Special feature: European broadcasters debate their future

From the growth of connected TV advertising to the threat of Amazon and Facebook, bosses from the largest broadcasters in Europe shared their views at dmexco 2017. David Pidgeon reports.

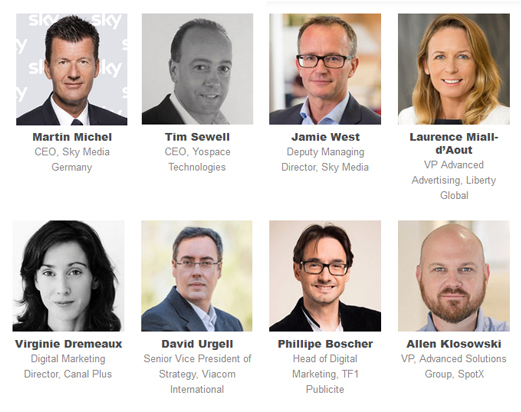

Attendees: Allen Klosowski, VP, Advanced Solutions Group, SpotX | Virginie Dremeaux, Digital Marketing Director, Canal Plus | Laurence Miall-d’Aout, VP Advanced Advertising, Liberty Global | Jamie West, Deputy Managing Director, Sky Media | Tim Sewell, CEO, Yospace Technologies | Phillipe Boscher, Head of Digital Marketing, TF1 Publicite | Martin Michel, CEO, Sky Media Germany | David Urgell, Senior Vice President of Strategy, Viacom International | David Pidgeon, Editor, Mediatel Newsline (chair)

More than half a century ago the very first TV ad was broadcast in the UK. Airing in 1955, it was for SR Toothpaste, and it helped kick-start a revolution that would see television dominate the world of media and advertising.

Today, TV remains top dog, but it is changing and it is challenged: viewers now watch on different devices, often outside of the living room; there is fresh and growing competition from outside of the traditional broadcast industry; and the impact of data and adtech is opening up new possibilities.

The best of these new possibilities are collectively known as ‘advanced advertising’, comprised of programmatic TV, addressable TV and connected TV (see ‘TV redefined’ below).

Programmatic TV, although quite well developed in the US, is still in its infancy in Europe, while addressable and connected TV are set for rapid growth.

New research published just ahead of Mediatel’s debate on the future of European broadcasting revealed the scale of opportunity for connected TV (CTV) advertising in particular, with “widespread agreement” across the entire market that CTV is a new class of inventory, combining the established value of big-screen engagement with the application of advanced advertising capabilities to measure and target audiences.

The analysis, produced by video ad serving platform SpotX in partnership with research firm MTM, shows that the UK is the largest and most advanced market in Europe with an established connected TV advertising ecosystem, and shows that £115m of advertising was viewed on a TV connected to the open internet via streaming devices, smart TVs, games consoles and set-top boxes in 2016.

As the over-the-top (OTT) advertising landscape grows across Europe, the US and Asia, CTV advertising in the UK is expected to grow to £220m in 2020. In the five largest European markets, MTN’s analysis estimates that CTV could be worth up to 825m euros, up from 265m euros in 2016.

Speaking at Mediatel’s debate on the future of broadcast at this year’s demxco, Cologne, Germany, Allen Klosowski, VP Advanced Solutions Group, SpotX, says broadcasters are starting to make more of their content available on different devices – and this represents an opportunity.

“I think the audience is moving in this direction because the consumption of content is spanning devices. Country by country there’s different levels of adoption, but it’s still a growth area in the wider TV marketplace.”

However, Klosowski warns that it’s not just broadcasters that can operate in the CTV space, and that might pose a threat.

“The question for Europe is: who is going to get out in front and really embrace delivery across all screens? Once you get into the OTT space and the ability to deliver personalised, data-driven advertising, you can effectively raise yields.

“But who gets there first? Is it going to be Amazon – or will it be the broadcasters and the telcos coming together to provide something to compete on equal footing before other businesses come in and get a foothold?”

For Laurence Miall-d’Aout, VP advanced advertising, Liberty Global – which, until now, has largely been interested in STB addressable advertising – she can understand the appetite for connected TV. However, like all forms of advanced advertising, she sees some barriers.

“One challenge is getting consent and being able to use data,” she says. “Advertisers want to target better, and we need data to fulfil advertiser needs. We also need customer consent and we don’t really have a proposition yet that gives a viewer a benefit for giving their data away.”

TV redefined

As the TV market embraces new technologies it also has to embrace new definitions — sometimes creating confusion. Here is the simplest way to understand the main types of advanced TV advertising.

Programmatic TV: linear TV refers to traditional television watching, where consumers tune into content at the appointed hour and channel of the broadcaster. The content is delivered one to many, with all consumers tuning to the same channel, seeing the same TV spot. Programmatic TV advertising is purchased through an automated platform and delivered via set-top boxes. Targeting and reporting is based on traditional TV metrics (daypart, network, GRP).

Addressable TV: delivered via set-top boxes to individually selected households through satellite and cable providers such as BT, Sky and Virgin. The content is delivered one to many, but, a portion of consumers tuning into the same channel will see a different TV spot than their next door neighbours. Typically using first or third party data for targeting. Reporting is often based on a mix of traditional metrics, and digital video metrics plus actual online and offline outcomes (site activity, branding, sales).

Connected TV: delivered through internet-connected TVs (smart TVs) or over-the-top (OTT) devices such as X-Box, Playstation or Apple TV. Connected TV content is often consumed through apps such as Channel 3’s All4 or BBC’s iPlayer. Content is delivered one to one, and ad insertion is also specific to each individual household, so that typically every household sees different TV spots. Reporting is based on digital video metrics (impression delivery, frequency, completion rate).

“We need, as an industry, to work towards those customer benefits.”

For others the main barrier is measurement, with claims that the measurement panels in Europe – although set to change – do not yet fully capture CTV viewing.

However, for Jamie West, deputy managing director, Sky Media, what the industry wants to sell, and the terms it wishes to use, are less important that placing customers first.

“In my view, we must simply think about the customer point-of-view. You’re either a customer as a viewer, or a customer as an advertiser. If you’re an advertiser what does it matter whether it’s connected TV or not; you’re thinking about an advertising campaign and you need to look at a campaign holistically.

“If you’re a customer as a viewer, what you’re looking to find is the best experience and best content – and we, as an industry, need to be thinking from that perspective – not because it’s connected, and not because it’s new. How does it improve the customer experience?”

Despite the challenges, the MTM research shows that most experts across Europe believe that the major commercial free-to-air broadcasters in each market are best placed to grow CTV – so we should expect those businesses to use their reach and resources to respond in the next few years.

Stitching it together

Broadcasters are seeing new opportunities to strengthen their data-driven advertising by investing in technologies such as dynamic ad insertion (DAI).

ITV, Channel 4, BT and Sky all offer DAI in the UK — a technology that stitches tailored ads into broadcasts, including live online – and new deals are expected to be announced in Europe shortly.

DAI is interesting because it is able to solve a major problem: when used online it can help monetise content more effectively whilst ensuring the strengths of TV advertising, built up over decades, are not lost.

“As more consumption moves on to over-the-top and IP platforms, for sure a service like ad insertion is going to become a bigger thing because it delivers a TV-like experience,” says Tim Sewell, CEO, Yospace Technologies, which has struck deals with all the major commercial broadcasters in the UK.

Discussing the opportunity for ad replacement in the on-demand environment, Sewell adds: “First, you don’t get any of the buffering problems with playback that you get between more traditional VOD services – and where the user also gets three minutes of pre-roll before they watch their content and has a pretty crappy experience, and where the quality of the ad might not match the quality of the content.”

Sewell says there has been a certain amount of pushback on ad-supported VOD content in the past because the user experience has been “pretty shocking”, but as the tech has improved, so has the opportunity,

“If you’re genuinely delivering a TV experience where you don’t need to put a heavy pre-roll load on the front of that VOD content because you are monetising it as if it were TV, then there is less pushback on the ad load on catch-up and VOD content,” Sewell says – adding that, at a technology level, DAI also allows true one-to-one addressability.

“Clearly there are scale and data issues around that, but from a technology perspective it makes that possible.”

Do the broadcasters see DAI it as a growing opportunity?

Sky Media’s Jamie West says that, historically, TV anywhere services were just simulcasts of the existing broadcast channel and companies like Yospace enable broadcasters to monetise where previously they were unable to.

“As consumer-facing products evolve and we’re servicing the consumer, we need to find ways to monetise and this is a great example of that,” he says.

However, West notes that it is important to balance customer experience with commercialisation.

“So in an on-demand world we have the choice as broadcasters and platforms on what ad load we run. At Sky, rather than having eight, nine, 10 ads as a pre-roll and a mid-roll in on-demand content we tend to have two or three because we cherish the customer experience all the way through the line.”

Coming back to the wider possibilities, including for live, further research from MTM shows many broadcasters believe the scale of opportunity associated with advanced advertising and its potential to grow as audiences migrate to IP channels will prove “hugely significant” as competition for online viewing increases.

The future of live TV in this space might be hard to predict – but broadcasters should feel reassured that the tech is there to maximise its potential.

There are also some interesting developments in the pipeline, such as the impact of using DAI with cloud-based personal video recorders.

“This will allow you to do fully addressable advertising into cloud PVR content, catch-up, live rewind content,” says Sewell.

“We have broadband customers who, where a user joins a live programme twenty minutes late and so rewinds to the start, there is credit control to stop them from skipping through the breaks – but they have a far shorter break until they catch up with live so they have a much lighter ad load to better the end-user experience.”

The trick here is that the broadcaster is still able to monetise their content as opposed to simply allowing the user to skip through the break.

This is a capability that only launched this summer, so it is too early to know how it has been adopted, says Sewell.

“But it is at least allowing you to preserve a load on services where users traditionally would have potentially skipped through the entire ad break.”

New competition

Earlier this year a report from OC&C Strategy Consultants argued that traditional broadcasters could lose a combined £1bn per year if rival services from Amazon, Facebook and YouTube became the dominant players in the TV industry over the next decade.

Whether you believe that analysis is likely to happen or not, broadcasters are unquestionably facing new competition that might be hard to deal with.

So how do European broadcasters feel about the prospect of businesses like Amazon, Google and Facebook taking video more seriously – or taking an interest in live sports rights more seriously? Or how do they feel about the prospect of Netflix opening up to advertising?

“I think it’s a real threat,” says Liberty Global’s Laurence Miall-d’Aout.

“They’ve positioned themselves, they’ve been harvesting data, they have the technology, they are global brands, they are trusted.

“We keep talking about Netflix like the new premium TV but they haven’t started launching advertising yet and the day they do I think that could be a huge challenge for traditional broadcasters.”

However, others, including Miall-d’Aout, feel traditional broadcasters are well-placed to combat the threats.

Virginie Dremeaux, digital marketing director, Canal Plus says: “Broadcasters have credibility and as an industry we are still trusted – but we must be prepared to adapt.”

And in terms of the tech giants upsetting live sports right, Sky Media’s Jamie West, is bullish:

“For Facebook or Google to buy global Premier League rights you’re talking many, many billions of pounds. I think we’re more likely to see them investing in original content, trying to adopt the Netflix or Amazon approach, than buying unilaterally global sports rights,” he says.

West adds it is incumbent on platforms and broadcasters to evolve strategies so that they can compete.

“It’s not right to complain without investing and trying to solve the solution – which is why, at Sky, we invest so much in data-enabled capabilities so we will be fit for purpose over the next ten years.

Frenemies unite

As new threats appear, one thing is strikingly clear from the conversations: broadcasters want to collaborate for the greater good of advertising on TV. These sentiments both opened and closed the debate.

“In the UK, to all intents and purposes, we’ve set aside our differences to make sure we can offer a consistent proposition to advertisers – consistent currency, consistent targeting attributes, consistent integration points – which was everything that was asked of us by the advertising community,” says Jamie West.

West now predicts that across more territories there will be more collaboration, so that broadcasters and platforms can compete more globally and more readily with the bigger digital and online players.

Phillipe Boscher, head of digital marketing, TF1 Publicite, agrees.

“It’s not the time to decide what you want to do alone in your market, alone as a TV broadcaster; it’s time for collaboration – to find the right models with pure-players, the right models between TV and broadcasters and telcos.

“It’s a new mindset and it’s not very easy for companies such as ours, with so much focus on the competition in a very competitive world, but it will be key in the future.”

Some of that collaboration is already clear to see: Viacom is now part of the Sky Media world — Sky do their ads sales — and Channel 5 is the first traditional public broadcast channel in Europe that lets a platform owner — in this case, once again, Sky — sell their ad inventory for addressable.

Earlier this year Virgin Media and Sky also announced that they would partner, with Virgin joining Sky AdSmart — a major deal that will boost the scale of the targeted advertising platform.

The pay-TV and broadband rivals will add Virgin’s 3.7 million homes to the AdSmart network, giving total access to more than 30 million targetable TV viewers in the UK and Ireland.

The partnership covers both targeted linear and video on demand (VOD) TV advertising, with Virgin Media making use of technology developed by parent company, Liberty Global, as well as Sky AdSmart.

“We have to understand and work with our ‘frenemies’,” says Virginie Dremeaux. “But what we are just understanding right now is there is no sense in having a digital department within a TV company; we just have to digitalise everything so we are trying to spread the knowledge and digital mindset to the broadcast world. Everybody has to think digital-first.”

Meanwhile, David Urgell, Viacom International’s senior vice president of strategy, suggests that the competition doesn’t care much about the ideas of transparency, openness and clarity.

“Facebook and Google don’t care much about them but they have scale, and we are competing with those people.

“The margins that we used to have are gone; we have to get used to having lower margins and need to adapt to this change; be more clever and more collaborative.”

Being smarter means being open to new ideas, and it is clear – from this debate, at least – that broadcasters want to learn, particularity from each other.

Mediatel’s debate was hosted in partnership with SpotX and Yospace. All reporting is independent.