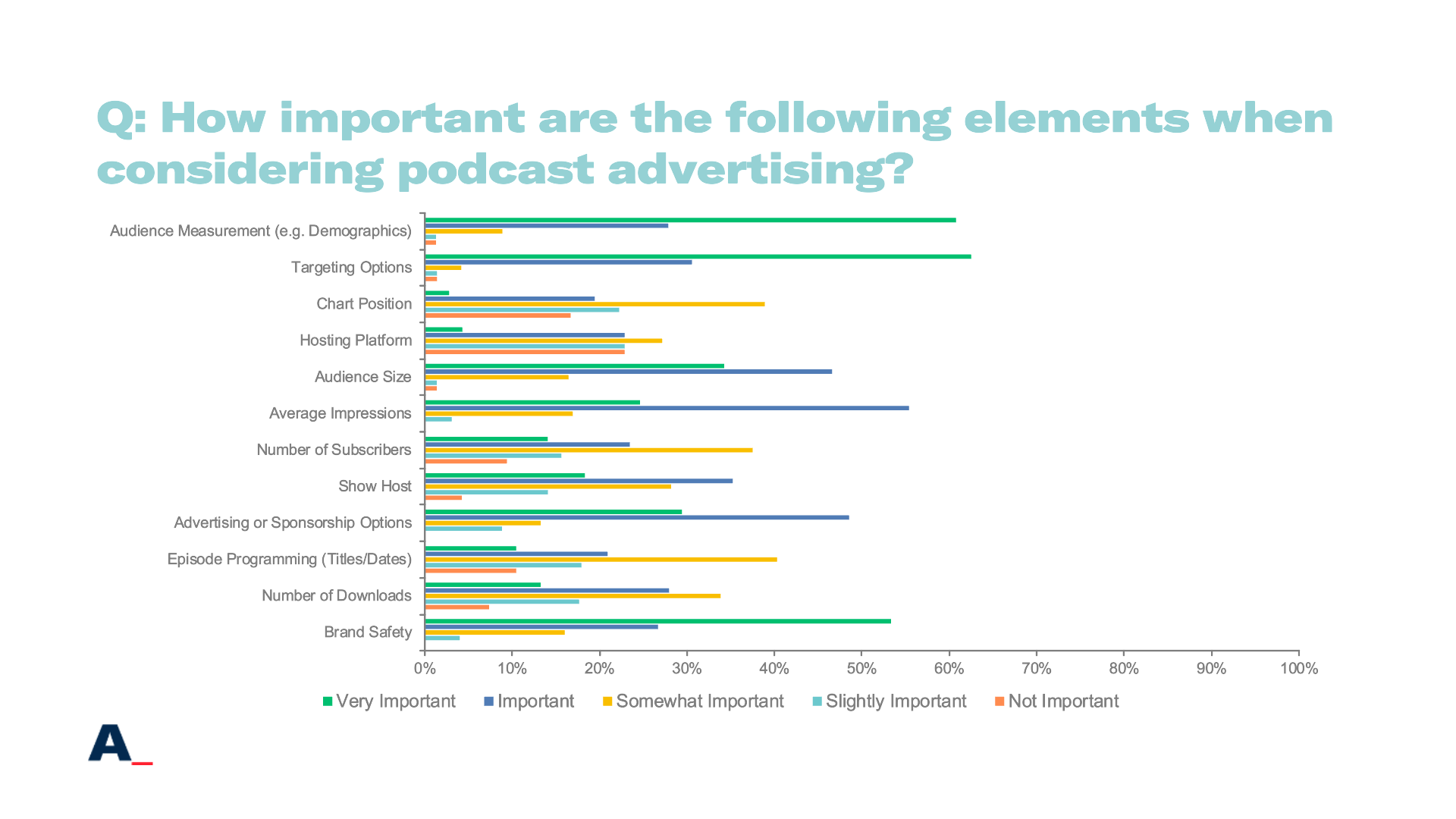

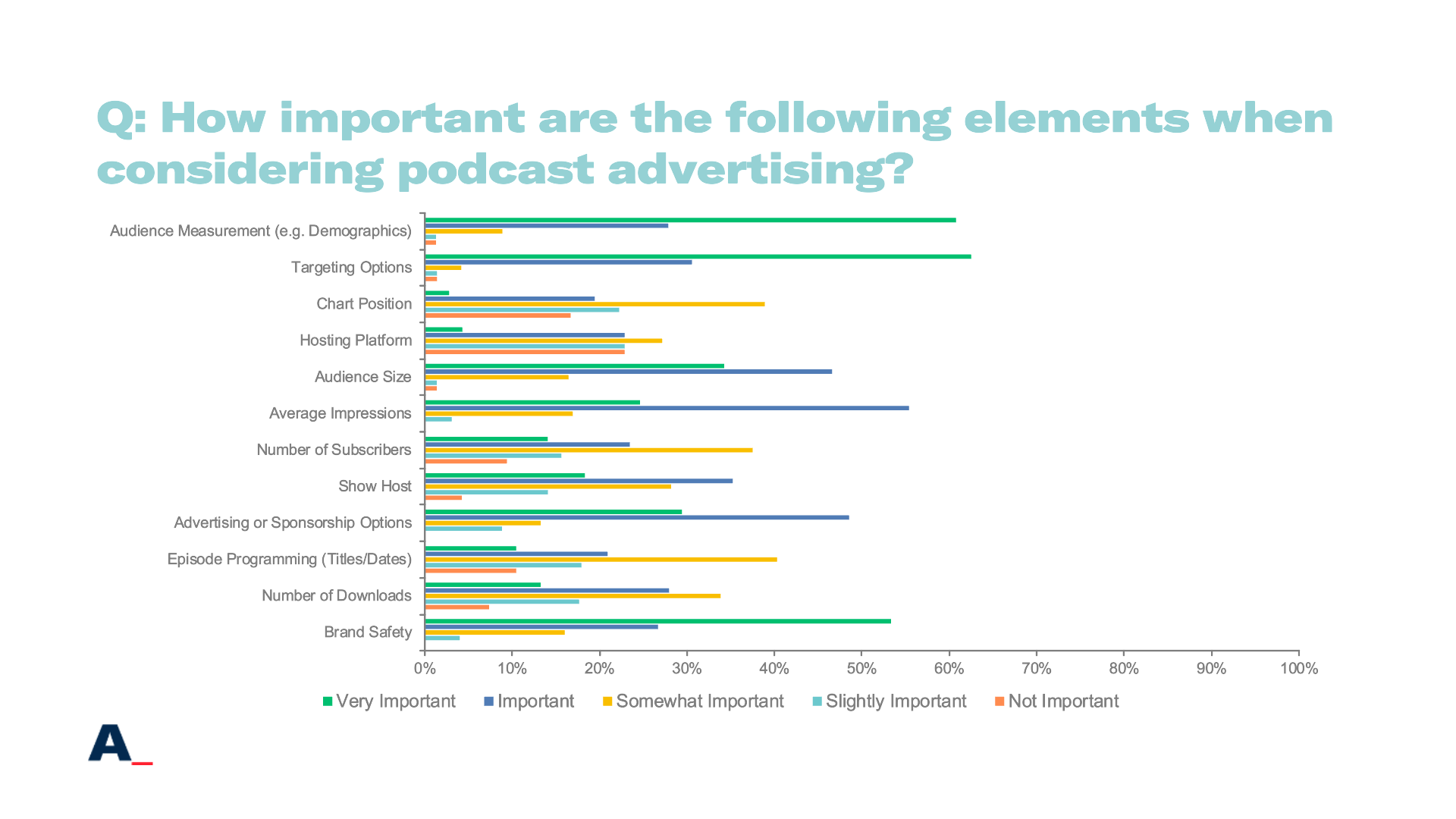

The majority of respondents (88%) cited podcast measurement as either “very important” or “important” when considering whether to add podcasts to a plan.

Other important issues brought to the fore when selecting podcasts for a campaign included lack of accountability and lack of discoverability.

Click to enlarge the graphic in a new browser tab

What are the biggest ‘pain points’ when planning or buying podcasts?

Nearly a third (31%) of those surveyed said they had difficulties with measurement and reporting with podcast advertising. This was the most common issue cited in the report, with those surveyed reporting a lack of trust in the data provided by podcast platforms and being unable to “combine” data with different podcast platforms and other media channels.

One respondent told the survey: “Our campaign objectives are often reach, so the niche nature of podcast vs broader audio options puts it lower down the candidate list.”

Another said: “This is a difficult area, precisely because there is no obvious direct ROI path to track, other than looking at Google search volumes once the podcast goes live and/or bespoke pre/post listener research.”

The second most common reported “pain point” was with the current buying options in the podcast industry, mentioned by 21% of respondents. Often these included availability, segmentation and the lack of a single buying platform.

Meanwhile, nearly one in five (18%) of respondents said cost was one of “the biggest pain points” when planning or buying podcasts for campaigns, and the same proportion mentioned a lack of accountability. In this vein, agency execs also highlighted high cost-per-thousand (CPT) and expensive creative costs for talent-led ads, as well as “a lack of transparency” throughout the whole buying process as another pain point with the medium.

Targeting and total audience size or reach were highlighted as concerns with planning and buying podcasts by 13% and 12% of the agency respondents respectively.

Adwanted Audio surveyed 84 people from different media agencies. Nearly a quarter (23%) were senior management, and half described themselves as media planners or media buyers.

The majority of respondents (80%) classed brand safety in podcasts as either “important” or “very important”.

Today The Media Leader’s sister company, Mediatel Connected launched new podcast reports, powered by Podcast Index in its platform, containing over 350,000 series, with thousands more to be added daily going forward. The report has more than 100 sortable sub-categories as well as filters for explicit content to aid podcast discovery and planning, plus brand safety scoring from Barometer.

Adwanted Audio and Mediatel Connected are part of The Media Leader‘s parent company Adwanted Group. All reporting by The Media Leader is independent; any paid-for content is clearly marked as “Partner content”.

Adwanted UK are the audio experts at the centre of audio trading, distribution, and analytics. We operate J‑ET - the UK’s trading and accountability system for both linear and digital radio. We also created Audiotrack, the country’s premier commercial audio distribution platform, and AudioLab, the single-point, multi‑platform digital audio reporting solution delivering real‑time insight.

To scale up your audio strategy,

contact us today.