Retail media boom set to defy rising costs with 2023 surge

Retail media is forecast to be the fastest growing area of UK commercial media this year, despite rising costs in an already expensive buying market to reach consumers where they shop.

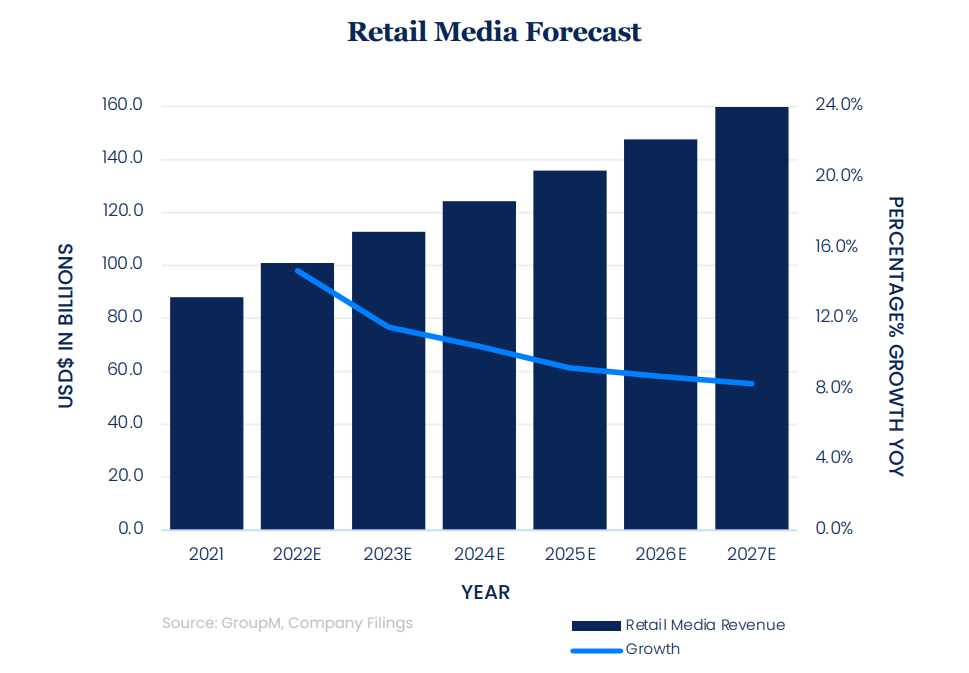

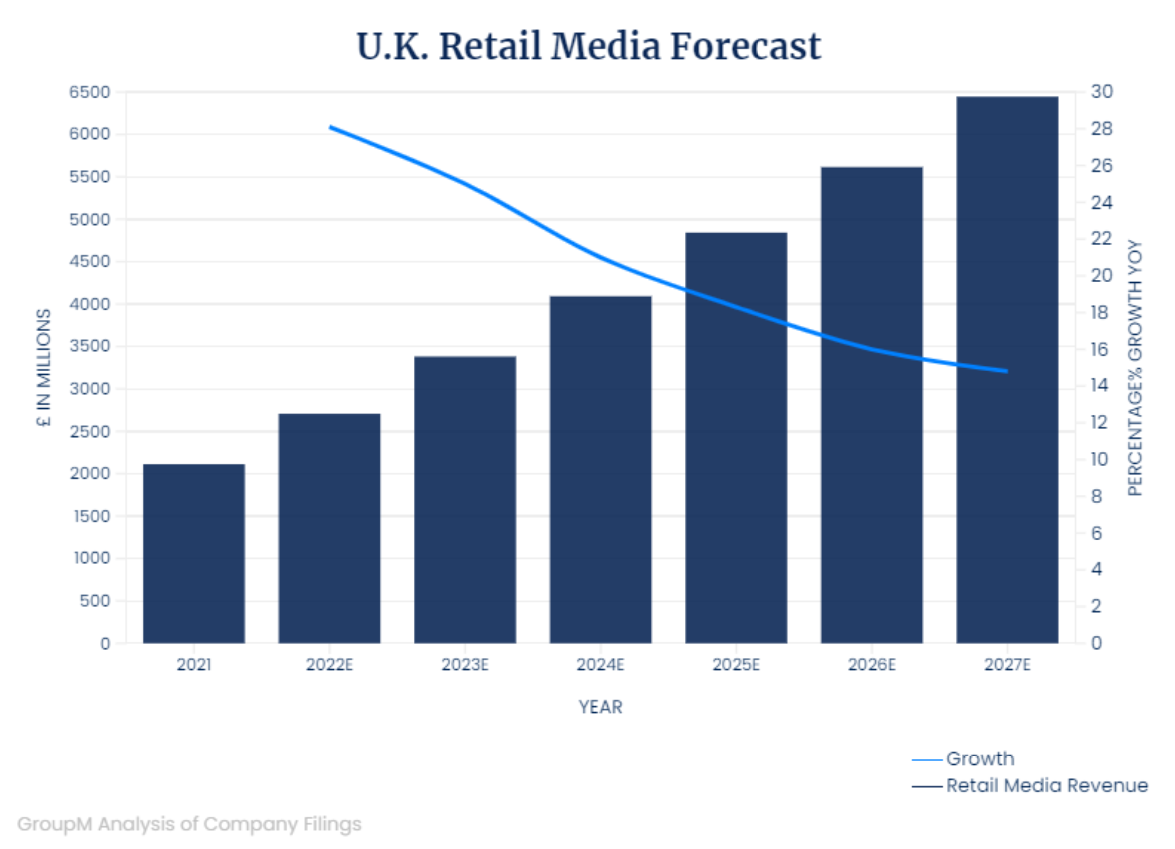

Retail media is forecast to hit 25% growth in 2023, according to GroupM analysis. The sector grew 28% to £2.7bn in the UK in 2022, and the WPP media-buying arm estimates it will grow to £6.5bn by 2027, making up 16% of total digital ad revenue in the UK.

Kate Scott-Dawkins, global president of business intelligence at GroupM, told The Media Leader the next fastest-growing segment would be broadcast video-on-demand (BVOD), which is on track for 19% growth this year.

“This channel has likely been a beneficiary of shifts in offline to online retail advertising as well as budget from other media owners to retail media networks,” she added.

As an example, Scott-Dawkins highlighted the advertising revenue outperformance of retail players like Amazon in the third quarter of 2022 versus declines at some less commerce-focused platforms. Last night Amazon’s fourth-quarter earnings report revealed the ecommerce behemoth grew its ad revenue by 19% to $38bn in 2022.

Scott-Dawkins also pointed to spend from overseas merchants, particularly from China, as a source of current and future incremental growth in the UK’s retail media market.

Growth is also being driven by non-retail-endemic advertisers — those which advertise on a platform where their product isn’t listed — adding media to their plans either in-store, online, and via a direct or programmatic audience buying.

Stuart Johnston, commerce business director at Publicis Commerce, said these advertisers were being attracted to the market by historic data on customer behaviours, retail media platform evolution, and customers’ acclimatisation to ad formats along retail journeys. This would be “increasingly relevant” for low-cost retailers that do not have loyalty programmes or third-party brands that were looking at ways to monetise their audience, he added.

He said: “Highly engaged, purpose-driven audiences are highly desirable to advertisers, particularly at present when the need to drive sales outcomes – and measure them – is increasingly vital. Being able to target audiences in the same retail sphere they are able to convert is a superb opportunity.”

Rising retail media costs

However, as retail media spend has increased and is on course for more growth, Johnston warned: “Whilst we recognise the effectiveness of retail media – there is undoubtedly an inconvenient commercial angle that advertisers seldom openly talk about amongst all the sustained hype. Retail media isn’t cheap and is getting pricier.

As an example, he said cost-per-clicks in some grocery retailers have increased by almost 35% year-on-year.

This is turning lower-priced consumer goods, which are already seeing margin pressures, “holistically unprofitable” Johnston said.

Although this rise in cost-per-clicks is not consistent across the board, as more mature or self-serve platforms are “holding steady” by comparison, according to Johnston, this jump in cost “must be carefully considered when planning and activating campaigns”.

The auction model behind many retail media platforms is “partly to blame” for this increasing cost as more and more brands have started bidding for top terms and valuable placements.

Johnston said: “Despite the above, there remains an incredibly powerful first-mover advantage for brands who are venturing into the retail media space.”

He said there were still “considerable untapped areas to exploit” that are not yet “wholly competitive” particularly on newer retail media platforms.

Johnston called for “smarter investment” down to a granular level using machine learning algorithms to optimise retail media bidding. He also urged “more holistic” thinking about which retailer advertisers to activate media against and how it “ladders up more broadly” with above-the-line campaigns, availability and pricing.

“We can be smart by directing media budget to areas of retailer websites where we don’t have organic visibility, rather than doubling up on placements unnecessarily and wasting spend.”