Mr Bates vs the big agency networks

Opinion

The big media agencies are damaging the outlook for UK broadcasters through opaque trading practices that do not give them a fair share of client spend.

Ray Snoddy’s excellent opinion piece last week highlighted the challenges facing UK broadcasters, as audience declines are inevitably leading to a reduction in investment in programming, which could in turn accelerate the decline in audiences.

Nick Manning has written about the challenges to the big media agency model that have spawned the non-transparent “proprietary media” offered by big media buying groups, in which a basket of media — including non-linear AV inventory — is opaquely bundled up and sold at a margin to clients.

MediaSense and the World Federation of Advertisers have highlighted the appetite from advertisers to move to a fresh remuneration model. A model that is more closely tied to commercial outcomes generated by agencies, which generally are still levying the traditional fee plus/or commission remuneration structure, with any performance-related fees largely tied to audited price delivery.

For their part, the established industry auditors — with some notable exceptions — are still largely auditing the price of the fixed traded airtime audiences, rather than a client’s actual target audience. And they are now excluded from auditing large chunks of the buy — especially proprietary media.

Corruption of the market

My argument is that these points are all interrelated.

To be blunt, the big media agencies are damaging the outlook for UK broadcasters in favour of streaming and connected TV (CTV) platforms. Advertisers are (correctly) following audiences and taking money out of declining linear airtime and moving it into growing non-linear/VOD platforms.

But the network agency buyers are corrupting the market by failing to return a fair share back to the UK broadcasters relative to their non-linear audiences. The networks are choosing to package their VOD airtime into bundled, opaque, proprietary products that overcommit to the streaming and CTV platforms that enable agencies to make the biggest profit margin for their holding companies.

It’s a double hit for UK broadcasters.

And because the big agencies know they are not buying the best inventory for their clients, they don’t want their remuneration to be linked to commercial outcomes.

‘Does Donald Trump approve of my media plan?’ How advertising is getting politicised

Let’s do the maths

If all TV is a £5.7bn ad market, then within this there is about £2bn up for grabs for non-linear TV. The TechEdge K2 TV planning tool shows that spending £1m on UK broadcaster VOD (BVOD) only delivers 14.4% adult reach.

Interestingly, as the streaming platform CPMs are significantly higher than that of BVOD, K2 suggests that the streamers don’t actually add any incremental reach against an “all adults” audience. This is due to the number of afforded gross rating points decreasing as their share increases.

But bearing in mind the niche — especially younger — audiences being delivered by the streamers, we might generously say that they would get 20-25% of VOD spend, with CTV on about 5%.

They don’t, though. The streamers get half the non-linear TV money coming out of linear TV. BVOD gets about £1bn in advertising revenue and so do the streaming platforms. This leaves UK broadcasters about £600m short, by my maths.

Proprietary media’s role

Why is this happening? Why is money being pulled out of UK broadcasters and not being reinvested back into their VOD platforms at the level their reach suggests it should be?

The answer lies in the rapid expansion of the big agencies’ proprietary media products that they have been selling hard to clients, estimated to account for up to 50% of non-linear TV spend through the big groups.

When the networks sell clients their proprietary media, they show them slides with all the UK BVOD logos plastered prominently on them, plus the streaming services, plus the better-known CTV channels.

Then they ask the client to sign a contract that is likely to prevent them from ever knowing which channels their money is going to be spent on and how much the agency has paid for the inventory. The contracts also usually prevent the airtime from being audited, either in terms of the cost paid or where the airtime was delivered.

The contracts may reveal that there could be a price differential between the cost of the inventory paid by the agency and the cost charged to the client, but this will be attributed to impenetrable data and tech costs.

Rethinking agency remuneration in 2025 — with MediaSense’s Ryan Kangisser

Lack of visibility

My agency has been lucky enough to have won some scaled businesses from the big networks. When this happens, part of the transition process is to understand from the TV sales houses how much VOD spend they have received.

In one case, a client that had presumed the bulk of their VOD spend was going on UK BVOD uncovered that it had in fact been about 10%. The bulk was going to streaming platforms and CTV channels that are likely to generate a much larger profit margin for the agency when packaged into proprietary media buys.

None of this touches the sides of the auditors, which have little or no visibility on proprietary media. The networks get to hit their generic traded audience targets that trigger their performance-related bonuses and there is little or no incentive for them to comb broadcaster schedules to buy the best converting airtime for their clients’ individual target audiences.

No wonder agencies do not share advertisers’ appetites for being paid on commercial outcomes.

Fair share needed

Fundamentally, I believe UK broadcasters should be rewarded with a fair share of client spend — for the viewers they have retained and attracted through the investments made in their digital products, allowing them to invest in more programming.

They should not penalised in favour of platforms that generate the most income for holding companies.

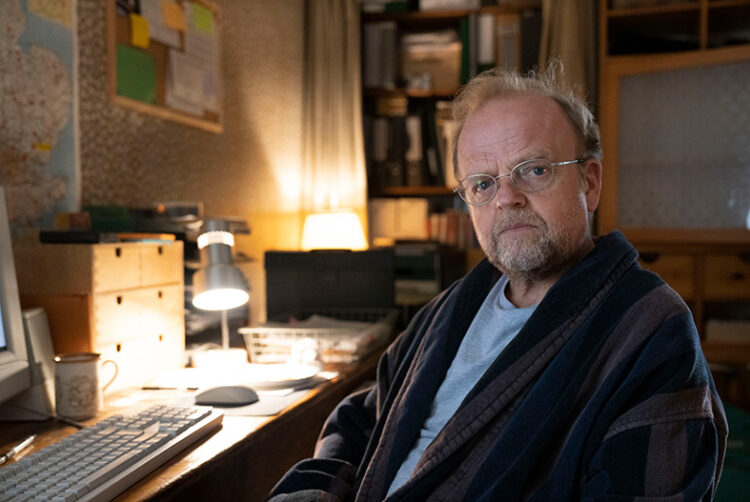

The £600m (or so) market underspend in UK BVOD relative to their reach figures could have funded enough dramas of the quality of Mr Bates vs The Post Office or Lockerbie: A Search for Truth to compete with the big-budget streaming platforms.

And isn’t that what we all should want to see?

Simon Davis is CEO of Walk-In Media

Simon Davis is CEO of Walk-In Media