OOH will be a key battleground in this general election

Opinion

As election spend is set to rise, new Route research can help political planners target marginal seats via a high-reach, trusted medium.

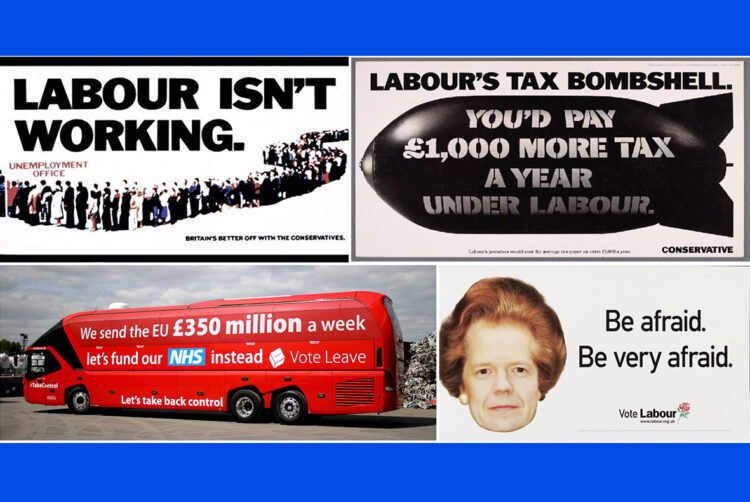

1979: Labour isn’t working

1992: Labour’s tax bombshell

2001: Be afraid. Be very afraid

2016: We send the EU £350 million a week. Let’s fund our NHS instead

Ring any bells? Of course they do. Even if you’re not old enough to have lived through some of these campaigns, you’ve almost certainly heard of them. They cemented advertising as an important force in society.

General elections and recent referendums have been the occasion for some of the most evocative and effective work ever seen in UK OOH. So much so that they now serve as visual shorthand, encapsulating important waypoints in our nation’s political history.

No wonder the OOH community stirs with anticipation when the political circus is expected in town — and, whether the actual vote is destined to take place this spring or this autumn, we’re already in pre-election mode.

It’s likely that the medium will have a huge part to play in the campaign strategies of all the major parties. This will serve as a potent reminder of OOH’s virtues, both qualitative and quantitative.

Trusted medium

First, the qualitative. It’s not an aspect Route focuses on, but there’s been lots of research that’s worth dwelling on briefly, because it speaks to the medium’s effectiveness in this space.

Put simply: OOH is a trusted medium. Recent research undertaken by JCDecaux and Clear Channel established a positive correlation between trust and consideration, with OOH the strongest media at delivering both.

There’s no real surprise here: OOH, because it carries no editorial baggage, is seen by the public as an honest broker.

In the political sphere, there’s a heritage factor in play too — the medium’s importance over the years has been reinforced by the fact that political TV advertising has never been allowed in the UK.

Trust, obviously, is a huge issue at general election time.

Politicians, as you might expect, are regarded generally as the least trustworthy tribe there is, with a UK public rating in the latest Ipsos Veracity Index of 9%.

But lest you get too smug about this, guess which fine body of men and women weighs in at second to last in the trustworthiness league table? Yup, you guessed it. Advertising execs, on a score of 16%, are below even estate agents. (Feel free to insert your own emoji here.)

Spend increase expected

In terms of strategic planning parameters, campaign weights, timings and priorities, this coming election will likely depart from recent norms.

We are, for instance, almost certainly going to see record levels of spend across the media marketplace.

New rules introduced recently by the Electoral Commission mean that the national election spending cap will rise to £35m for each of the major parties. At the last general election in 2019, the cap was £19.5m; the Conservatives spent £16.5m, Labour £12m and the Lib Dems £14.5m.

In other words, the total pot could more than double. OOH has every hope of taking (more than) its fair share of that. After all, the medium’s broad numbers are unsurpassed.

Route data shows that OOH reaches 97% of the adult population in a week — more than any other medium, according to the IPA’s TouchPoints study.

While it’s beyond the scope of TouchPoints to identify weekly reach for individual OOH companies, Route can do this. New audience data shows that three OOH media owners would feature in the IPA’s “top five buyable media types by weekly reach” metric, including taking the top two positions.

It’s fair to say that OOH gives political parties unprecedented reach of the voting population.

But it doesn’t mean we’ll just see the last general election schedules repeated. The rise of digital capabilities in the medium means that there is greater scope for flexibility, targeting and creative than ever before. Digital OOH ads are seen 4.7bn times each week.

Fragmented campaign

But early indications are that, in terms of comms tactics and ad strategy, this could be one of the most confused and fragmented general election campaigns ever.

Under “normal” conditions, Route would expect to see a high demand for audience data on marginal constituencies — those where the winning margin last time around was under 10%. At the December 2019 general election, there were 51 “ultra-marginal” seats where the margin at the previous general election in 2017 was under 2%.

Clearly, though, with Labour currently almost 20 percentage points ahead of the Conservatives in the opinion polls, the usual reckonings on where the margins are might just not apply. A YouGov poll published in January stated that Labour was 34 points ahead of the Conservatives across 150 crucial marginals.

Finding opportunities

There are going to be some unexpected campaign hotspots driven by highly localised issues and tactical opportunities.

So we’ve been making our own preparations. We have created a new data visualisation blending together Route impact data alongside electoral results from 2019.

This enables us to identify the likely battlegrounds (where margins were closest at a constituency level), filter the data by the winning/challenger parties and pinpoint the OOH inventory that generates the greatest audiences at that local level.

Analysis of this dashboard, which you can access here, enables political planners to target the heaviest-hitting OOH inventory in the most crucial of areas.

From this analysis, we can see that within constituencies that held less than 5.3% winning margin in 2019, there are a total of 10,511 OOH locations that, together, are seen 495.9m times each week.

Tight margins

Taking the OOH data one step further, we identified the top audience-generating site from a range of high-profile constituencies and note that in each of these in the table below, just one frame has the potential to swing the result as it is seen by more individuals than the winning margin last time around.

In this table, we’ve created a “majority multiplier” that shows the factor of reach from the top-grossing OOH site in the constituency against the margin of victory last time around. This is, in effect, a “multiplier” of potential to affect the vote.

Should the Conservatives aim to take out Sir Keir Starmer, they would be wise to target Underground advertising within his Holborn and St Pancras constituency. Perhaps Labour wants to pick off Michael Gove? Then a mix of roadside and shopping mall inventory within his Surrey Heath area should be on the plan.

From a media and advertising point of view, this campaign is destined to be compelling.

In January, there was a flurry of speculation that the big day was now likely to be 14 November.

Who knows? But, as an industry, we’re ready. Bring it on. Our own slogan for the forthcoming campaign? We’re here to help.

Euan Mackay is chief strategy officer at Route

Euan Mackay is chief strategy officer at Route