Media spend in ‘dour holding pattern’ as total marketing budgets rise

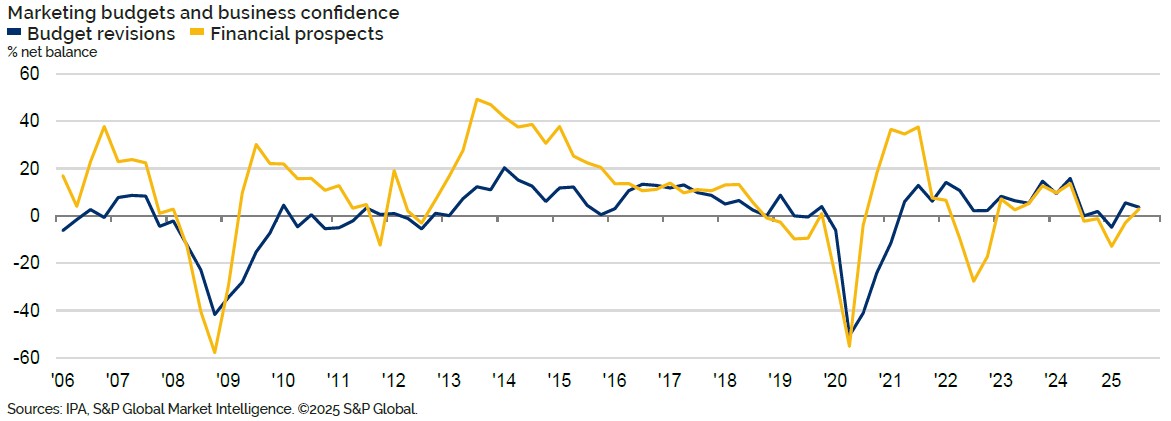

Total marketing budgets have expanded for a second consecutive quarter, according to the latest IPA Bellwether report.

A net 3.6% of businesses surveyed by the IPA reported a rise in marketing budgets. This is down from 5.5% in Q2, but it nevertheless represents a consistent show of growth after budgets were revised down in the UK for the first time in four years in Q1, when global trade uncertainty, prompted by US President Donald Trump’s tariff policy, reduced business confidence.

Growth was buoyed by events (+10.9% net balance) and direct marketing (+9.7%).

In contrast, main media budgets stayed flat for the second consecutive quarter. This follows contractions in main media budgets in Q4 2024 and Q1 2025.

Notably, sales promotions were reduced for the first time in two years, with the net balance of firms investing in the practice falling to -0.9%, compared to +9.4% in the previous quarter.

Maryum Baluch, the Bellwether‘s author and an economist at S&P Global Market Intelligence, commented that the rise in total marketing budgets provides “further encouraging news after a soft beginning of the year”.

She suggested firms “prioritised face-to-face client and prospect engagement” through events and direct marketing. In contrast, the decline in sales promotions led Baluch to conclude brands “favoured brand-building activities, which are more supportive of long-term growth”.

IPA director-general Paul Bainsfair concurred, noting that a recent study by Les Binet and Medialabs’s Will Davis “reinforces the strong link between budget and business growth”.

He continued: “The message is simple: to drive meaningful results, advertisers need to think big. Big marketing budgets, broad reach and high exposure. Scale really does matter, which is why investing in big, brand-building media remains so important.”

Mixed picture

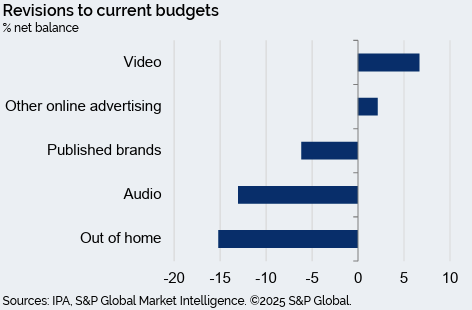

However, flat main media budgets disguised “an uneven picture” at the category level, with many media channels closely associated with brand-building efforts left out of upward budget revisions.

Video (+6.7%) and “other online” (+2.2%) saw marketing budgets rise during the quarter. In comparison, the other three categories tracked by the IPA all saw varying degrees of reduction. These include published brands (-6.2%), audio (-13%) and OOH (-15.2%).

For Yahoo UK managing director Tom Curry, the drop in OOH and audio budgets came as a surprise.

“A major reason for brands shifting their spending was to improve targeting and customer engagement,” he said. “But developments are helping improve the ROI of both of these channels by delivering programmatic solutions and better attribution — especially in areas such as DOOH and programmatic podcast advertising.”

Curry added: “Advertisers should reconsider these channels as part of their omnichannel strategy if they want to reach audiences effectively.”

Rik Moore, managing partner of strategy at independent media agency The Kite Factory, likened the flat main media spend figures — in concert with uncertainty amid macroeconomic headwinds — as akin to “a dour holding pattern”.

“I think there are real opportunities to steal a march,” he told The Media Leader. “Smart advertisers will recognise this as a moment to sharpen their planning and diversify their comms mix, ensuring they’re ready to capitalise as conditions improve.”