Record increase in sales promotion drives marketing budget growth

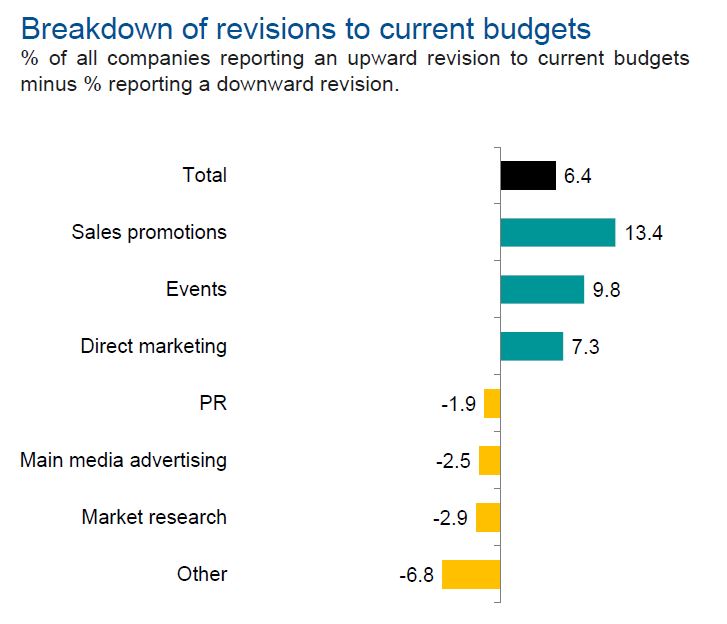

Total marketing budgets grew over the last quarter, driven by a record increase in sales promotion activity, according to the latest IPA Bellwether report.

By category, three out of seven budget areas experienced net balance growth in the second quarter; namely a record 13.4% more firms recorded budget expansions in sales promotions. 6.3% did the same for events and 7.3% for direct marketing—its sharpest increase since 2006. This is compared to 8.8%, 9.8% and 4.2% respective net balance growth in the first quarter of the year.

Meanwhile, other budgets were “scaled back”. “Other” marketing activity saw net balances decline -6.8%; PR budgets -1.9%; market research -2.9%; and main media -2.5%. It is the first time since Q3 2022 that main media budgets declined.

Within main media, growth areas like other online (8.3%) and video (3.2%) were offset by drops in audio (-8.0%), out-of-home (-7.1%) and published brands (-5.0%). This is compared to other online recording a 10.5% net balance, video 7.9%, audio 1.7%, out-of-home -12.4% and published brands -1.9% in the previous quarter.

Just over 20% of survey respondents saw growth in total marketing spend between April and June 2023 compared to 14.4% that cut budgets, resulting in a net balance of +6.4%. This marks “a slight softening” on the previous quarter, which registered a net balance of 8.2% due to “persistent inflationary pressures”.

Carl Nawagamuwa, investment managing director at GroupM told The Media Leader: “[D]espite inflation being high for a prolonged period and interest rates continuing to rise, consumer activity amidst the cost-of-living crisis has held somewhat steady. Advertisers are most certainly favouring media channels they know and understand well during this climate, however they are still spending.

“There are undoubtedly closer links than ever between brand and performance and advertising partners who can offer full funnel all the way through to sales, have reason to be optimistic – particularly those within retail media. The long-term visibility into budgets is increasingly challenging and is understandably a trend we started to see last year, mostly when looking more than six months ahead. We anticipate this will remain until more economic certainty comes back.”

‘A counterproductive exercise’

The rise in spend on sales promotions and decline in main media budgets was described by the Bellwether report to suggest “reactive change by UK businesses in response to the economic climate.”

Paul Bainsfair, IPA director general, said: “It is welcome news that total UK marketing budgets remain in positive territory, despite the latest figures from the ONS which reveal a ‘listless’ UK economy.

“It is therefore not surprising to see a dramatic increase in sales promotion this quarter. But we would not want to see this as a long-term trend because our comprehensive bank of evidence shows that price promotions damage brands because they lower consumer price references and do not build brand loyalty.

“While, understandably, brands may think this is the right thing to do for their customers during the current cost-of-living crisis, it is a counterproductive exercise that may generate short-term spikes in sales volumes but will almost never change how consumers think or feel about their brand because they are only interested in the lowest price point.

“What happens next is the eventual erosion of a company’s long-term brand health and profitability. We continue to advocate the well-tested rule of thumb that a 60:40 ratio of brand building to sales activation is the best way to grow business through marketing activity.”

Click image to enlarge

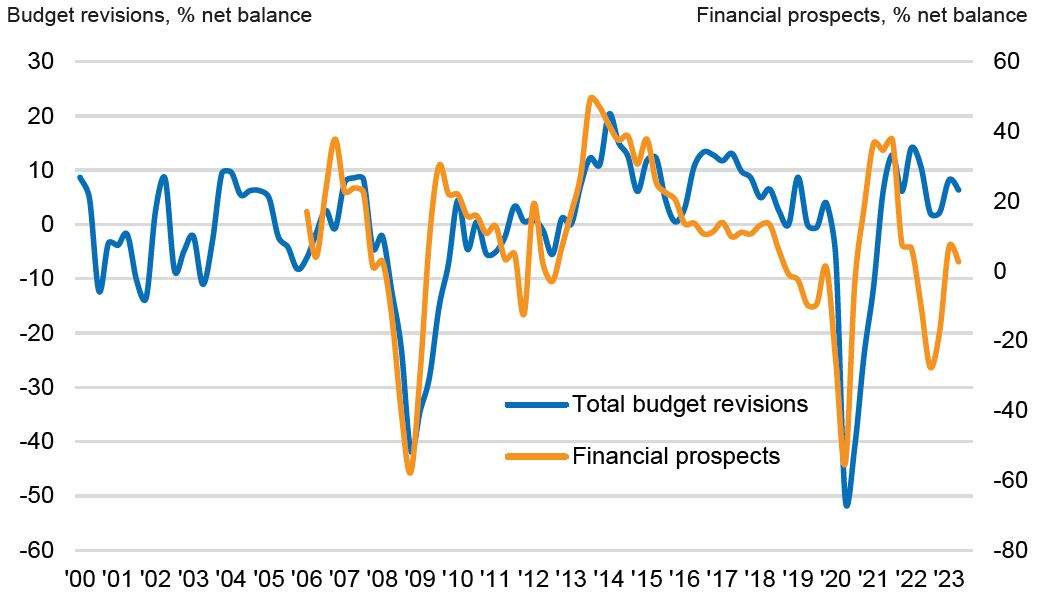

More pessimism over financial prospects?

The survey data also revealed “a more sombre mood” with regard to UK companies’ own financial prospects and industry-wide financial prospects.

Respondents who had optimistic attitudes towards their own companies’ financial prospects declined from a net balance of 7.0% to 2.6%, and 48.4% reported no change in their opinion. As a whole optimists about company financials represented 27.1% of respondents, and pessimists 24.5%.

More than a quarter (28.8%) of respondents were pessimistic about the financial future of the industry over the next 12 months, compared to 16.2% who were optimistic creating a net balance of -12.6%, down from -7.1% in the prior quarter (though still higher than in 2022).

Adspend growth to gather pace in 2025

Looking forward, S&P Global has upgraded its UK GDP growth forecast to 0.3% to reflect “the surprising resilience of consumers throughout a period of double-digit inflation and rising borrowing costs”.

However, the marketing intelligence provider said the immediate growth outlook “remains challenging,” particularly with the Bank of England on course to raise interest rates again. In 2024, S&P Global expects UK GDP to rise by 0.4% and in 2025 onwards there will be “stronger rates” in the UK economy and improvement in adspend.

The Bellwether report now anticipates adspend to decline by -0.6% this year, an slight upgrade compared to previous estimates of -0.9%. Further forward in 2024, it forecasts spend to be “broadly flat” on a year-to-year basis, with growth of 0.1%.

Adspend growth is then predicted to improve to 1.5%, 2.0% and 2.1% in 2025, 2026 and 2027 respectively.