Expanded subscription and content offerings, combined with lower churn despite consecutive price increases, have contributed to continued growth at Spotify.

In its latest earnings, CEO Daniel Ek said Spotify was starting to “prove” that it could be a “great business” as well as a “great product”, as the company marked its third consecutive quarter of profitability in its “year of monetisation”.

Spotify had shifted its approach to focus on subscription, which was previously a “one-size-fits-all” model whereby subscribers for the Premium tier typically came from the funnel of consumers using its Basic free ad-supported plan.

Premium subscription plans now include Individual, Duo, Student, Family and Mini, while the Basic tier has options with and without audiobook access.

During the earnings call, Ek discussed introducing an “ultra premium” tier that he expected “a good subset” of its 246m subscribers would be interested in.

The plan was billed as a “much better version of Spotify” with more flexibility and music capabilities. Priced at $17-18, compared with $11.99 for an individual Premium plan, it aims to give “a lot more control” and “higher quality” across the board.

Ek added that price increases, including in the US, were being rolled out “with great success” and led to “less churn” than the last round of increases in 2023, when churn was “already low”.

Slowdown in advertising growth

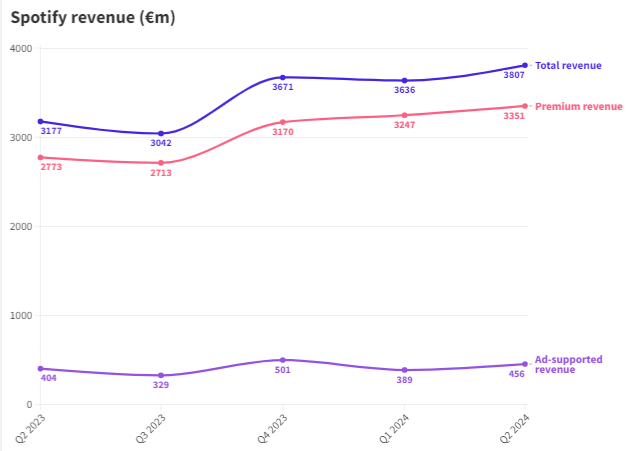

In Q2 ending 30 June, Spotify’s total revenue grew 20% year on year to €3.81bn — of which revenue from the Premium tier grew 21% and ad-supported by 13%.

Ben Kung, Spotify’s interim chief financial officer, described the company’s advertising performance in the quarter as “a bit slower relative to Q1” as marketers’ spend on upper-funnel brand-related campaigns “continued to be volatile”.

In Q1, Spotify recorded 18% year-on-year growth.

When asked about this advertising slowdown and the viability of Spotify’s 20% ad revenue goal, Ek cited two factors.

First, the subscription side of the business was “probably doing a little bit better than we expected it to do”, meaning highly engaged users were turning in to paid subscriptions — something that “diminishes” some of the potential on the advertising side.

The second was that Spotify had been making “a lot of investments” in the last few years — a move he described as a “heavy lift” — to enable more programmatic and automated buying.

Kung added that Spotify’s ads business was direct sales and that tapping into new demand pools like programmatic and also small and medium-sized business were “forward-looking opportunities”.

Changing acquisition strategy

Total monthly active users grew 14% to 626m, of which 246m were premium subscribers (up 12%) and 388m were ad-supported users (up 15%).

This user growth was behind target, to which Ek responded he was “disappointed”, but he remained “confident” in seeing “healthy MAU engagement trends year over year”.

Ek highlighted that the relationship from free to paid users was “no longer a one-size-fits-all scenario” and Spotify was “less dependent” on free users to fuel revenue growth in the short-to-mid term.

He spoke about the differences in Spotify’s paid subscription and ad-supported segment, with the former “primarily anchored” in developed markets and the latter focused in developing markets that had a “much longer time horizon” to become subscribers.

Spotify would be examining its user acquisition strategy in light of “changing marketing dynamics” to make sure it would only be marketing to attract new listeners if it met expectations of return on investment.

Ek added that there was “significant potential to attract a large number of new users” in developing markets, but engagement “looks different” in these areas and conversion to paid subscription “can be slower”.

To tackle this, he said Spotify would be “intensifying” efforts to improve the impact of its marketing in the upcoming quarters and prioritise enhancements in its free product pipeline to boost engagement and retention in developing markets.

Video growth

Asked if Spotify had seen changes in podcast engagement now that podcasters like Alex Cooper and Trevor Noah distribute non-exclusively, Ek insisted there is “very health engagement on podcast that has not changed”, adding that video podcast engagement was “even higher” than audio-only.

Previously, Ek had said short-form clips and music videos would be “a big focus” in 2024.

In addition, more creators were uploading video content, with 250,000 video podcasts already, according to Ek, and that it was “growing really nicely”. Moreover, longer-form content on the video site “tends to do really well” on Spotify compared with other platforms, Ek added.

Spotify grows video podcasts and ‘podfluencers’

Forecast

Kung said Spotify was forecasting an addition of 13m to reach 639m monthly active users in Q3 and an increase of 5m to reach 251m subscribers in the same time period.

He forecast revenue growth to be “sequentially consistent” with Q2, pointing to €4bn in total revenue.

Adwanted UK are the audio experts at the centre of audio trading, distribution, and analytics. We operate J‑ET - the UK’s trading and accountability system for both linear and digital radio. We also created Audiotrack, the country’s premier commercial audio distribution platform, and AudioLab, the single-point, multi‑platform digital audio reporting solution delivering real‑time insight.

To scale up your audio strategy,

contact us today.